19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The American Express® Gold Card offers special military protections for active duty, Guard and Reservists on 30+ day orders, and military spouses under the Military Lending Act.

The same Amex military rules that apply to the The Platinum Card® from American Express for you and your spouse, also apply to the Amex Gold Card.

American Express® Gold Card

Learn how to apply on our partner's secure site

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount – all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year- includes OCONUS Commissaries

- 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- No foreign transaction fees – great for the 4x on restaurants when traveling for fun, OCONUS TDY, or PCS!

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That's up to $120 Uber Cash annually! Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: You can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment required.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. Enrollment required.

- Go explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- Read my full review of the Amex Gold card for military, terms apply

- Enrollment is required for select benefits

- $325 Annual Fee* See more details about American Express protections for you and your spouse

The Amex Gold card is the second most popular American Express card on my site, after The Platinum Card® from American Express, and for good reason.

The Amex Gold Card is perfect for military troops and family members who dine out, order delivery, get takeout, or buy groceries and want to earn valuable Amex Membership Reward points.

The Amex Gold card is also my #2 recommended American Express card for military spouses. Again, this article here explains all the details on why I recommend this card so highly.

Both the active duty servicemember and the civilian spouse can open up their own account. You do not need to be authorized users on the account. This can double your annual benefits!

I recorded two episodes on the Military Money Manual Podcast on the Amex Gold card and the best cards for military spouses. You can listen in the players below or on Spotify or Apple.

In this post:

Amex Gold Card Military Fee Protection

American Express offers special protections on all of their personal cards for “covered borrowers” of the Military Lending Act. Covered borrowers, as defined in the law, include:

- Active duty members in the Army, Navy, Marine Corps, Air Force, Space Force, and Coast Guard

- National Guardsmen, Air National Guardsmen, or military Reservists on Title 10, Title 32, or other active duty orders for 30 days or longer

- Military spouses of any of the above

Once again, if you are active duty, a Guard or Reservist on 30+ day plus active orders, or a military spouse, you can all open your own, individual card accounts with American Express and be covered by these special military protections.

You can get all the benefits of these cards and have your annual fee reduced to $0.

To confirm that you will receive MLA protections when you apply for your American Express card, you can check your MLA eligibility in the MLA database.

I recommend checking the MLA database before applying for your first card, even if you've been active duty or a military spouse for a while. Sometimes Social Security Numbers are missing or DEERS is inaccurate. You must be listed as eligible for MLA benefits in the MLA database or you will have a difficult time proving eligibility to American Express.

Cards eligible for the American Express MLA protection include:

- The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card*

- Marriott Bonvoy Brilliant® American Express® Card

- Delta SkyMiles® Reserve American Express Card

- Blue Cash Preferred® Card from American Express

- Hilton Honors American Express Aspire Card*

American Express, like all US credit card companies, complies with the Servicemembers Civil Relief Act and Military Lending Act.

The date you open your American Express card or account determines which Act you may be entitled to relief under.

| Account Opened While On Active Duty Orders | Account Opened Before Active Duty Orders |

| Military Lending Act | Servicemembers Civil Relief Act |

Read this article for more information on the American Express military protections.

Amex Gold 100k Bonus

Currently the Amex Gold card is offering the opportunity to earn as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount – all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

At 11 cents per point, the Amex Gold Card welcome offer could be worth $11,000, which is more than minimum spend required!

100,000 points can be cashed out through the Schwab Platinum Card for $1,100 (at 1.1 cents per point) or transferred to over 20 travel transfer partners for maximum value. Now is a great time to earn the points and then cash them in latter for when travel opens back up.

Learn how to maximize your Amex points in my free Ultimate Military Credit Cards Course. Or check out the Military Money Manual Podcast for more military travel credit card tips.

100,000 Amex points are worth approximately $2,000 if you transfer to a partner airline or hotel, if you can get 2 cents of value per Amex Membership Reward points.

Sometimes you can get much more than 2 cents per Amex point. For example, I recently booked a round trip, first class flight for my wife and me to go to Japan next year.

