American Express military fee benefits are an annual fee reduction to $0 on all Amex personal cards such as:

- The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card*

- Marriott Bonvoy Brilliant™ American Express® Card

- Delta SkyMiles® Reserve American Express Card

- Blue Cash Preferred® Card from American Express

- Hilton Honors American Express Aspire Card*

*Information on the American Express® Green Card and the Hilton Honors American Express Aspire Card has been collected independently by Military Money Manual

To put in bluntly: active duty, Guard and Reserves on 30 day active orders, and military spouses can open any personal American Express card and pay no annual fees.

Check the MLA database before applying for a card to ensure you will get your fees reduced to $0.

If you would like me to send you a link to apply for any of the above cards, drop in your email below.

I will send you 1 email with a link. I will NOT subscribe you to my newsletter, The Ultimate Military Credit Cards Course. If you want to sign up for the course, follow this link.

Just 1 email with links, no spam, no other emails. Thanks for your support!

In this post:

Amex Military Fee Benefits Explained

Amex military benefits are provided to active duty, Guard and Reserve on over 30 day active orders, and military spouses of any of the former. These are all known as “covered borrowers” of the Military Lending Act.

There are two military related credit laws American Express complies with: the Military Lending Act (MLA) and the Servicemembers Civil Relief Act (SCRA).

The date you open your American Express card or account determines which Act you may be entitled to relief under.

| Account Opened While On Active Duty Orders | Account Opened Before Active Duty Orders |

| Military Lending Act | Servicemembers Civil Relief Act |

If an account, card, or credit is established prior to active duty, you must apply for Servicemembers Civil Relief Act (SCRA) benefits while on active duty.

Check the SCRA database to confirm that you are listed as eligible for SCRA benefits.

If the account was established while on active duty, you fall under MLA. You'll want to check the MLA database to confirm you are eligible.

Amex Military Lending Act

Consumers eligible for the Military Lending Act are known as “covered borrowers.” Covered borrowers include:

- Active duty members in the Army, Navy, Marine Corps, Air Force, Space Force, or Coast Guard

- Spouse of an Active Duty member of the Armed Forces

- National Guardsmen, Air National Guardsmen, or military Reservist on Title 10, Title 32, or other active duty orders 30 days or longer

To comply with the Military Lending Act, American Express reduces the following fees for covered borrowers:

- Annual Membership fees

- Overlimit fees

- Late Payment fees

- Returned Payment fees

- Statement Copy Request fees

Note that only personal cards issued my American Express are eligible for the military fee reductions, not business credit cards.

How to Apply for Amex MLA Benefits

The Amex MLA process is automatic. When you apply for a card like the Amex Platinum, your Social Security number is run against the MLA database here. You can also select military as your source of income to activate a search of the MLA database.

If the credit applicant shows as eligible for on the MLA database, then the applicant is identified as “covered borrower” of the Military Lending Act. Covered borrowers include anyone on active duty orders or a military spouse identified in DEERS as a dependent of someone on active duty orders.

If you are identified as a covered borrower when you apply for the card, your Amex card annual fees will be reduced to $0. This has been the way it's worked since at least 2011.

As an active duty Air Force officer, my and my wife’s card agreements opened after Oct 2017 (when MLA started being enforced) with Amex state “You have been identified as a ‘Covered Borrower’ under Military Lending Act”. My wife is a civilian but identified as a dependent of an active duty servicemember in DEERS, so she shows as eligible for MLA benefits in the MLA database.

If you want to see if your account has been identified as a covered borrower, follow these steps:

- Go to your American Express Account Management page.

- At the bottom there is a link to “Request Cardmember Agreement”

- In the agreement you should see the text: “You have been identified as a ‘Covered Borrower' under Military Lending Act.” on the bottom of page 2.

Here is the MLA statement from the American Express Cardmember agreement:

Military Lending Act – Federal law provides important protections to members of the Armed Forces and their dependents relating to extensions of consumer credit. In general, the cost of consumer credit to a member of the Armed Forces and his or her dependent may not exceed an annual percentage rate of 36 percent.

