19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

Here's my actual investment portfolio. Lots of people will tell you what you should own without telling you what they own. I try to demonstrate how I think military servicemembers should invest by showing you my actual asset allocation.

My goal is to achieve financial independence by age 40. Therefore, I'm investing with the intention of having enough money to live on without running out before I die.

These are the exact mutual funds that I own in my and my wife's Roth IRA, military Thrift Savings Plan (TSP), taxable brokerage account, and Solo 401k. Cash makes up a small percentage of my total net worth and is in checking accounts with USAA.

In this post:

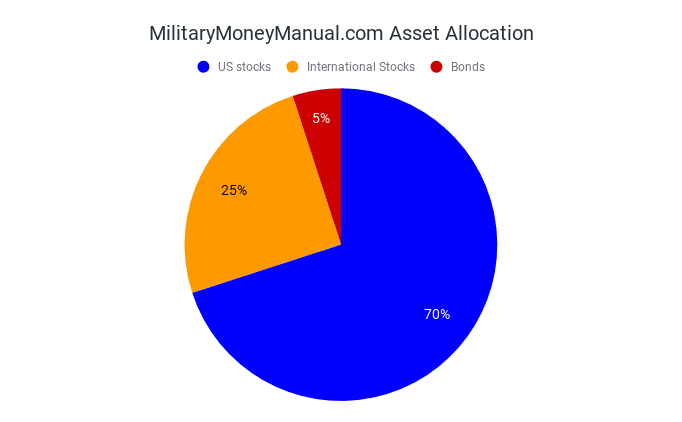

My 2022 Asset Allocation

It's a pretty simple portfolio: 70% US stocks, 25% international stocks, 5% bonds. All in Vanguard or the TSP.

It's very similar to my 2014, 2016, and 2018 asset allocations. I have added 5% to my international stocks in the last 2 years and taken away from 5%. Good discussion on international vs US investing on the Go Curry Cracker blog.

Domestic (US Stocks) Funds in my Portfolio

Vanguard Total Stock Market Fund – available as VTSAX (I own this fund) and an ETF (VTI). VTSAX contains every publicly tradeable company in the US.

TSP C Fund – this fund is made up of the largest 500 firms in America. You might have heard of the S&P 500. Same thing, different name. The ETF SPY also tracks the S&P 500, just like the TSP C Fund.

TSP S Fund – TSP small cap fund. Small cap means “small market capitalization,” which is a fancy way of saying “the rest of stocks on the US stock market not in the C fund.” As of Dec 31, 2019, the S fund invested in the shares of over 3000 U.S. small and medium sized companies.

The Dow Jones U.S. Completion Total Stock Market Index is an index of all actively traded U.S. common stocks that are not included in the S&P 500. The index is designed to be the broadest measure of the non-S&P 500 domestic stock markets.

TSP Information Sheet on the S Fund

As of December 31, 2019, the index was comprised of 3,266 common stocks. The Dow Jones U.S. Completion TSM Index made up approximately 16% of the market value of the U.S. stock markets; the S&P 500 accounted for the other 84%. Thus, the combined S Fund and C Fund cover virtually the entire U.S. stock markets.

How to Simulate VTSAX (VTI) in TSP

To create a total stock market fund in the TSP, like VTSAX, you need to hold a market cap weighted ratio of 5 percent C fund to 1 per cent S fund. The 500 stocks of the C fund has a market capitalization of about 5x that of the 2500+ stocks of the S fund.

So if you want your entire TSP to be one big VTSAX, about 80% C fund and 20% S fund is the way to go. If you want to add some bonds in there, like G or F fund, for every 1% you decrease the S fund decrease the C Fund by 5%.

So if you hold 10% bonds in your TSP and want to simulate VTSAX with the other 90%, buy 75% C fund and 15% S fund. 75 + 15 + 10 = 100%

International (Everywhere Else Except US) Funds in my Portfolio

Vanguard Total International Stock Market Fund – VTIAX is the mutual fund, VXUS is the ETF. I hold all of my shares in VTIAX.

