19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The Marriott Bonvoy Brilliant® American Express® Card is a great card for military servicemembers and military spouses, especially if you enjoy traveling or you go TDY often.

American Express may extend protections for you and your spouse. Learn more details about those protections here.

Marriott Bonvoy Brilliant® American Express® Card

Learn how to apply on our partner's secure site

- $650 Annual Fee* See details about American Express protections for you and your spouse

- Earn up to 150,000 Marriott Bonvoy® bonus points. Earn 100,000 points after you spend $6,000 and an extra 50,000 points after you spend an additional $2,000 in purchases on the Card within your first 6 months of Card Membership.

- Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card at restaurants worldwide.

- With Marriott Bonvoy® Platinum Elite Status, you can receive room upgrades, including enhanced views or suites, when the stay is booked with a Qualifying Rate at hotels that participate in Marriott Bonvoy (subject to availability upon check-in).

- Earn 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy® program.

- 3X Marriott Bonvoy® points at restaurants worldwide and on flights booked directly with airlines.

- 2X Marriott Bonvoy® points on all other eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card.

- Enjoy a night away when you receive 1 Free Night Award every year after your Card renewal month. Free night can be used for one night (redemption level at or under 85,000 Marriott Bonvoy® points) at hotels participating in Marriott Bonvoy®. (Certain hotels have resort fees)

- Get rewarded each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant® American Express® Card. Select one Brilliant Earned Choice Award benefit per calendar year. See here for Award options.

- Elevate your stay with $100 Marriott Bonvoy® Property Credit: Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card.

- Save time traveling with either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant® American Express® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Receive 25 Elite Night Credits toward the next level of Marriott Bonvoy® Elite status each calendar year with your Marriott Bonvoy Brilliant® American Express® Card. (Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express.)

- Lounge Access! Enroll in Priority Pass Select, which offers unlimited airport lounge visits to over 1,200 lounges in over 130 countries, regardless of which carrier or class you are flying. Escape the busy airport and enjoy snacks, drinks, and internet access in a quiet, comfortable location.

- Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- No Foreign Transaction Fees on international purchases.

- Terms Apply, Enrollment is required for select benefits

I typically try to get 1 cent per Marriott point, so a hypothetical 50,000 Marriott Bonvoy point welcome bonus would be worth at least $500 of hotel stays.