This rate must include, as applicable to the credit transaction or account: the costs associated with credit insurance premiums; fees for ancillary products sold in connection with the credit transaction; any application fee charged (other than certain application fees for specified credit transactions or accounts); and any participation fee (other than certain participation fees for a credit card account).

To listen to this statement, as well as a description of your payment obligation for this Account, call us at 855-531-0379. If you are a covered borrower, the Claims Resolution section of this Agreement will not apply to you in connection with this Account. Instead, the Claims Resolution for Covered Borrowers section will apply.

Amex Servicemembers Civil Relief Act

American express explains these MLA and SCRA protections in their “Servicemembers Benefits” link at the bottom of americanexpress.com.

How to Get Amex SCRA Benefits

Please note you only need to apply for Amex SCRA benefits if you opened the account BEFORE active duty military service. If you open your Amex account while on active duty military service, you will automatically be enrolled in AMEX Military Lending Act.

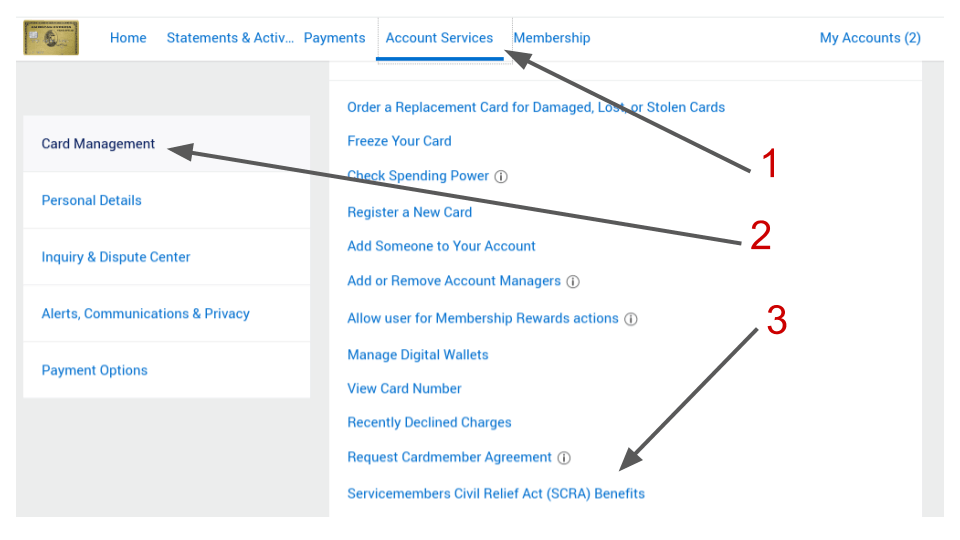

To have AMEX handle your account in accordance with the SCRA, you can go 2 ways: call AMEX or apply online. The online application is easy and they are quick to respond. Follow this 3 step process or click the picture:

- Log in to your account, click “Account Services”

- Click “Card Management” on the left

- Click “Servicemembers Civil Relief Act (SCRA) Benefits”

If you want to call, simply dial the number on the back of your card or 1-800-528-4800. Tell them you are serving on active duty military and had heard that AMEX offers to handle your account in accordance with the Servicemembers Civil Relief Act.

You will be asked 5-10 questions about your situation, such as when you entered active duty and how long your commitment is.

This information is then verified by Amex before they approve your account for the military protections, including the fee reduction to $0. The entire process took about 6 weeks for me, from phone call to receiving the secure message that my account had been approved.

You can check your eligibility before you even apply at the official DOD SCRA and MLA websites here and here.

Amex SCRA Denial

If you have any issues with an Amex SCRA denial, check out this post to resolve it. If your card is opened after you start active duty, you should not be eligible for SCRA but should be eligible for MLA. The benefits are the same and your annual fees will be reduced to $0.

American Express Platinum Military Fee Benefits

When I was active duty, we received over $12,000 of annual fee benefits thanks to the Military Lending Act protections. I first learned about these benefits from a loadmaster friend of mine.

