Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the Ink Business Premier® Credit Card, Ink Business Preferred® Credit Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

Comparing the Chase Sapphire Reserve® vs the the American Express Platinum Card® is a fun exercise in comparing two of the ultimate luxury travel cards available.

Military servicemembers and their spouses get the Chase Sapphire Reserve card with annual fees reduced to $0! American Express also applies special military protections for you and your spouse.

Assuming you're married and both spouses get both cards, over 10 years you save $29,800 on these cards and still access all of the perks.

Let's compare the Amex Platinum vs the Chase Sapphire Reserve on several different factors:

- Chase Ultimate Rewards vs Amex Membership Rewards

- Hotel and airline transfer partners

- Spending bonus categories

- Value of welcome bonus

- Annual benefits like travel credits

- Rental Car and Trip Insurance

- Airport Lounge Access

- Annual fees and foreign transaction fees

Check out my full Chase Sapphire Reserve military review and the Amex Platinum military review.

Special military protections are offered on both cards for both military spouses and the active duty Space Force Guardian, soldier, sailor, airman, Marine, or coast guardian.

These travel credit cards offer excellent transfer partners, card membership rewards, annual recurring benefits like travel credits, lounge access, travel and rental car insurance. Let's get into it…

In this post:

Which is better: Amex Platinum or Chase Reserve?

Chase Sapphire Reserve® Card

Learn how to apply on our partner's secure site

- $795 annual fee waived to $0 for US military + spouses with Chase MLA policy

- bonus_miles_full

- Earn 8x points on all purchases through Chase Travel℠ including The Edit℠

- 4x points on flights and hotels booked direct

- 3x points on dining worldwide

- 1x points on all other purchases

- Get a $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Live the lounge life at over 1,300 airport lounges worldwide with a complimentary Priority Pass™ Select membership, plus every Chase Sapphire Lounge® by The Club with two guests.

- Up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years which saves you a ton of time

- Up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables.

- Trip Cancellation/Interruption Insurance, Auto Rental Coverage, Lost Luggage Insurance, no foreign transaction fees, and more.

- Complimentary Apple TV+ and Apple Music. Subscriptions run through 6/22/27 – a value of $250 annually

- Member FDIC

- Learn more in the Chase Sapphire Reserve review

card_name

Learn how to apply on our partner's secure site

Welcome Bonus Offer: bonus_miles_full

- $895 annual fee* American Express special protections apply

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel® up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel®.

- $600 Annual Hotel Credit: Get up to $300 back in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using your Platinum Card®. Note that The Hotel Collection requires a minimum two-night stay

- Enjoy noon check-in, when available, and guaranteed 4PM check-out when you book Fine Hotels + Resorts® through American Express Travel®.

- $400 Resy Credit + Platinum Nights by Resy: Get up to $100 in statement credits each quarter when you use the Platinum Card® to make eligible purchases with Resy, including dining purchases at U.S. Resy restaurants. Enrollment required. Platinum Nights by Resy gets you special access to reservations on select nights at participating in demand Resy restaurants with the Platinum Card® when add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you.

- $300 lululemon Credit: Get up to $75 back each quarter for eligible purchases at lululemon in the U.S. (and online) when you use your Platinum Card. Enrollment required.

- $300 Digital Entertainment Credit: Get up to $25 back in statement credits each month when you pay for eligible purchases with the Platinum Card® at your choice of one or more of the following providers: Disney+, a Disney+ bundle, ESPN streaming services, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV when you purchase directly from one or more of the providers. Enrollment required.

- $200 Uber Cash: Platinum Card® Members can get $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. Enrollment required.

- $120 Uber One Membership Credit: When you use your Platinum Card to pay for an auto-renewing Uber One Membership, you can et up to $120 in statement credits each calendar year. Terms Apply.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Platinum Card® Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, call the number on the back of your Card. Qualifying airlines are subject to change. Enrollment required. See terms & conditions for more details.

- $209 CLEAR+ Credit: CLEAR+ helps get you to your gate faster by using your face to verify you are you at 55+ airports nationwide. Receive up to $209 in statement credits per calendar year after you pay for your CLEAR+ Membership* with the Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $120 Global Entry and TSA PreCheck Credit: $120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA PreCheck® official enrollment provider) application fee, when charged to your Platinum Card®! Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Airport Lounge Access: Enjoy the benefits of the Global Lounge Collection, with over $850 of annual value if you visit Centurion Lounges and each of our partner lounges including Delta Sky Club® lounges when flying an eligible Delta flight (subject to visit limitations), select Lufthansa lounges when flying Lufthansa, Plaza Premium lounges and Escape Lounges, and enroll in Priority Pass™ Select. See terms.