Because the TSP “i fund” doesn't hold as many countries as VTIAX does, I choose to hold all of my international shares with Vanguard.

Bond Funds in My Portfolio

I hold my 5% bonds in TSP G fund and F fund. The G fund specially issued Treasury bonds that never decrease in value. The F fund is a broad US bond market fund, similar to the Vanguard Total Bond Market Fund available as a Admiral mutual fund VBMFX or ETF BND.

Tracking Asset Allocation

| Asset Class | Fund I Use | Target Allocation | Actual Allocation |

| US Stocks | VTSAX, C, S | 70 | 70 |

| Int'l Stocks | VTIAX | 25 | 27 |

| Bonds | F and G | 5 | 3 |

Currently my asset allocation is a little off. I am 2% overweight in international stocks and 2% underweight in bonds. I will probably just increase my bond purchases inside my TSP for the next year until the percentages are back where I want them.

I use 2 tools to track my asset allocation across all of my investment accounts. Personal Capital (see my Personal Capital review) and a custom Google spreadsheet that I made. Download the TSP and Vanguard asset allocation spreadsheet.

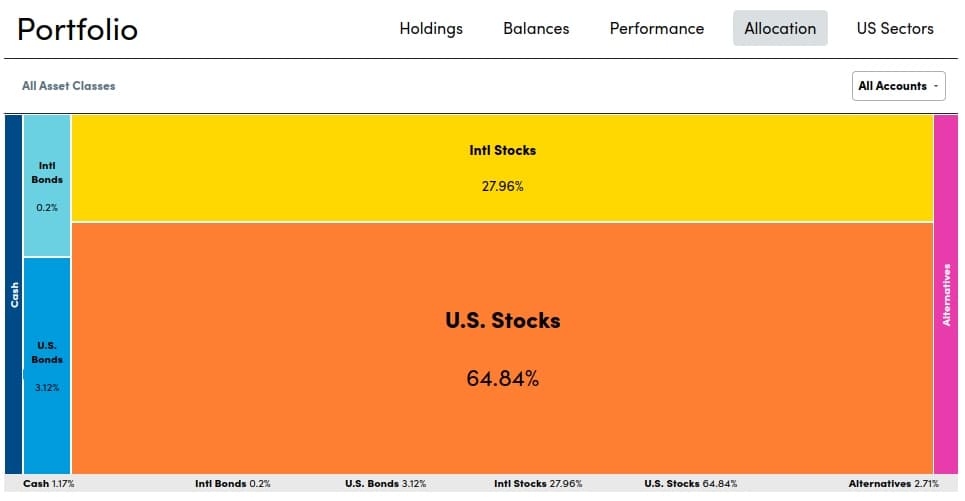

Here's what my asset allocation looks like in Personal Capital at the moment. Personal Capital is great for a quick snapshot off all your investment accounts on one site.

I've used PC for years now and plan to keep using the free version for many more years. I do not recommend their investment services as they are much too expensive.

Why I Invest Like This

A Random Walk Down Wall Street, The Little Book of Common Sense Investing, and several other books formed my investment philosophy. These books have undoubtedly increased my net worth at least 100x.

Here are a couple of quotes from Jack Bogle, founder of Vanguard, which summarizes my investment strategy.

- “The winning strategy is to own all of the nation's publicly held businesses at very low cost.” Action: buy index funds

- “Index funds eliminate the risks of individual stocks, market sectors, and manager selection. Only stock market risk remains.” Action: buy index funds

- “Over the long term, the miracle of compounding returns is overwhelmed by the tyranny of compounding costs.” Action: keep costs low

- “The winning formula for success in investing is owning the entire stock market through an index fund, and then doing nothing. Just stay the course.” Action: buy and hold forever

How Often I Rebalance My Portfolio

Typically I rebalance annually sometime in May of the year. Usually though, since I am adding funds throughout the year, I will simply contribute more funds to my underweight assets and not sell any of my assets to rebalance.

I don't worry too much about re-balancing. Like many things in investing, it makes a lot less difference than you think it would. Vanguard Personal Advisory service only rebalances if your portfolio drifts more than 5% from your targets, as summarized by My Money Blog.