While on a TDY to France in 2013, a military buddy of mine (an Air Force Tech Sergeant) mentioned that he had the American Express Platinum card that comes with a $695 annual fee.

This Sergeant had access to great airport lounges in Amsterdam while we were travelling on TDY. While I paid $15 for an airport sandwich, he was enjoying free food and drink courtesy of Amex in the lounge.

My friend also told me about the other Amex Platinum benefits, such as airline fee reimbursement and the welcome bonus offer.

I thought the rewards program sounded good and the benefits were great, but I couldn't justify that insanely high annual fee. $695 a year was WAY too much money for a young lieutenant!

But then my friend mentioned to me that he wasn't paying any annual fee because Amex had reduced the annual fee to $0 under the Servicemembers Civil Relief Act, a law Congress passed in 2003. I thought this was too good to be true so I had to do some more research.

The SCRA has several sections covering taxes, lawsuits, and outstanding debt. Credit card companies are only legally required to keep your interest rate below 6% on any outstanding debt you acquire before you enter military service.

I had never heard of a credit card company waiving annual fees because of the SCRA so I had to investigate further.

American Express Military Fee Protections

After further research, I discovered that American Express reduces annual membership fees for active duty military servicemembers and military spouses to $0. In fact, my site broke the news to Yahoo! Finance and ABC News.

This includes the $695 per year Amex Platinum card and all of the other personal credit and charge cards in the AMEX portfolio.

Amex decided that they are going to be a true class act and go beyond their legal requirements. For the duration of your active duty military service, they will reduce the following fees:

- Annual membership fees ($12,000+ savings for my credit cards)

- Overlimit fees

- Late Payment fees

- Returned Payment fees

- Statement Copy Request fees

Here's the email I received from American Express once my active duty status had been verified under SCRA:

Dear Spencer

To support the men and women who serve in the United States Armed Forces, we are handling your account referenced above in accordance with the Servicemembers Civil Relief Act. The Servicemembers Civil Relief Act provides for a maximum annual interest rate of 6% per year on loans you received before starting active military duty.

As of today, your account does not have a balance owed which generates interest charges so there is no eligible balance. However, we have waived the following fees on the account for the duration of your active military duty:

* Annual Membership fees

* Overlimit fees

* Late Payment fees

* Returned Payment fees

* Statement Copy Request feesThis completes our review of this account, if there are any additional accounts you would like reviewed for Servicemembers Civil Relief Act benefits, please call us at 1-800-253-1720. If you're outside the United States, call us collect at 1-336-393-1111.

We are grateful for the service and devotion you have shown to our country.

Sincerely,

American Express Customer Care

How to Get Amex Gold Card Military Fee Reduced

US military servicemembers and spouses can usually get their annual fee reduced on the Amex Gold Card without even calling in.

If you open the card while you or your spouse is on active duty, your fees should be reduced to $0 under Amex MLA policy. You can confirm your MLA eligibility in the MLA database.

If you opened the Amex Gold card before active duty, you may need to apply for Amex SCRA benefits, as described above.

10 Years of Amex Platinum Military Benefits

Just a quick update in 2023 here – I've had dozens of Amex cards since 2012. I have never been charged an annual fee. Neither has my wife. We're both still getting our Amex fees recued after 3 years separated from the military.

Imagine if I keep all the cards I listed above for another 11 years of active duty military service. That would be over $60,000 in annual fees over the next 11 years.

Think of all the free airport lounges I've been in, the hotels I've been upgraded at, and the upgraded flights I've taken in those 11 years! The value of this benefit for military servicemembers is truly astronomical.

In December every year I receive over $235 of Uber Cash from my 7 Amex Platinum cards. That's at least a few free meals from a restaurant!