- $155 Walmart+ Membership Credit A Walmart+ membership can get you free shipping with no order minimum on eligible items shipped by Walmart. Use your Platinum Card® to pay for a monthly Walmart+ membership (subject to auto-renewal) and receive one statement credit for up to $12.95 (plus applicable taxes. Plus Ups not eligible) each month (enrollment required). Free Shipping excludes most Marketplace items, freight & certain location surcharges. Paramount+ Essential plan only, separate registration required.

- Global Dining Access by Resy gets you access premium dining experiences. Receive Priority Notify and unlock insider access to some of the world's most sought-after restaurants with Global Dining Access by Resy. Download the Resy iOS app or log into Resy.com and add your Platinum Card® to your Resy profile to take advantage of your special benefits and discover restaurants near you.

- No foreign transaction fees

- Enrollment is required for select benefits

- Learn how to apply for card_name on our partner's secure site

- Read my full review of the American Express Platinum Card® for military, terms apply, see rates and fees

Chase Ultimate Rewards vs Amex Membership Rewards

Ultimate Rewards and Membership Rewards points are the most valuable credit card reward points because of how flexible they are. You can use these flexible credit card points to:

- Pay for items on Amazon with points

- Pay for charges on the credit card account

- Buy gift cards

- Cash out the points and receive a check through the mail

- Book travel with the points through the Amex or Chase Travel℠

- Transfer the points to airline or hotel travel partners to maximize value

When you first get into the credit card travel hobby, it can be tempting to cash out your points for cash. While this can be a quick and easy way to earn some extra money, it does not extract the best value from your points.

The cash value of Chase points is 1 cent when cashed out in the Chase Ultimate Rewards Portal, available at UltimateRewards.com.

Amex points are a bit harder to cash out, but you can cash them out if you have an Amex Platinum Card for Charles Schwab. The Schwab Platinum is a separate card and product to the regular AMEX Platinum. The cash value of Amex points is 1.1 cents when cashed out through a Schwab Amex Platinum.

Best Use of Chase or Amex Points

The most valuable use of credit card points is transferring the points to the Amex or Chase transfer partners. I have received anywhere from 3-11+ cents per point, making 100,000 Amex or Chase points worth $3,000 to $11,000+ of travel value!

Currently Chase has 13 Ultimate Rewards transfer partners and American Express has 22 Membership Rewards transfer partners.

Chase Ultimate Rewards Transfer Partners

- Aer Lingus AerClub

- Air France/KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- Iberia Plus

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

Amex Membership Rewards Transfer Partners

- Aer Lingus

- AeroMexico

- Air Canada

- Alitalia

- ANA

- Cathay Pacific (Asia Miles)

- Avianca

- British Airways

- Delta

- El Al

- Emirates

- Etihad

- Flying Blue (Air France / KLM)

- Iberia

- Hawaiian Airlines

- JetBlue

- Qantas

- Singapore Airlines

- Virgin Atlantic

- Choice Hotels

- Hilton Honors

- Marriott Bonvoy

Since both credit card reward programs offer different transfer opportunities, it makes sense to to have both cards. Which card you should get first depends on where you are more likely to transfer points to.

For instance, many US government flights are operated by United Airlines. It might make sense to have some Chase points stocked up so you can transfer the UR points to United and upgrade your ticket.

You can combine Chase UR points between accounts in the same household, like a husband and wife. With AMEX you cannot combine MR points but you can transfer points to the same frequent flyer or hotel loyalty program account, effectively allowing you to combine points with your spouse.

CSR vs Platinum Card® Reward Categories

Both cards earn extra reward points in different but similar categories. The main Sapphire Reserve earning category is 4x points on flights and hotels booked directly and 3x points on dining.

The Amex Platinum Card® earns 5x points on airfare purchased directly with the airline or booked through amextravel.com.

If you value MR and UR points at about 2 cents per point, that means you can make about a 6% return on dining and travel spending and a 10% return on airline tickets.