As long as you portfolio doesn't drift by more than 10%, you are probably fine to just rebalance every 5 years. It seems extreme, but from 1926-2018 but the return the from rebalancing every month (1116 times) was exactly the same as only rebalancing when your portfolio was off by 10% or more. 8.2% for both rebalancing 1000+ times vs just 14 times.

Back Testing My Asset Allocation

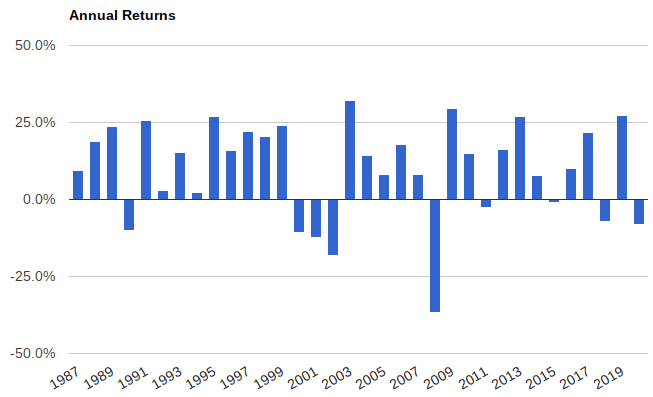

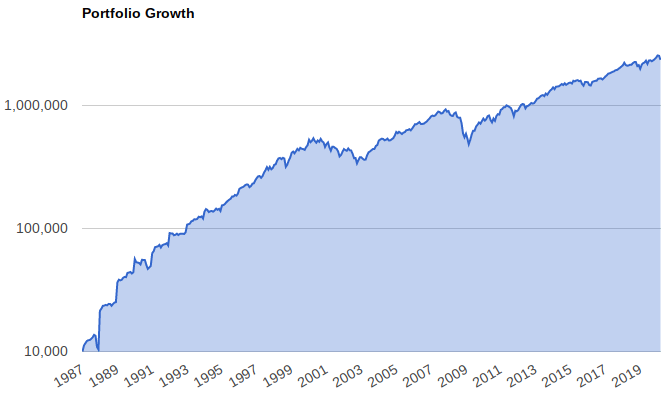

You can back test your asset allocation with Portfolio Visualizer, a great free site that shows you how your asset allocation would perform historically.

Here's what $10,000, invested in Jan 1987 (the furthest you can go back with international stock market data on Portfolio Visualizer) would grow to today if you added $10,000 every year until Feb 2020.

| Initial Balance | Final Balance | CAGR | Best Year | Worst Year | Max. Drawdown |

|---|---|---|---|---|---|

| $10,000 | $2,327,180 | 17.86% | 32.23% | -36.70% | -50.57% (-47.80%) |

For reference, $10,000 in 1987 is about $22,700 in 2020 dollars.

Notice that over the 33 years of putting in $10,000 annually, you only contributed $330,000, and yet your final portfolio value is $2.3 million. Compounding interest is amazing!

Rich, Dead, or Broke

Check out this calculator from Engaging Data: Rich Dead or Broke. Let's say I retire at age 40 with 25x my annual expenses invested in 80%, 18% bonds, and 2% cash.

20 years later, at age 60, I would have an 11% of being dead and a 30% of having twice as much money (inflation adjusted!) as I did at age 40!

I think this topic is fascinating as most people are obsessed with preserving their retirement savings but they neglect their health, fitness, relationships, and experiences while they are young. Simply by applying the 4% rule, you are probably going to be fine.

In fact, at age 82, when your portfolio has the greatest probability for failure, you have a 6.3% chance of being broke and a 57% chance of being dead. Those are not odds I would take at the casino. Death eventually truly does come for us all.

In this example we are simply applying the 4% rule (25x your expenses invested when you retire, spend 4% of the value, inflation adjusted, until you die). The 4% rule is extremely safe and you have a much better chance of dying than running out of money.

With Social Security as well, you are not going to be eating cat food during your retirement if you retire early at age 40 with 25x your expenses. Adding just 10% flexibility into your plan (so spending $108,000 in a few years vs $120,000) moves your chance of success (i.e., not going broke before you die) from 82% to 95%.