Amex Platinum Card Military Fee Benefit Success Stories

Fellow servicemembers report thousands of dollars of fees refunded and excellent cards obtained with no annual fees. Just read some of the dozens of comments below this post. Here's a few highlights:

Brian from the Army sent me this email on Christmas Eve, 2013:

Wanted to thank you for your posts about American Express's unique support for SCRA. I called Amex last month (Nov '13) and applied to have my account associated with the program. Last week I received $2,500 in returned fees (annual fees, interest charges, etc…), all paid to Amex over the last 10 years as a Delta Amex card member. Today I just applied for the Amex Blue Preferred Card and according to customer service, the annual fee is not charged. Thank you again for sharing and for the support you've provided to all Servicemen.

So awesome to hear, Brian!

Kevin reported in 2016 getting over $8,000 back:

I was looking around the AMEX website and came across their SCRA link. I have the AMEX Blue card and recently opened up an AMEX Platinum account…mostly for the airport lounge access.

A friend of mine said AMEX will reduce the annual fee for active military, which is a hefty annual fee. I didn’t even speak to anyone, just clicked on the link. This was March 19th. I received an email saying I had a message in the secure message center which in turn said my “issue” has been resolved and I would be receiving written confirmation of the results.

On April 2nd, I started downloading transactions through Quicken and had several from American Express. They were all refunds in varying amounts, ranging from $50 all the way to $5,382.61.

The total amount I received back was $8,604.05. I actually have a credit of nearly $1,900! I was happy, but at the same time concerned a mistake had been made. I’ve had an Amex account since 2002 and been active army since 1999, so I’ve amassed some fees, however when I called to confirm, I was told, yes, this is all correct, no errors made. Needless to say, I am forever dedicated to Amex.

Since writing this post over 10 years ago, I've received hundreds of responses from military servicemembers getting their fees reduced and enjoying the benefits of Amex cards.

There are also lots of posts on Reddit describing the fees Amex has reduced for military personnel.

Best Amex Cards Free for US Military

American Express has the best travel reward credit card lineup of any of the major credit card companies. These cards include:

- The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card*

- Marriott Bonvoy Brilliant™ American Express® Card

- Delta SkyMiles® Reserve American Express Card

- Blue Cash Preferred® Card from American Express

- Hilton Honors American Express Aspire Card*

*Information on the American Express® Green Card and the Hilton Honors American Express Aspire Card has been collected independently by Military Money Manual

With just these cards, you can get $3,140 of annual fees reduced to $0 and you get perks like:

- Diamond Status at all Hilton Hotels

- Free airport lounge access

- $450 per year of airline fee credits

- $200 per year of Uber credits

- $240 of digital entertainment credits

- Platinum Elite Status at Marriott Bonvoy Hotels

- 360,000+ points in welcome bonuses

- 4x points on dining, groceries

- 5x points on airfare

Currently, I have the following American Express cards, all with the annual fees reduced:

- Amex Platinum x7 $4,865

- Amex Gold Card x2 $790

- Green Card $150

- Charles Schwab Amex Platinum Card $695

- Amex Delta Reserve $550

- Amex Marriott Bonvoy Brilliant x3 $1,350

- Amex Hilton Honors Aspire x4 $1,800

Total annual fees reduced to $0: $10,200

With these cards I earned over 250,000 Hilton points, 270,000 Amex Membership Reward Points, 410,000 Marriott Bonvoy points, and 75,000 Delta Skymiles.

Valued at a conservative 1.5 cents per point, that's $25,200 of travel value, just from the welcome bonus offers.

Authorized User

Military spouses, correctly identified as “covered borrowers” in the MLA database, can get their own Amex Platinum card annual fees reduced without adding the active duty servicemembers as an authorized user to the account.

Personally, my wife has 5 Amex cards now. All the annual fees were reduced to $0 without adding me (the military person) as an authorized user.

Once the SCRA or MLA benefits are applied to the first personal Amex credit or charge card, usually you don't need to apply for the benefits again – they are automatically applied to future accounts you open.

American Express Military Questions

Yes! The Amex Platinum card for US military servicemembers and their spouses reduces the annual fee to $0. The normal $695 annual fee is reduced under Amex's interpretation of the Servicemembers Civil Relief Act (SCRA) and Military Lending Act (MLA) laws.