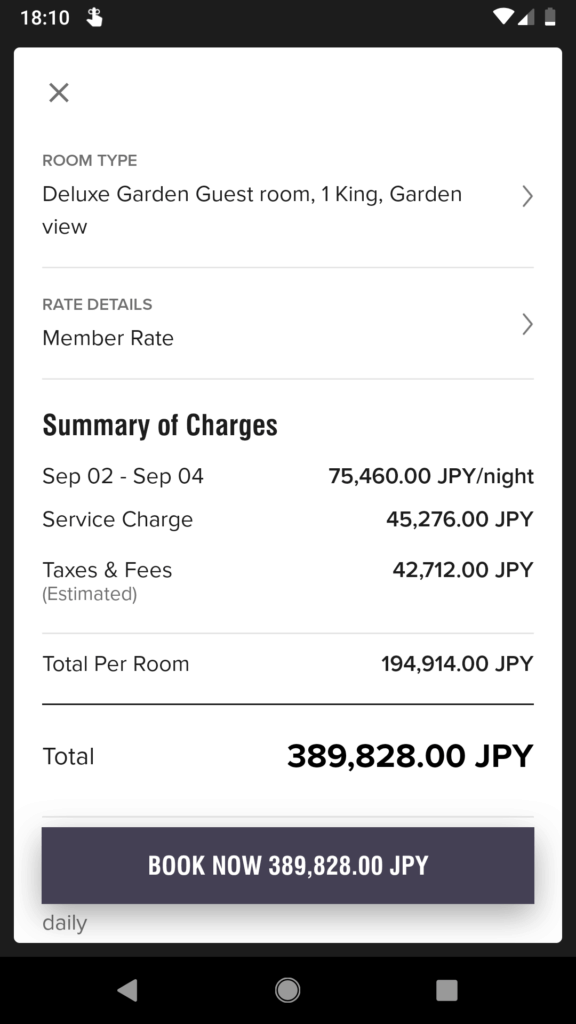

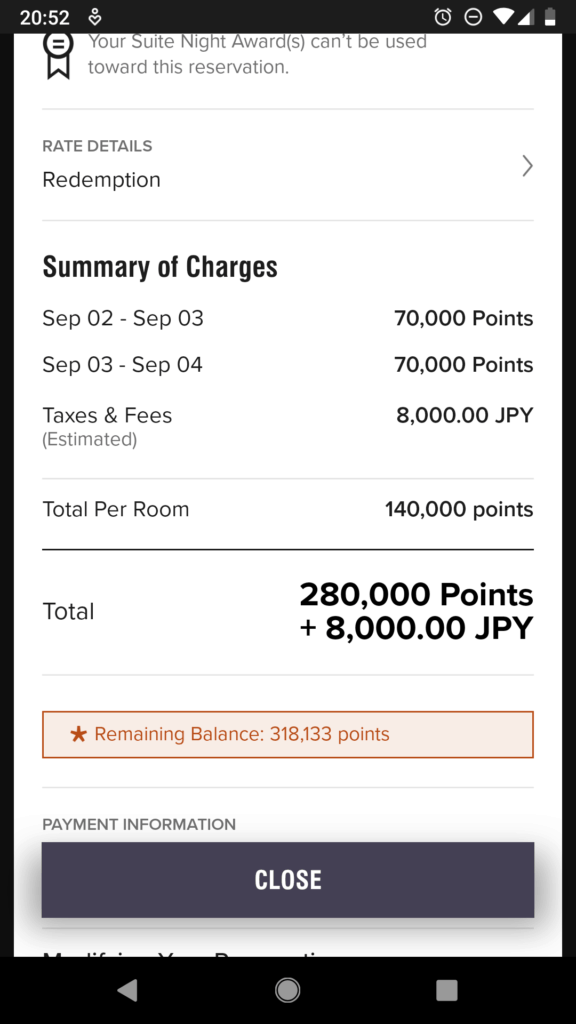

For example, I booked a stay on Marriott Bonvoy points at the Kyoto Ritz Carlton, one of the most luxurious hotels in the world.

Two nights and 2 rooms would have been $3500, but I only paid 280,000 Marriott Bonvoy points, giving me over 1.25 cent per point of value.

$3,564.21 USD for 2 rooms, 2 nights at Kyoto Ritz Carlton

Or 280,000 Marriott Bonvoy Points and $73 USD for the same rooms!

Marriott has re-branded the Marriott Rewards, Ritz-Carlton Rewards, and Starwood Preferred Guest (SPG) Rewards into “Marriott Bonvoy.” With the re-branding comes some excellent card opportunities.

Active duty US military personnel can check American Express benefits here and Chase military benefits here.

I recommend you pick up all 4 of the best hotel credit cards for military.

In this post:

Amex Marriott Bonvoy Brilliant for Military

This is my top recommend Marriott card for US military personnel. It really is a complete no-brainer. Let's review the benefits.

You get an annual free night at any Marriott property up to 85,000 points. That means you could stay 1 night at a Category 7 hotel, like the St. Regis Deer Valley or the Moana Surfrider on Honolulu's Waikiki Beach for free during off-peak season. Every year you have the card open!

What are you waiting for?

If you are in the military or a military spouse, you should learn how to apply for a Marriott Bonvoy Brilliant® American Express® Card.

Marriott Bonvoy Redemption Chart

Marriott Bonvoy has dynamic pricing for it's hotel rewards.

It ranges from 5,000 points for a category 1 hotel off-peak to 120,000 points for a category 8 peak redemption.