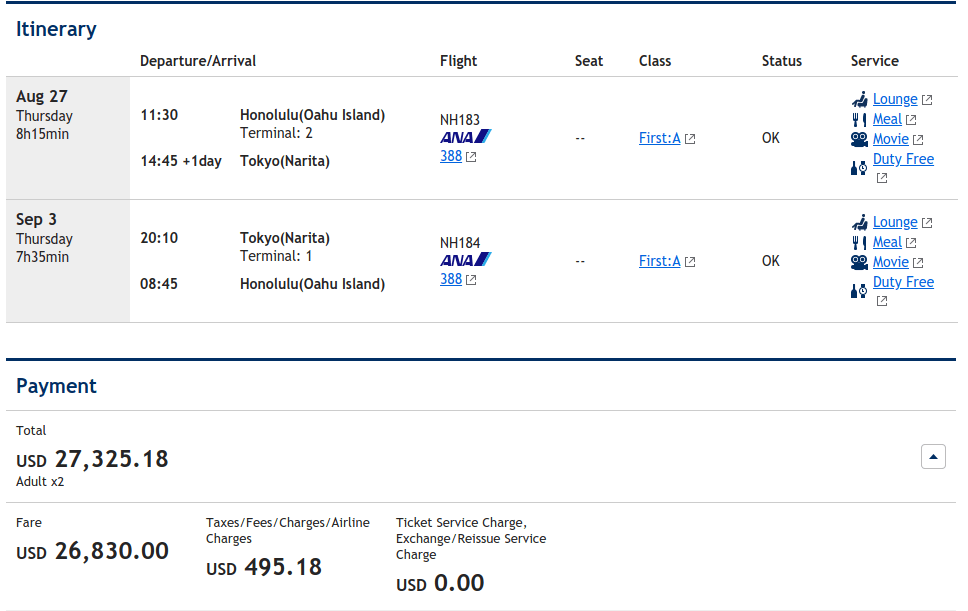

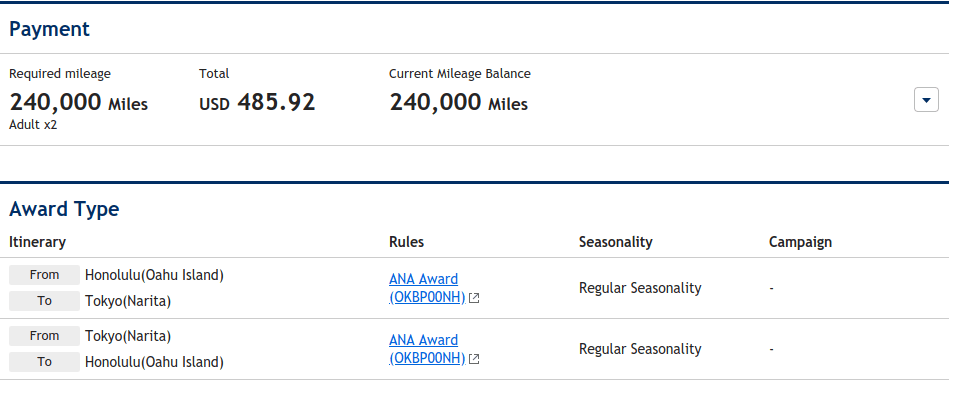

These flights would have cost $27,000, but I I cashed in 240,000 AMEX MR points instead for a valuation of over 11 cents per American Express Membership Reward point. Here's two screenshots comparing the cash price vs the points price.

Amex Gold Bonus Categories: Food!

The bonus categories for the Gold card include 4x on restaurants worldwide, which is even better than the 3x points on dining with Chase Sapphire Reserve®.

The Amex Gold card also offers 4x points on US supermarkets up to $25,000 per year. This could be worth 100,000 Amex MR points if you spend a lot on groceries!

If you value Amex Membership Rewards points at 2 cents or greater, this is an even better return on supermarket spending than the Blue Cash Preferred® Card from American Express with 6% cash back on US supermarkets (see Special Protections for active duty military and their spouses).