Check the MLA database to confirm you are a “covered borrower” of the Military Lending Act. Then you can learn how to apply for the Amex Platinum card on MilitaryMoneyManual.com

Yes, Amex reduces all of their annual fees, including on the Amex Platinum card, for US military spouses listed as covered borrowers in the Military Lending Act database

Amex reduces the annual fee to $0 on all of their personal cards, like the Amex Platinum. Cards opened while on active duty are reduced with Military Lending Act (MLA). Cards opened before active duty are reduced with SCRA.

Amex MLA benefits should be automatically applied for “covered borrowers” listed in the MLA Database. Active duty, Guard and Reserve on 30+ day orders and military spouses. If your fees are not reduced and you think you should qualify based on military service, call the number on the back of your card or start a secure chat on AmericanExpress.com

Go to your Amex Account Management page. At the bottom there is a link to “Request Cardmember Agreement” In the agreement you should see the text: “You have been identified as a ‘Covered Borrower' under Military Lending Act.”

To get your Amex Platinum fee reduced to $0 for military, apply for the card while on active duty orders or be married to an active duty servicemember. Guard and Reserve must be on 30 day or longer active orders. Check the MLA database before you apply to ensure your Amex Platinum fees are reduced.

Amex, Chase, Citi, and US Bank all reduce their annual fees for credit cards opened after starting active duty military service.

The easiest way to get your Amex Platinum annual fee reduced to $0 is apply and open the card while on active duty military servicemember or while married to an active duty servicemember.

First, confirm you are eligible for Military Lending Act protections in the MLA Database. Then, learn how to apply on MilitaryMoneyManual.com

Yes, the annual fee on the Amex Gold card is reduced to $0 for active duty servicemembers, spouses and dependents, and Guard and Reserve on Title 10 or Title 32 orders. This is thanks to the Amex MLA and SCRA policies.

If you opened the card while on active duty, there is a good chance Amex will continue to reduce your annual fees as a veteran. However, if you open the card after you leave active duty, you will not get your annual fees reduced.

Yes! Amex Delta cards are all fee reduced, including the $550 per year Amex Delta Reserve. Head to this page if you want to learn more about Amex's MLA and SCRA policy.

Yes! As parts of Amex's Military Lending Act (MLA) and Servicemember Civil Relief Act (SCRA) compliance, accounts opened before or during active duty military service are eligible for special protections. Learn more about Amex MLA here.

The Delta Skymiles Reserve card is $550 but the annual fee is reduced to $0 for US military servicemembers and their civilian spouses.

Yes, the Blue Cash Preferred annual fee of $95 is reduced to $0 for military servicemembers and their spouses. This is to comply with the Military Lending Act (MLA) law.

Yes, the Amex Blue Preferred annual fee is reduced to $0 for active duty military and their spouses.

Yes, the Amex Platinum is still free for military as of 2024. The Amex Platinum annual fee is reduced to $0 for active duty, Guard and Reserve on 30 day orders, and military spouses eligible for Military Lending Act benefits.

When you apply for an Amex card, American Express will check your Social Security Number in the Military Lending Act database. If you are eligible for MLA protections in the MLA database, your Amex card annual fees will be automatically waived. You should check the MLA database yourself before applying for an Amex card to ensure you are listed in the database correctly.

I am an active Reservist. I have 26 day AD orders coming up. I had 30 day orders in 2023. Is there any way that I qualify for having the fees waived?

You need 30 day or longer active orders.

If you open an Amex Platinum card before the 30+ day active orders start, you’ll need to apply for SCRA benefits when you show as eligible in the SCRA database. Fees should be waived for at least a year or two.

However, I would wait to apply until you are on 30+ day active orders. Check MLA database before applying to ensure fees will be automatically waived. If you show as eligible in the MLA database, fees are automatically waived with no action on your part. If you’re not in the MLA database, it becomes a huge pain in the ass.