Amex Platinum Card® vs Chase Sapphire Reserve Travel Credits

Chase Sapphire Reserve is the clear winner in this category. The $300 annual travel credit is extremely flexible, easy to use, and doesn't require any registration. It refreshes every year on your card membership anniversary.

Here's an example of how quickly the CSR travel credit posts and how easy it is to use:

I pre-paid for a rental car on Priceline for $203.50 and I took an Uber and paid $30.31. My CSR travel credit reloads in December every year. The day the charges posted to my account, the $300 CSR travel credit kicked in and zeroed out those charges. Easy!

The Amex Platinum Card® airline incidental fee credit is more unwieldy and difficult to maximize the value from. You can only select one airline a year to use the credit on. You must sign up for the benefit and activate it on americanexpress.com before you use it.

Airline incidental fee charges that count towards the Amex Platinum Card® credit include:

- Airline tickets

- Upgrades

- Mileage points purchases

- Mileage points transfer fees

- Gift cards

- Duty-free purchases

- Award tickets

Which is better – Amex Platinum Card® or Chase Sapphire Reserve?

The cash value of American Express Membership Rewards Points vs Chase Ultimate Rewards Points:

If you have the Schwab Platinum Card®, you could cash out 100,000 Amex Membership Rewards points for 1.1 cents per point or $1,100.

100,000 Chase Ultimate Rewards points can be cashed out for $1,000

If you transfer Chase and Amex points to a travel partner, you can get significantly more value from the points. Here are some examples:

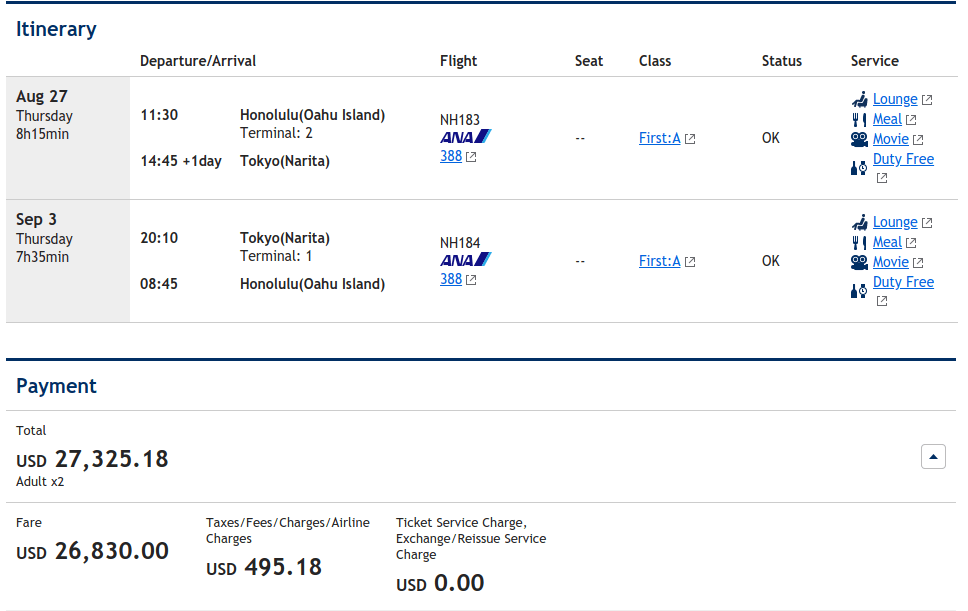

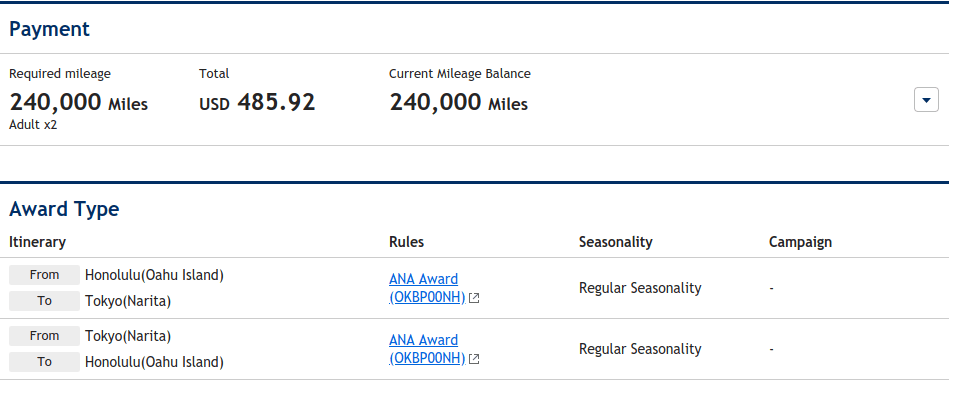

I recently booked 2 ANA first class tickets from Honolulu to Tokyo. $27,000 tickets for 240,000 AMEX points. That's 11 cents per Amex Membership Reward point!