US military Commissaries overseas are eligible for the 4x points on US supermarkets. If you're stationed in Japan, South Korea, Germany, England, Spain, Italy, or Bahrain, you can use this card on base at the Commissary, and earn the 4x points.

The no foreign transaction fees on this card make it perfect for OCONUS TDY, PCS, and deployments. If you like to travel internationally on vacation, you need this card in your wallet.

This card is an excellent compliment to the Amex Platinum card. The Gold card earns more points (4x vs. 1x) on restaurants worldwide and US supermarkets than the Platinum card. I compared the Amex Gold vs Amex Platinum to see which is better for military servicemembers.

The Platinum Card earns 5x Membership Rewards® Points on flights booked directly with the airlines or with American Express Travel® (up to $500,000 per calendar year) vs the Amex Gold card's 3x points on airfare booked directly with the airline or on amextrael.com. Therefore, use your Amex Platinum Card for airfare and your Amex Gold card for groceries and dining out.

Having both cards in the military makes perfect sense for reasons I spell out in this article.

Amex Rose Gold Card for Military

The Amex Rose Gold card is a special edition of the Amex Gold Card. It has all the same perks and benefits.

The rose gold color is very distinctive. It also sounds very distinctive when you tab it on the table. Both the Amex Gold and Rose Gold card are made of metal.

I personally picked up one of these Amex Rose Gold Cards as soon as it was offered earlier this year.

Upgrade Amex Gold to Amex Platinum

While the Amex Gold card is great, you can upgrade this card to the another Amex Platinum after 1 year of card membership. Then you can open another Amex Gold. You probably won't be eligible for the welcome bonus, since Amex has a “once per lifetime” welcome bonus policy.

Now you'll have 2 Amex Platinums and 1 Amex Gold.

I recently upgraded my Amex Gold card to another Amex Platinum card. I then opened another Amex Gold card account to continue to have access to the 4x points on restaurants worldwide and US supermarkets.

Because I had previously opened an Amex Gold card account and received a welcome offer, I will not be eligible for future welcome offers on new or upgraded Amex Gold accounts.

After another year I will upgrade my new Gold card to another Amex Platinum Card and the open another Amex Gold card. This process should be able to continue until I leave active duty or I hit the Amex charge card limit. Maybe I'll even get more than 11 Platinum cards!

Bottom line, the Amex Gold card is perfect for traveling military servicemembers and spouses who eat out at restaurants worldwide, either at home or on the road or grocery shop. The Gold Card should be your go to card for all food purchases, whether it's making food at home or letting someone else do the cooking and clean up!

American Express® Gold Card

Learn how to apply on our partner's secure site

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount – all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year- includes OCONUS Commissaries

- 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- No foreign transaction fees – great for the 4x on restaurants when traveling for fun, OCONUS TDY, or PCS!

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That's up to $120 Uber Cash annually! Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: You can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment required.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. Enrollment required.

- Go explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- Read my full review of the Amex Gold card for military, terms apply

- Enrollment is required for select benefits

- $325 Annual Fee* See more details about American Express protections for you and your spouse

Amex Gold FAQ

The Amex Gold card is still metal.

The Amex Gold card benefits include a large welcome bonus offer, bonus categories to earn extra points like worldwide restaurants, US supermarkets, and travel. You also get monthly Uber and dining credits. No foreign transaction fees Amex Gold a great travel rewards card.

The Amex Gold card should be pretty easy to get with a credit score over 700.

The balance is due in full every month. However, Amex does offer a pay over time feature, that allows you to make monthly payments towards your balance, similar to a credit card.

Yes, the Amex Gold card offers special protections for active duty and military spouses. Guard and Reservists on 30 day active orders and their spouses also qualify. Check the MLA database before applying.

American Express uses the MLA and SCRA databases to verify military status. You may also be able to submit military orders directly to Amex.

First off: great blog, great course, great podcast! Love it ALL!

I’ll be joining the AF soon (OTS in Jan) — I assume that is the start of my 30-day count down, correct?

After reading through most of the credit card course, I want to make sure my understanding and comprehension of everything said is correct. Therefore, . . .