Nothing is guaranteed in life. If you have to make a bet, I'd bet on the thing with a 95% chance of winning. See more about sequence of returns risk and the worst retirement ever.

Compounding Interest

Naval Ravikant, an American investor and entrepreneur, likes to say all good things in life come from compounding interest: wealth, health, fitness, relationships, business, and learning.

Consistent, little investments in each of these things, daily, weekly, monthly, turns into enormous returns over many years.

Spending 15 minutes with your partner in the morning, drinking coffee together, leads to a life of deep emotional connection.

A habit of riding your bike 60 minute 3 times a week may lead to better cardiovascular fitness and let's you live a health and active life until 85.

Drinking a 3-4 liters of water a day keeps you hydrated and prevents headaches, which makes you more productive and perform better in athletic activities.

Here's another quote from Arete Hoops on compounding interest.

Compound interest is one of the most powerful forces in the universe. In finance, in your habits, and throughout life in general, this idea has transformative power like nothing else.

Arete Hoops

I'm going to republish the quote from Arete Hoops in it's entirety here:

Think about a simple investment equation: if you take an initial sum of $40,000 and invest it at an average rate of 10% over the course of 40 years, you will become a millionaire. But here’s the kicker: when you look at the composition of your new 1 million dollars you will find something interesting. You would have $40,000 of your initial investment, $136,000 of simple interest on the principle, and a whopping $869,000 of compound interest.

The large majority of your money’s growth can be attributed to the miracle of compounding interest (i.e. the interest that was earned on your interest). In other words, when you invest in the right things, you will experience exponential growth; and so it is with life.

All of the biggest benefits in life come from compounding interest: relationships, habits, money, success, and growth are the result of making small investments in the right things and watching those investments grow over time. For example, when you invest in relationships through a genuine care for someone else, that relationship will benefit you in more ways than one. The interconnected web of good deeds will conspire to multiply your investment exponentially . There is a compounding effect in the nature of making small investments in the right things that brings exponential growth over the course of time. The theory of compounding interest is based on the reality that your investments will grow on top of your investments.

My Personal Investing Principles

I believe everyone should write down their Personal investing principles. It doesn't have to be long or complicated, but just the act of writing it down will force you to organize your thoughts.

Personal investing principles can be part of your personal investing policy statement. An investing policy statement is just a fancy way of saying a written down plan for how you will invest. It can help when things aren't going your way, like during a huge market crash from the COVID-19 pandemic.

My principles are simple, low cost, diversified, automatic. I want my money to work for me without any input from me, not cost me much, and automatically invest in the entire world economy.

Getting Started Investing While in the Military

I started investing in stocks when I was in high school, around 2005. I had to get my parents to jointly open an account at a discount online brokerage that charged about $7 per trade. Nowadays you can start investing with no trading costs on Schwab, Fidelity, and Vanguard.

My first few stocks were a bust but I learned a lot. I quickly learned that individual stocks were far too risky and index funds, whether through ETFs or mutual funds, were the way to invest.

I quickly learned about asset allocation, diversifying my investments, and the advantages of retirement savings accounts, like the Roth IRA. Attempting to day trade, trade options, and beat the market when I was young helped me realize I can't beat the market, I can't time the market, and I can't pick stocks.

When I was in college, I read the Personal Finance reddit, Get Rich Slowly, and other personal finance blogs.

I discovered Financial Independence and Retiring Early from Mr. Money Mustache after graduating my military training course in 2012. I learned about life style design from Tim Ferriss. The most important habit I established early in life was an insatiable drive to read and learn more. If you can do that, you can achieve almost anything.

Here are some other asset allocation ideas from My Money Blog, Bogleheads Investment Policy, Bogleheads' 3 fund portfolio, JL Collins, Bogleheads' lazy portfolios, 150 portfolios better than yours, White Coat Investor's simplifying from 28 funds to 3. And here are my 2014, 2016, and 2018 asset allocations.

How are you investing? What's your portfolio look like? Let us know in the comments!