I’m in the ANG. Currently deployed, I know I’m covered by the MLA and SCRA laws. However, when I get back home and return to drill status, does that change? I’m curious if I’m “grandfathered in”, in some sort of way. This would change things for me if I have to pay the annual fees for my Platinum and Gold card(s) whenever I’m not deployed, or activated.

Not grandfathered in. Fees will eventually be charged unless you go on orders. Might take a few months, might take years. Here’s my tips for what to do with you credit cards when you come off orders.

I have searched online for this answer but there is nothing clear. I am not in the military but my relative is. I’d like to help him build credit history by making him an authorized user on one of my CCs. I’m wondering if I open an Amex platinum and add him as AU, will the fee be waived for both of us or just his AU fee?

It’s easier if he opens his own account, as it will be automatically covered by Military Lending Act. You may be able to add a servicemember as an authorized user and then apply for SCRA benefits, but it’s much easier to have them open their own account if they are in the MLA database. Then fee waivers are automatic.

Good morning! This is an amazing resource!

In this article, there are many great examples of an AD military member and their spouse each applying for AMEX Platinum Cards and getting each of their $695 annual fees waived. But what about folks with Authorized User fee situations? Does AMEX waive Authorized User Fees under MLA, SCRA, or both?

Many folks that do not want multiples of the same AMEX credit cards in their household opt-into the Authorized Users scenario. This is because they want to build up points together under one account/AMEX card instead of 2 separate pools of points that are non-transferable between AMEX members (despite being family members)

American Express waives authorized user fees under MLA and SCRA.

It’s far more advantageous for each spouse to open up their own card accounts to earn the welcome bonuses and unlock the annual recurring benefits, like $200 Uber credit and $200 airline fee credit. These benefits are not available for authorized user accounts.

For example, take the Annex Platinum card. It earns 4x points on airline purchases. But if it pays a 80,000 point welcome bonus with $8,000 spend, that’s equivalent to 10x points. You’d need to spend $16,000 in airfare to earn 80,000 points at a 4x multiplier.

I discussed the topic of prioritizing welcome bonuses vs spending categories in podcast episode 70.

Spencer,

Thanks for the reply! I really appreciate the information! I’m glad to hear AMEX does waive Authorized User Fees for AD military and spouses under Both SCRA and MLA.

You really opened my eyes with that statement of “one would have to spend $16,000 in airfare to earn 80k points, whereas the welcome bonus only requires $8,000 of spending”! That makes a huge difference, and I appreciate the advice on welcome bonuses!

I didn’t realize a spouse can open their own card. I made mine an AU on our platinum. Can she still open up her own? Would I need to take her off my card first?

Check to make sure she’s in the MLA database before she applies.

Yes, she can still get get own cards even as an authorized user on your account.

No, you don’t need to remove her from your card first.

Make sure you send her a referral link from your account (if you have one) so she earns a welcome bonus and you earn a referral bonus.

Hello. Great article with lots of useful information. Main Question: When a current Active Duty Military Member upgrades or downgrades an AMEX card (this card has already been applied for and established a couple of years before becoming Active duty), will an upgrade make the card eligible for MLA? Or is the card locked in SCRA forever?

I understand applying for a new AMEX card would give MLA as that is a new line of credit, but I have not seen/read any examples of Upgrading cards.

For example, I was thinking about UPGRADING my base Hilton Honors AMEX card (the one with no-annual fee and complimentary Silver Status) to the possibly the Surpass and later to Aspire in order to get 2 welcome bonuses. I prefer to not have multiple Hilton Honors credit cards right now, hence upgrade inquiry.

The opening day of the account determines MLA or SCRA. Upgrading does not change the opening day of the account.

In your example, if the card was established before active duty, it is SCRA eligible, not MLA eligible, even if upgraded or downgraded.

Upgrading the base Hilton to Surpass and Amex Hilton Aspire is not an optional strategy. You should directly apply for the cards to earn the welcome bonuses. Then upgrade the lower tier Hilton cards, especially if offered an upgrade bonus.