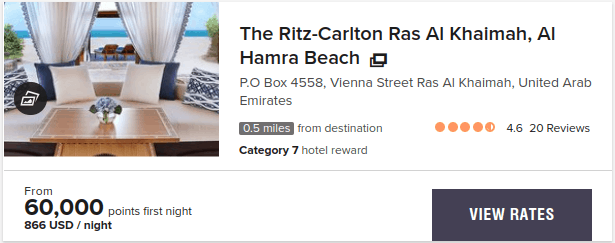

For instance, you could book the Ritz Carlton Al Hamra Beach Resort near Dubai for 60,000 points or a 1.4 cents per point value. This is a Category 7 hotel, soon to be upgraded to Category 8. See the screenshot below:

I usually try to get at least 1 cent per point on my redemption. If a room is $100 per night or more I'm willing to part with 10,000 points or less to get it. Many travel points enthusiasts value Marriott points between .5 cents to 1 cent.

Marriott Credit Cards Military Advantages

Since you are paying no annual fees, it makes sense to hold on to these cards as long as you are in the military.

If you go TDY frequently, chances are you will end up staying in a few Marriott's. The Amex Bonvoy Brilliant gives you automatic Marriott Bonvoy® Platinum Elite status, so you can expect upgraded rooms and free breakfasts at many locations.

I earned Platinum Elite status with a single 2 week stay in Egypt in 2018. We stayed at the Cairo Marriott Hotel & Omar Khayyam Casino. It was a lovely spot, with great food, clean and quiet rooms, and literally on an island in the Nile river.

Watch out for Marriott “Elite Status Challenges.” This is an easy way to earn elite status with only a few stays. Thanks to this TDY, I'm now Marriott Bonvoy Platinum Elite for the rest of 2019.

How I Use Marriott Bonvoy Points

Marriott points are great to have stored up, as whenever you need to travel, whether it's for work or pleasure, chances are there is a Marriott nearby. For instance, if you have to go to your brother's college graduation, rather then shelling out $300 for a hotel you can just cash in some points.

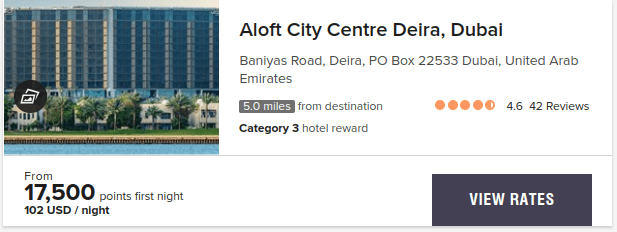

My wife and I are catching a 6AM international flight out of an airport 1.5 hours away. Rather than get up at 2AM to get there 2.5 hours prior to takeoff, we are checking into an Aloft Hotel right by the airport the night before.

Now we'll get a good nights sleep, get up at a more reasonable 4AM, and it only cost us 17,500 points. The cash rate was $102 before taxes and fees, so we only got .6 cents per point, but it's better than paying cash!

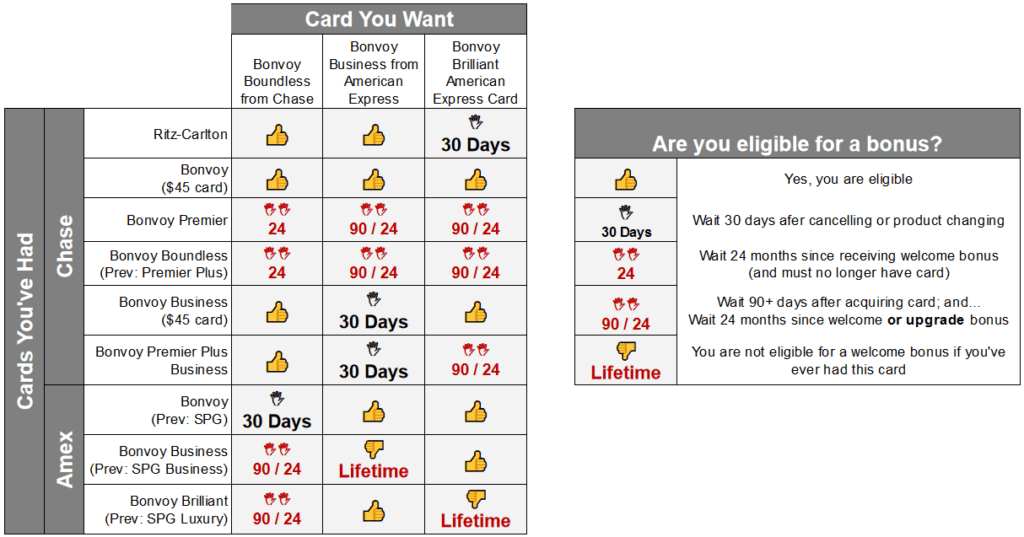

If you are interested in getting more than one of these Bonvoy cards, just check this handy chart below from Frequent Miler, explaining the Chase and AMEX Marriott Bonvoy credit card rules:

I recommend you learn how to apply for the Marriott Bonvoy Brilliant. This is the best Marriott Bonvoy credit card for all military servicemembers. If you are in the military, the no annual fee benefits of this card make it too good to pass up.

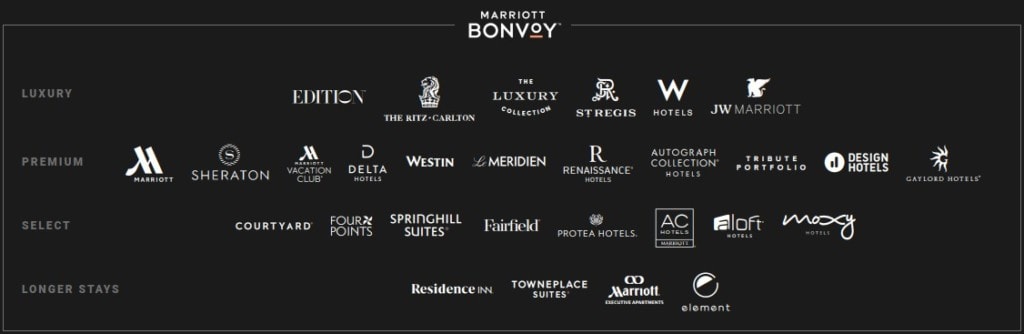

Marriott Properties List

Here is a list of all of Marriott Bonvoy's brands. They have over 7000 hotels and resorts worldwide, so there's probably one where ever you go!

The Ritz Carlton, Edition, W Hotels, The Luxury Collection, St. Regis Hotels and Resorts, JW Marriott, BULGARI Hotels and Resorts, Sheraton, Marriott, Marriott Vacation Club, Delta Hotels, Westin Hotels and Resorts, Le Meridien, Renaissance Hotels, Autograph Collection Hotels, Tribute Portfolio, Design Hotels, Gaylord Hotels, Courtyard by Marriott, Springhill Suites by Marriott, Four Points by Sheraton, Fairfield by Marriott, Protea Hotels, AC Hotels, Aloft Hotels, Moxy Hotels, Residence Inn, Townplace Suites, Marriott Executive Apartments, element by Westin

After opening a Marriott Bonvoy Brilliant card, I recommend you check out the other hotel credit cards for military.

Marriott Bonvoy Brilliant® American Express® Card

Learn how to apply on our partner's secure site

- $650 Annual Fee* See details about American Express protections for you and your spouse

- Earn up to 150,000 Marriott Bonvoy® bonus points. Earn 100,000 points after you spend $6,000 and an extra 50,000 points after you spend an additional $2,000 in purchases on the Card within your first 6 months of Card Membership.

- Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card at restaurants worldwide.

- With Marriott Bonvoy® Platinum Elite Status, you can receive room upgrades, including enhanced views or suites, when the stay is booked with a Qualifying Rate at hotels that participate in Marriott Bonvoy (subject to availability upon check-in).

- Earn 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy® program.

- 3X Marriott Bonvoy® points at restaurants worldwide and on flights booked directly with airlines.

- 2X Marriott Bonvoy® points on all other eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card.

- Enjoy a night away when you receive 1 Free Night Award every year after your Card renewal month. Free night can be used for one night (redemption level at or under 85,000 Marriott Bonvoy® points) at hotels participating in Marriott Bonvoy®. (Certain hotels have resort fees)

- Get rewarded each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant® American Express® Card. Select one Brilliant Earned Choice Award benefit per calendar year. See here for Award options.

- Elevate your stay with $100 Marriott Bonvoy® Property Credit: Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card.