Spencer,

Almost about 8.5 years in service, O-3. still 50/50 if I’m going to stay in for a few more years or not, we’ll see.

TSP balance sitting roughly around 230K, mimicking a VTSAX composition. 99% of TSP investments have been Roth and continue to be. Blended retirement plan.

When did you start making traditional contributions to your TSP? Did you do half and half until you fully switched or did you just completely change at a certain time?

-Jack

When I was active duty, I waited until my taxable income (Line 11b on the 1040) was in the 22% bracket before switching from Roth TSP contributions to Traditional TSP. For married filing jointly in 2024, that bracket starts at $94,301.

However, I found that if I picked up a couple tax free months each year, it was hard to get into the 22% bracket, even with flight pay and other special pays.

I don’t think you are wrong for leaving it all Roth contributions, mixing it 50/50 Roth and Traditional, or switching to all Traditional contributions. Have a look at RMDs in retirement if you build a huge Traditional IRA/401k pot of pre-tax money. The RMDs can get ridiculous.

How do you balance TSP and IRA perfectly with each different monthly contributions? I want to have 30% VTIAX in IRA and Keep all us stocks in TSP resulting in 70(us stocks TSP)/30(int stock IRA) but I’m not sure how to maintain that balance without having to manually rebalance after each IRA contribution.

I don’t. There’s no need to. Vanguard white paper on rebalancing. Basically, every 6 months to 3 years is probably fine.

Just contribute 100% VTIAX in your Roth IRA and 100% C and S Fund in your TSP. At the end of the year or every few years just buy the asset your low on.

Rebalancing really doesn’t matter much in the beginning of your FI journey. More important to focus on savings rate and maximizing your investments.

60/20/20 in TSP in C, S and I funds – I am very aware this is a very aggressive approach – TSP overall was about 12% down in 2022 and now an average of 24% up in 2023 YTD (as of 18 Dec 2023), plan is to keep it up and see how my returns are by June of 2024!

Hi Spencer,

Now that you are FI, can you do an article or podcast episode about your post-military retirement withdrawal strategy? For example, is the optimal tax strategy to withdraw from pension (if applicable), then brokerage, then Roth IRA? Also, are you attempting to remain within a certain tax bracket during retirement?

Any chance we can get an update for 2022?

Can do. Spoiler alert: My asset allocation hasn’t changed in 2022. This is a forever portfolio that takes decades to work. I will update the post but don’t expect any new revelations. It’s still a mix of US stocks, global stocks, and some bonds.

There are similar funds to VTSAX if you are not using Vanguard. I made the mistake of buying Vanguard funds in my Fidelity account and I was hit with a $75 fee https://usefidelity.com/t/how-much-does-fidelity-charge-to-buy-vanguard-funds/117

Do your research before you jump right into buying. I have since switched to Vanguard for a peace of mind.

Spencer,

Thanks for all your insight on your site. I’ve followed you for a couple years now and have read your book a couple times over. Must read material for CGOs like myself.

O-2 in the Army. 29 yo. Wife and I just broke the $260k net worth mark this month.

I’ve streamlined all our Vanguard IRAs (Roth and Trad.) and TSP into 2055 Target Date funds and Life Cycle funds. For me, TDFs are the best insurance to protect my accounts from myself down the line.

Taxable is completely in VTSAX.

Haven’t heard your take on the updated Life Cycle funds the TSP opened up this year. Also, any word if TSP board will be updating the I fund any time soon?

Regardless, my retirement accounts seem to work well. The Personal Capital investment checkup has helped me confirm that its in the ballpark of being properly allocated. Thanks for recommending that too. Game changer.

Thanks, Spencer. Incredible content.

-Cody

Thanks for the very positive comments. It’s comments like yours’ that let me know I’m doing something right.

Look for a printed and totally revised and updated version of my book mid next year. I’ll send you a copy ;)

That’s great work on the net worth! When I was 29… My net worth was $237k so very similar situations.