Why do you not want multiple Hilton cards at the moment?

Spencer,

Thank you for the very important information that “Upgrading the card does not change the opening day of the account.” I now understand that MLA and SCRA are set at the very beginning of each credit card application. I also appreciate the reminder about losing out on the Welcome Offer if one upgrades a credit card.

In my example, the reason why I was personally hesitant in applying for Surpass and Aspire as separate cards was because the Annual Fees for each would be a bit daunting to have once leaving Active Duty Status later in the future. In other words, hypothetically 3 Aspire Cards is amazing to maximize welcome and card benefits, but Annual Fees would take into effect once Separating or Retiring from AD service.

Follow up questions, (for cards technically under SCRA-type) do spouses also qualify to have their existing AMEX cards’ Annual Fees Waived? Example: if a spouse obtained AMEX Gold card before partner was Active Duty, then it sounds a bit too good to be true for it to be waived too.

Thank you for your answers so far! It really does help.

Hi, I have a few questions about your advice or personal experience about acquiring multiple Amex Platinum cards as an Active Duty service member. Do you have an article that speaks about your own recommended process to get more than 1 Amex Platinum card other than the Sailor’s experience that you have posted before? I have noticed you refer to yourself having 7 Amex Platinum cards, and I have not been able to find another article like the Sailor’s experience. I think it would be really helpful if you could speak about your own experience, since I personally cannot find other resources or anecdotes about stacking benefits or multiple Amex Platinums in the military, or if possible recommend other posts or articles from others that can help me understand this a bit more. Thanks! I’m really grateful for your content it’s really helpful!

There are a few ways to gain multiple Amex Platinum cards. You can open an Amex Schwab Platinum, upgrade Amex Green cards to Amex Platinum, upgrade Amex Gold cards fo Amex Platinum, or just do direct applications to open another Amex Platinum. You won’t be eligible for the welcome bonus on multiple Amex Platinum applications, but you are eligible to open multiple accounts and stack the annual and recurring benefits, like Uber, Saks Fifth Avenue, and airline fee credits.

What happens when you are no longer active duty? Do you have to start paying these annual fees? I want to get my wife an Amex but I don’t know if she should open her own account or if I should add her as a user onto mine. Would we start to incur double the annual fees when I am no longer active duty? Also, cancelling accounts due to annual fees after active duty would hurt our credit scores.

Here’s my credit card strategy for when you are no longer active duty

In summary:

1. Keep the accounts open you are getting value from

2. Downgrade to low or no annual fee versions of the cards

3. Close accounts you aren’t getting value from

Amex has continued to waive my fees 1.5 years after separating from active duty. My wife has been charged annual fees on about half of her Amex accounts after I separated. Neither of us have had to pay any Chase annual fees yet 1.5 years after separating. Chase sent us a letter saying we would have 24 months of continued fee waivers.

You should get your wife her own account. More information in my military spouse credit card article and Amex Platinum article. If she is in the MLA database, her Amex Platinum fees will be waived.

If you close accounts, it won’t hurt your credit scores that much or for that long. Maybe 10-15 points for a few months. Just keep your oldest account open to age your credit score.

My wife and I have closed dozens of accounts. We both still have credit scores over 800. It doesn’t hurt your score that much. People worry way too much about closing accounts and effect on credit score. Plus who cares what your credit score is unless you’re buying a house or car in the next year?

Chase was nice enough to tell me when my SCRA benefits would be ending and sent me a letter with updated cardholder agreements and a reminder my protected accounts would soon be losing their benefits (about a month in advance).

I’d like to have the same heads up from AmEx and Barclay’s but don’t want to call them up and say “Hey, I’m a year and half out of the military. Could you tell me when these benefits might end?” But I also don’t want to downgrade my Platinum if the fee is still being waived.

Do you know if they’re required to provide in writing that your benefits will be ending?

On my JP-Morgan Chase agreement it even said the fee could be refunded if I decided to cancel the card within a month of being charged.

Amex will provide a warning in writing. See my article on Amex cards after military separation or retirement.