- Save time traveling with either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant® American Express® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Receive 25 Elite Night Credits toward the next level of Marriott Bonvoy® Elite status each calendar year with your Marriott Bonvoy Brilliant® American Express® Card. (Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express.)

- Lounge Access! Enroll in Priority Pass Select, which offers unlimited airport lounge visits to over 1,200 lounges in over 130 countries, regardless of which carrier or class you are flying. Escape the busy airport and enjoy snacks, drinks, and internet access in a quiet, comfortable location.

- Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- No Foreign Transaction Fees on international purchases.

- Terms Apply, Enrollment is required for select benefits

Hey Spencer,

A lot of good info thanks so much for your website- if I have 2 brilliant credit cards both the black ones does my marriot account get 50 elite nights? chat rep said its only allowed for one consumer and one business card- curious if you have run into this? thanks

I have a platinum and gold, and nothing else from Amex. I went to apply for the Marriott Brilliant, but when I go to click submit, it notifies me that I am not eligible for the bonus offer (currently 85k points) and does not give any reason why. It asks if I want to proceed with the application or cancel, so I hit cancel.

Any idea what’s going on here? Do I need to open a separate Amex account to open the Marriott Brilliant under and then eventually merge it into my platinum/gold account?

No need for a separate Amex account. I’m sounds like you’re in Amex pop-up jail. Wait a while to get out, work on Chase cards in the meantime.

Hey Spencer, thanks for the quick response!! I already have the Chase cards (Reserve, Southwest, Amazon, Hyatt, and IHG). So do you think I should just get a Capital One card while I do hard time in the Amex pop-up jail? I don’t see any harm in working on Capital One.

Or Citi cards. I just reviewed your page on Capital One and realized they don’t waive the annual fee.

If my original Amex card was the newly created SPG and it got converted to the bonvoy brilliant…. can i sing up for another brilliant and/or would i get the sign up bonus?

I’ve been in the AMEX pop-up jail for some time now (no carried debt and transactions spread out over several AMEX cards). Should I just pull the trigger and open this card and forgo the 75k in points? The perks seem well worth it and I keep finding myself in a Marriott while on TAD (tough life haha). Starting to think it may be worth just opening the card and giving up on the SUB

I would hold off, Kyle. I think it’s worth waiting for the welcome bonus. It might be more worthwhile putting the spend from all those TAD on another card, like the Chase Sapphire Reserve or Amex Gold.

Quick clarification question for you-the AMEX Marriott Bonvoy Brilliant card- does that offer Gold Elite or Platinum Elite status? I think there may be a typo in that section of this article/table, thank you!

Fixed that, you are right, currently the offer is Gold Elite status.

This has changed to Platinum status late last year.

Yes, thanks, the post is updated.

Another of your posts discusses new AMEX business cards as no longer qualifying as annual fee waived for military. If valid, recommend this post be updated to reflect this (or remove the references to the AMEX Marriott Bonvoy Business as “$125 annual fee waived for military”) as readers are trying to understand the pros/cons of new card membership.

REF first comment @ https://militarymoneymanual.com/american-express-waives-all-card-holder-fees-for-active-duty-military/

Mike, you are correct, Amex no longer waives business card fees on new cards opened. I will update the post, thanks!

How do you get 2 Bonvoy Brilliant cards on the same account?

I upgraded an old SPG card (not available anymore) to Bonvoy Brilliant. Or, open another Bonvoy Brilliant but you won’t be eligible for the welcome bonus.

I love Amex credit cards!They are the most military friendly company particularly their credit cards, their customer service is amazing, their website is easy to navigate and they are easier to get approved as long as your credit score is good. However, I’m scared of applying for too many cards and ruin my good relationship with Amex. Is there a limit of the number of cards that you can have at once? I currently have 2 charge cards, 4 credit cards and 1 business credit card.

AMEX allows a maximum of 5 credit cards per person and unlimited charge cards. I currently have 2 Bonvoy Brilliant, 2 Hilton Honors cards, 1 Bonvoy Business, and 6 charge cards with them (Green, Gold, Platinum).

You won’t ruin your relationship with AMEX by applying for too many cards: that’s what they want! They want you to apply for as many cards as you can!