Great thinking with the Target date funds. The updated Lifecycle Funds from TSP are great in my opinion. The L2065 is 99% stocks, perfect for new LTs and enlisted troops. No word on TSP I Fund updating, I think it will take a few years of a new administration to look at that again.

Thanks again Cody.

Spencer,

First I wanna say how much I appreciate you taking the time to teach so many of us your investing strategies. After reading a lot of your supporting articles, I’m pretty convinced that the strategy you use is the right way forward for me as well.

I’m an Army O-2, my wife also works, and we’re making pretty good income as a household. I’m currently investing 15% of my pay into my BRS TSP (breaks down to about $745), and have recently opened Roth IRAs (VTSAX) through Vanguard for both me and my wife.

My question: would you recommend solely investing our income into the TSP until we are maxing it out, then starting to invest as much as possible into our Roth IRAs? I planned on investing the 15% into the TSP monthly, while also contributing $500 into each of our Roth IRAs monthly, but wonder if that’s the right approach.

TIA

As long as your Roth IRAs are properly allocated in accordance with your asset allocation plan (sounds like all VTSAX? If so, nicely done) then it’s basically a wash whether you max your TSP or your IRAs. If you are BRS, make sure you are getting at least 5% every month into the TSP. I recommend maxing out both your IRAs and TSP as soon as you are financially able. Is your wife eligible for a 401k? Another account you should be maxing. The tax advantaged space disappears every year and you can’t reclaim it later in life when your income rises.

Also, if your wife’s income continues to rise and you continue to get promoted, it might be worth switching to Traditional TSP and Roth IRAs to create some tax sheltered diversification and reduce your tax burden today so you can invest the tax savings and achieve FI faster. Definitely a 1%er problem, you won’t be wrong for just sticking with Roth for a long time. Just something to consider as your household income rises.

Spencer,

(please disregard the grammatical imperfections, typing with haste, lol.)

before I throw a question your way, I appreciate your website and all the info you share. it’s cool to see other AD perspectives on financial independence early.

i stumbled upon a video the other day regarding vanguard funds. simply put, this guy is a pretty big critic on VTSAX (I also invest in that mutual fund., haven’t bought VTI yet.) curious what your thoughts on this guys position is in regards to a market cap weighted fund vs equal weighted fund. not gonna replicate a crappy synopsis of the video, but i am curious to hear your thoughts on it…

Take care,

Jack

https://www.youtube.com/watch?v=r9RL4c3jOsI

I think his basic argument is against market cap weighted indexing? The alternatives aren’t that great either. Market cap weighting reflects the priorities of the entire market. Google has a larger percentage of my portfolio than Ford because the market thinks Google is worth more than Ford. Who am I to argue against the market?

Spencer,

There are any number of ways to weight an index (value, price to book, large/small cap, small cap value, large cap value, if the CEO prefers burgers to pizza, etc). The market cap weight is fairly (if not completely) arbitrary. Meb Faber has spoken about this a lot. It is advantageous to apply “tilts” or weights by other metrics, such as value, small cap, etc, since these have been proven to provide better returns over time. They will have long periods of underperformance, but over the course of an investing lifetime, can do much better than market cap weighting (which is a form of trend following when you think about it). This youtube video is not wrong. You must realize, over-valued stocks can be weighted heavily in a market cap portfolio (TSLA anyone?). There are low cost ETFs that you can buy that tilt towards value, small cap value, trend, etc. These are worthwhile to investigate because market cap weighted index’s weight the winners so heavily, and the smaller companies over the past 100 or so years have been shown to have more runway (see what I did there?) to grow.

I think it is a detail worth noting since we are talking about retirement funds and over long periods this alpha makes a difference. It has always been a poor strategy to invest in the largest companies (again, meb faber did some great research on this). Being that the market is at all time highs, now could be a great time to diversify away from market cap and into other weights (and as the above guy said, equal weight has been proven to be an outperformer, as stated by Joel Greenblatt).

Either way the overall premise of what you wrote is spot on! love the info!

Can you send any links to the Meb Faber or Joel Greenblatt research? I’m interested in learning more, thanks for the in depth comment!

Hi Spencer, how do you feel about REITs? I placed 5% there and took out from US stock.