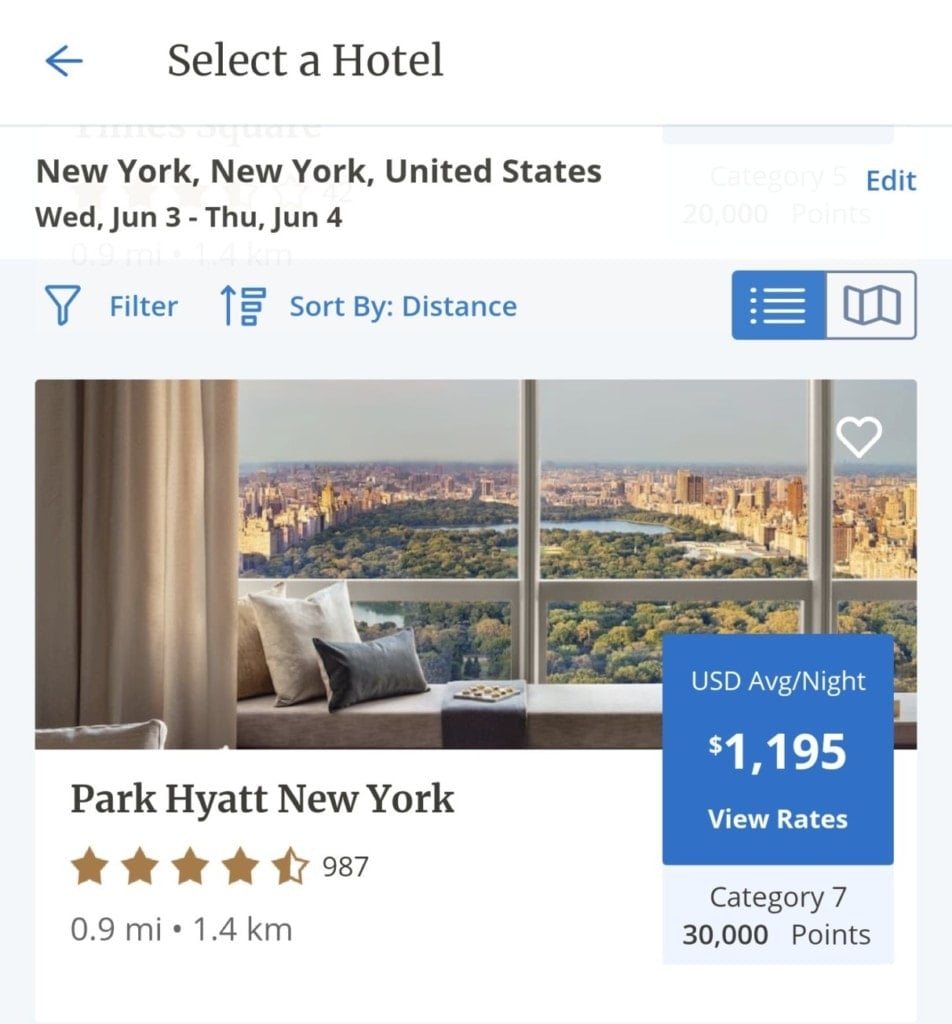

The Park Hyatt New York starts at $1,200 per night. You can transfer 30,000 Chase points to your Hyatt account and book a room to earn 4 cents per Ultimate Reward point.

Chase and Amex points are consistently valued at about the same 2 cents per point across the web. I usually use this as a benchmark when trying to make a travel redemption.

If I'm not getting 2 cents per point, I will frequently make the booking with cash and save my points for a big redemption, like ANA first class at 11 cents per point or luxury Hyatt hotels at 4+ cents per point. You can learn more about maximizing your military points in my 100% free course.