My question (to see if I’m correctly compiling the information you have in your articles):

I do a bit a credit card travel hacking already, thus I’ll be utilizing the SCR benefits once my 30 day hits for existing credit cards with annual memberships.

I have 3 existing old Chase cards (2 base tier no annual memberships + 1 CSP).

After reading this course/article, my next step is to open an Amex.

My question is regarding Amex Gold vs Platinum (which I know you have an article for, which I’ve read through). If Amex has the “one bonus per lifetime per product” rule, the suggestion of opening the Gold first (due to better daily use) and then upgrading to the Platinum (after 1 year) then opening another Gold later on (to compliment the Platinum), correct?

My thoughts: the benefits you mention with the Platinum (5x travel etc) seem similar to the Chase Reserve.

Therefore, I plan on upgrading my existing Chase Preferred to Chase Reserve (which wouldn’t be counted towards my 5/24 rule because I’m only upgrading and not opening and then apply the SCR benefits at 30days) and open an Amex GOLD for the daily benefits and 60K reward (or whatever it is as of today). Then aim to open an Amex Platinum later on so I can also get the 80K (or whatever it is at that time) reward because it’s a new product, therefore I haven’t used the “one bonus per lifetime per product”. Therefore, the Chase Reserve would substitute for the Amex Platinum in your mentioned Amex Gold and Platinum complimentary combo.

Summary:

– Upgrade existing Chase Preferred to Chase Reserve

– At the same time, open an Amex Gold for 60K bonus (or whatever it is now)

– Later date, open Amex Platinum for the bonus at that time

Does that sound right?

P.S. I’m wanting to open, and upgrade, the cards now instead of waiting until I’ve reached my 30 days AD because I’ll be traveling to/from OTS and to/from my first assignment which would be a perfect time for meeting the opening reward requirements, especially the Amex Gold benefits with grocery and restaurants, etc. Additionally, with upgrading the Chase Preferred to Reserve, I can take advantage of the lounge access during my flight layover to/from OTS. :-)

(I thought that might be a question that would pop into your head after reading everything).

Hello ! I would like to get the gold card. My concern is not all commissaries code as grocery store or supermarket . Have this been a issue with you guys ?

No, it hasn’t really been an issue. Most Commissaries code as grocery store or US supermarket, even the OCONUS ones. Check out which Commissaries code as a grocery store or supermarket.

What is the process to Upgrade from Gold to Platinum?

Thank you

Covered how to upgrade Amex Gold to Amex Platinum here.

“Earn 60,000 Membership Reward Amex points after spending $4000 in the first 6 months of account opening”

Spencer, It’s 3 months now instead of 6 months, could you please double check?

I still see 6 months when I use my link here. Did you try incognito mode on your browser?

From the application: “based on your history with credit card balance transfers, American Express welcome offers, introductory APR offers, or the number of Cards you have opened and closed, you are not eligible to receive the welcome offer.” Hmmm…

But I’ve never been a Gold card holder. Current AMEX wallet is a Plat, Hilton Prestige and Aspire, Bonvoy Brilliant. Ideas?

When was your last application? Did you break any of the Amex application rules here?

so when I have multiple AMEX platinum cards. can i combine all of my benefits? or are the still separated by the different card accounts? example, with 1 platinum cards I get a monthly $15 to spend on uber eats. with 2 cards i get $30. Would I need to make 2 separate orders from ubereats? or can I lump it into 1 order?

The benefits are additive. So for instance I get $75 of Uber credits per month since I have added all 5 of my and my wife’s Platinum cards to my Uber account. Or the Saks credit I just split the transaction over 5 cards or buy 5x $50 gift cards with each Platinum card.

Spencer have you had recent luck with buying the sacks giftcards and if so was it online or in person?

In person in July 2021. All successful across 8 Platinum cards. I will try again in January 2022 when my $50 credit refreshes.

Spencer, Can you confirm whether you are still having luck with Saks gift cards (in person vs online)? I’ve heard different things and this is definitely one part of the Platinum I haven’t utilized well.

In person gift cards working as of July 7 at Saks Fifth Avenue New York City.