What is your take on your asset allocations for taxable investment accounts?

For example:

I have maxed out my retirement accounts, TSP and Roth IRA (w/Vanguard). Now I have extra cash each month to invest for non-retirement accounts like “Down Payment on a House in 10-15 years”

How do you create an Asset Allocation for such? For the down payment on a house in 10 to 15 years, I wanted to do a 70/30 split between stocks and bonds respectively. However 30% in bonds aren’t really tax efficient put into taxable account. I recall you mention you like to use Betterment for taxable investments, but you don’t advise enabling the Tax Loss Harvesting+ feature. So what would you do in this example?

Mike

Same asset allocation as for retirement accounts. Except you probably want to hold bonds in retirement accounts, since they pay more taxable income. I set my asset allocation across all my accounts, not just within the account. So, across the sum total of all my accounts, TSP, IRA, solo 401k, wife’s IRA, and taxable brokerage account, 70% is in US stocks, 25% in international stocks, and 5% in US bonds.

If your down payment on a house is really 10-15 years away, just gotta invest that in your regular asset allocation. If you want 30% bonds, put them in your retirement account and hold the stocks in your taxable account. It’s all your money.

Let’s say you have $10,000 of down payment money that you won’t need for 10-15 years. Put $10,000 into your taxable account in VTI or VTSAX and then in your TSP move $3000 into G or F fund. Or in your IRA move $3000 into BND or VTBLX. Same result, but tax advantaged. As you approach the time you need the down payment money, maybe 3-5 years out, if the market is up, pull the money out and put it into a CD. Or if the market is down, let it ride until the recovery happens. You just don’t want to put yourself in the situation when you need to sell at a loss.

I don’t recommend the Tax Loss Harvesting only because not all of my money is in Betterment and I don’t want to run into “wash sale” rules by investing in similar funds outside of Betterment, such as VTI in Betterment, VTSAX in Vanguard Roth IRA or C fund in TSP.

Spencer,

Are you able to share your asset allocation template on your googlesheets you mentioned above?

Obviously just the shell, if you haven’t already done so.

Looking forward to your next update.

Thanks!

Sure, I will add it to the post. It’s nothing fancy. Here is the link.

Thanks Spencer!

Spencer,

I’m guessing you transferred your Betterment account to Vanguard? I was just about to open a Betterment Roth IRA based on your recommendations but I realized that I wanted more control of the assets in my portfolio so I decided to open a Roth with Fidelity instead.

I am planning on doing all the trading within my Roth so I can take advantage of the tax benefits and after maxing my Roth, then focus on my Traditional TSP. After speaking with a fiduciary, they recommended maxing the Roth then contribute to Traditional on order to have 2 tax deferred accounts while lowering my yearly taxable income. Any thoughts on this strategy?

Cheers,

Vincent

Vincent – I actually still have my Betterment account. It’s done great with an annualized return from Nov 2015 – Dec 2019 of 8.9%. It’s such a small percentage of my overall portfolio though that I no longer include it. It’s a taxable brokerage account, so I will pay long term capital gains tax if I sell it and move it to Vanguard. I am planning on just keeping it there until I have a low income year, selling the funds, and moving them to Vanguard for simplicity’s sake. I still recommend Betterment for people just starting out investing. You can open a Roth IRA there with $0. I think they have a great product and can justify their low fees long term.

I’m a big fan of lowering my taxable income now (as an O-4) so I can invest the tax savings and let it grow. I only do Roth accounts if I am in a CZTE tax free combat zone for 6 months or more of the year now. Once you reach a certain point, it’s pretty much even whichever way you go. Check out MadFientist’s take on Traditional vs Roth. Basically sums up my thoughts.

Spencer,

Have you thought about utilizing the vanguard personal investor, or the new digital investor at a lower fee? Thanks.

-Troy

Yes, I think Vanguard Personal Advisory service would be great for anyone not comfortable implementing a Boglehead 3 fund lazy portfolio. If you can comfortable implement a 3 fund portfolio, it’s a bit expensive when you could just replicate the portfolio yourself and save 0.25% annually.