CSR and Amex Platinum Annual Benefits

Amex Platinum Card®

- Enrollment required for some of these benefits

- $200 Uber or UberEats credit

- $200 airline incidental fee credit

- $600 annual hotel credit ($300 semi-annually) on select prepaid hotel bookings through Amex Travel™️

- $300 lululemon credit ($75 every quarter), in store or online

- $100 Saks Fifth Avenue, $50 every semi-annual calendar year

- $400 resy credit ($100 per quarter)

- $120 Uber One membership (must be annual)

Chase Sapphire Reserve

- Up to $300 in annual DoorDash promos for restaurant, grocery or retail, plus complimentary DashPass membership worth $120 annually

- Up to $300 annual travel credit—still the most flexible travel credit available

- Up to $500 annually for prepaid bookings made with The Edit*

- Up to $120 in annual Lyft in-app credits

- Up to $120 in one statement credit every 4 years towards Global Entry, TSA PreCheck® or NEXUS

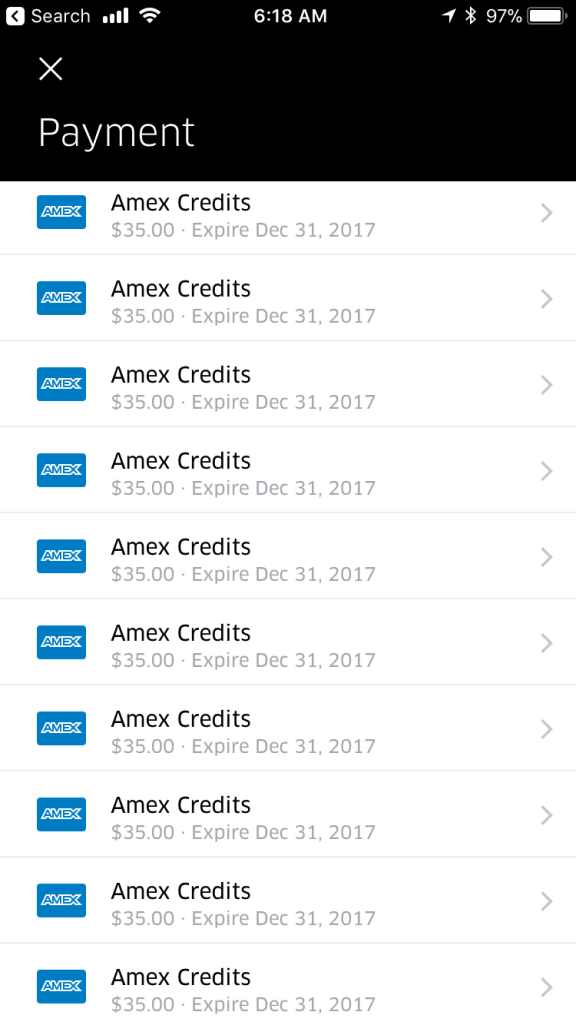

The Uber Cash is paid at $15 per month and $35 in December. Because my wife and I have multiple Amex Platinum Cards®, we received $175 in December Uber Cash last year. Hard to justify cooking when delivery is free!

Other recurring benefits for both cards include airport lounge access, travel insurance, and (only for military servicemembers and spouses).

CSR vs Amex Platinum Card® Airport Lounge Access

American Express Platinum Card® grants you access to many airport lounges.

- American Express Centurion Lounges

- Delta Sky Club Lounges

- Priority Pass Select Lounges

- Escape Lounges

- Airspace Lounges

- Plaza Premium Lounges

- International American Express Lounges

- Lufthansa Lounges

For Lufthansa and Delta Sky Club, you need to be flying that airline to access the lounge. Otherwise, you just show your Platinum Card®, a government ID, and your boarding pass for that day.

The CSR gives you access to Priority Pass lounges. When you open the Priority Pass app, you can see a list of lounges where you can access for free, usually with up to 2 guests.

The Amex Platinum Card® and Chase Sapphire Reserve cut the Priority Pass restaurant benefit. You'll need the Amex Platinum Card® to access Centurion, Delta, and Lufthansa lounges, so make sure you apply for both cards!

Chase Reserve vs Amex Platinum Card® Travel Insurance

To keep it simple, use your CSR for booking rental cars and either card for booking airfare.

The Sapphire Reserve rental car insurance is primary car rental coverage, meaning it kicks in and covers your damages before your regular auto insurance, like USAA or GEICO. Amex Platinum Card® only offers secondary coverage, meaning it only steps in when your regular car insurance is exhausted.

AMEX Platinum Card® Travel Insurance

- Trip cancellation and interruption: up to $10,000 per trip

- Trip delay: up to $500 for lodging, meals, etc if your trip is delayed by more than 6 hours

- Lost luggage: up to $2000 per person per trip for loss of checked bag and $3000 for carry-on

CSR Travel Insurance

- Trip cancellation and interruption: up to $10,000 per person per trip

- Trip delay: up to $500 for lodging, meals, etc if your trip is delayed by more than 6 hours

- Lost luggage: up to $3000 per person per trip

- Travel accident insurance: up to $1,000,000 per person

Sapphire Reserve vs Amex Platinum Card® Military Annual Fee

The American Express Platinum Card® annual fees are $895 per year. The Chase Sapphire Reserve annual fees are $795 per year.

Both American Express and Chase offer special military protections on these 2 cards for military servicemembers and spouses. Yes, you read that right:

Military servicemembers get special military protections on their Chase Sapphire Reserve and their American Express Platinum Card®.

For more information see my detailed explanation of the Chase MLA policy and the Amex MLA policy.

Is It Worth Having Both the Amex Platinum Card® and Chase Sapphire Reserve?

Yes! Every military servicemember and their spouse or partner should have their own Amex Platinum Card® and Chase Sapphire Reserve.

Both cards have their strengths and weaknesses. Together they have very complementary reward categories, so you can earn much more than 1 point per dollar spent on airlines, hotels, travel, and restaurants.

My wife and I both have our own Amex Platinum Card® and Chase Sapphire Reserve cards.

Here is the best way to maximize your points earning with these cards after you receive your welcome bonus:

- Book all airline tickets and airfare directly with the airline or through amextravel.com with your Amex Platinum Card®: 5x points

- Pay for your flights and hotels directly on your Chase Sapphire Reserve to earn 4x points

- Put all of your restaurants, cafes, bar tabs, and other dining on your CSR to earn 3x points

- Everything else put on the card (CSR or Platinum Card®) that earns the flexible points (MR or UR) you need the most

Best Travel Credit Card for Military Servicemembers

Military servicemembers and their spouses should each get their own Amex Platinum Card® and Chase Sapphire Reserve. These are the 2 best travel credit cards for military families.

Don't just add your spouse as an authorized user to your card! He or she is able to get their own welcome bonus and earn their own annual perks.

What are you waiting for? Who knows how much longer these protections will be available for military servicemembers? Get these cards before this amazing benefit goes away!

Learn more about applying for the Platinum Card from American Express®.

card_name

Learn how to apply on our partner's secure site

Welcome Bonus Offer: bonus_miles_full

- $895 annual fee* American Express special protections apply

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel® up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel®.

- $600 Annual Hotel Credit: Get up to $300 back in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using your Platinum Card®. Note that The Hotel Collection requires a minimum two-night stay

- Enjoy noon check-in, when available, and guaranteed 4PM check-out when you book Fine Hotels + Resorts® through American Express Travel®.

- $400 Resy Credit + Platinum Nights by Resy: Get up to $100 in statement credits each quarter when you use the Platinum Card® to make eligible purchases with Resy, including dining purchases at U.S. Resy restaurants. Enrollment required. Platinum Nights by Resy gets you special access to reservations on select nights at participating in demand Resy restaurants with the Platinum Card® when add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you.

- $300 lululemon Credit: Get up to $75 back each quarter for eligible purchases at lululemon in the U.S. (and online) when you use your Platinum Card. Enrollment required.

- $300 Digital Entertainment Credit: Get up to $25 back in statement credits each month when you pay for eligible purchases with the Platinum Card® at your choice of one or more of the following providers: Disney+, a Disney+ bundle, ESPN streaming services, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV when you purchase directly from one or more of the providers. Enrollment required.

- $200 Uber Cash: Platinum Card® Members can get $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. Enrollment required.

- $120 Uber One Membership Credit: When you use your Platinum Card to pay for an auto-renewing Uber One Membership, you can et up to $120 in statement credits each calendar year. Terms Apply.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Platinum Card® Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, call the number on the back of your Card. Qualifying airlines are subject to change. Enrollment required. See terms & conditions for more details.

- $209 CLEAR+ Credit: CLEAR+ helps get you to your gate faster by using your face to verify you are you at 55+ airports nationwide. Receive up to $209 in statement credits per calendar year after you pay for your CLEAR+ Membership* with the Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $120 Global Entry and TSA PreCheck Credit: $120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA PreCheck® official enrollment provider) application fee, when charged to your Platinum Card®! Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Airport Lounge Access: Enjoy the benefits of the Global Lounge Collection, with over $850 of annual value if you visit Centurion Lounges and each of our partner lounges including Delta Sky Club® lounges when flying an eligible Delta flight (subject to visit limitations), select Lufthansa lounges when flying Lufthansa, Plaza Premium lounges and Escape Lounges, and enroll in Priority Pass™ Select. See terms.

- $155 Walmart+ Membership Credit A Walmart+ membership can get you free shipping with no order minimum on eligible items shipped by Walmart. Use your Platinum Card® to pay for a monthly Walmart+ membership (subject to auto-renewal) and receive one statement credit for up to $12.95 (plus applicable taxes. Plus Ups not eligible) each month (enrollment required). Free Shipping excludes most Marketplace items, freight & certain location surcharges. Paramount+ Essential plan only, separate registration required.

- Global Dining Access by Resy gets you access premium dining experiences. Receive Priority Notify and unlock insider access to some of the world's most sought-after restaurants with Global Dining Access by Resy. Download the Resy iOS app or log into Resy.com and add your Platinum Card® to your Resy profile to take advantage of your special benefits and discover restaurants near you.

- No foreign transaction fees

- Enrollment is required for select benefits

- Learn how to apply for card_name on our partner's secure site

- Read my full review of the American Express Platinum Card® for military, terms apply, see rates and fees

Learn more about the Chase Sapphire Reserve or Chase Sapphire Preferred.

Chase Sapphire Preferred® Card

Learn how to apply on our partner's secure site

- Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

- 5x points on travel purchased through Chase Travel℠

- 3x points on dining (includes takeout, delivery, and dine-in), select streaming services and online groceries

- 2x points on all other travel purchases

- 1x points on all other purchases

- Earn up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠

- 10% anniversary points boost – each account anniversary you'll earn bonus points equal to 10% of your total purchases made the previous year

- No foreign transaction fees, great for overseas OCONUS assignments, TDY, and PCS

- Primary rental car insurance coverage & trip cancellation/interruption insurance, and more.

- DashPass is complimentary which unlocks $0 delivery fees & lower service fees for a minimum of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

- Upgrade to a Chase Sapphire Reserve after 1 year (compare Reserve vs Preferred)

- $95 annual fee waived for military and spouses with Chase Military Lending Act

- Member FDIC

Amex Platinum Card® vs Chase Sapphire Reserve FAQ

Both cards are fantastic travel rewards credit cards. I would recommend getting both as they both have their strengths for upgrading your travel experience. Amex has more Membership Rewards travel transfer partners, but Chase Ultimate Rewards tend to be more flexible to redeem.

The Chase Sapphire Reserve is an easy contender to the king of credit cards: the Amex Platinum Card®. I recommend you pick up both cards and compare their annual benefits like travel credits, airport lounge access, upgraded hotel stays, and excellent travel partners to transfer points to.

It depends on your travel goals. In general I get more value from Membership Rewards because they have more transfer partners that I used more frequently. However, Ultimate Rewards are very flexible. You can combine UR and MR points in some frequent flier programs, like Singapore Krisflyer, to maximize your travel redemptions.

Hey Spencer, appreciate you sharing your travel hacking knowledge on this site – I’ve found useful info here since I discovered it last year. I have a question – do you know of a way to find cheap Fine Hotels + Resorts at which to use the Amex Hotel credit? For a practical person trying to use the credit to stay at a hotel in lieu of paying for a more standard/normal hotel when traveling, I couldn’t find a good method. The Amex travel site doesn’t have good search features or filters. I made this tool this week to help people find better ways to spend their amex hotel credit:

https://medium.com/@tr15t4n/travel-hacking-with-network-and-data-analysis-8e02084a39c4

Curious if you have your own way of finding inexpensive hotels though!