19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

In this post:

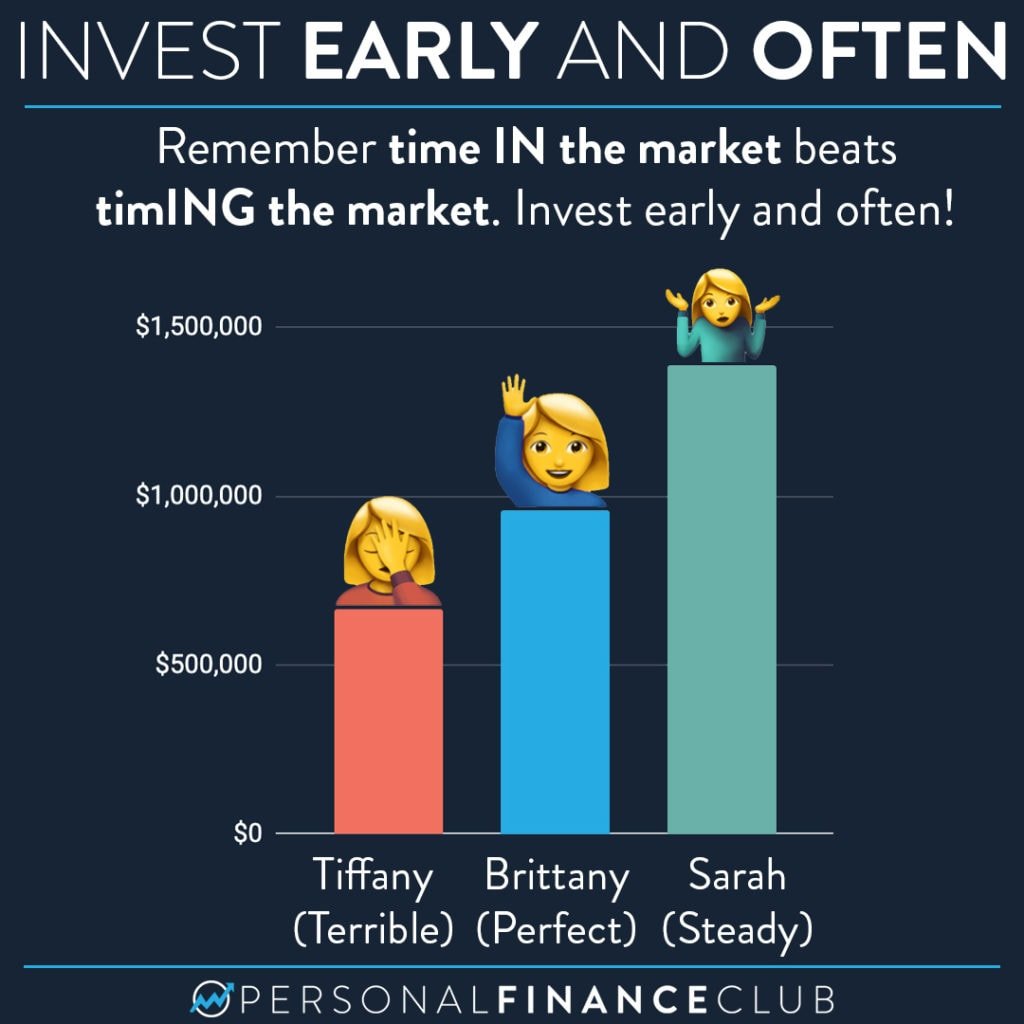

How To Time The Market

This is the story of 3 friends who each saved $200 per month and invested their money in a low cost S&P 500 index fund.

Each one saved and invested over the last 40 years from 1979-2019, but each had a different market timing strategy. In total each friend invested $96,000 over the course of the 40 years.

For reference, if they had invested the $200 per month into a 3% interest bank account over 40 years, from 1979-2019, they would only have $186,000.

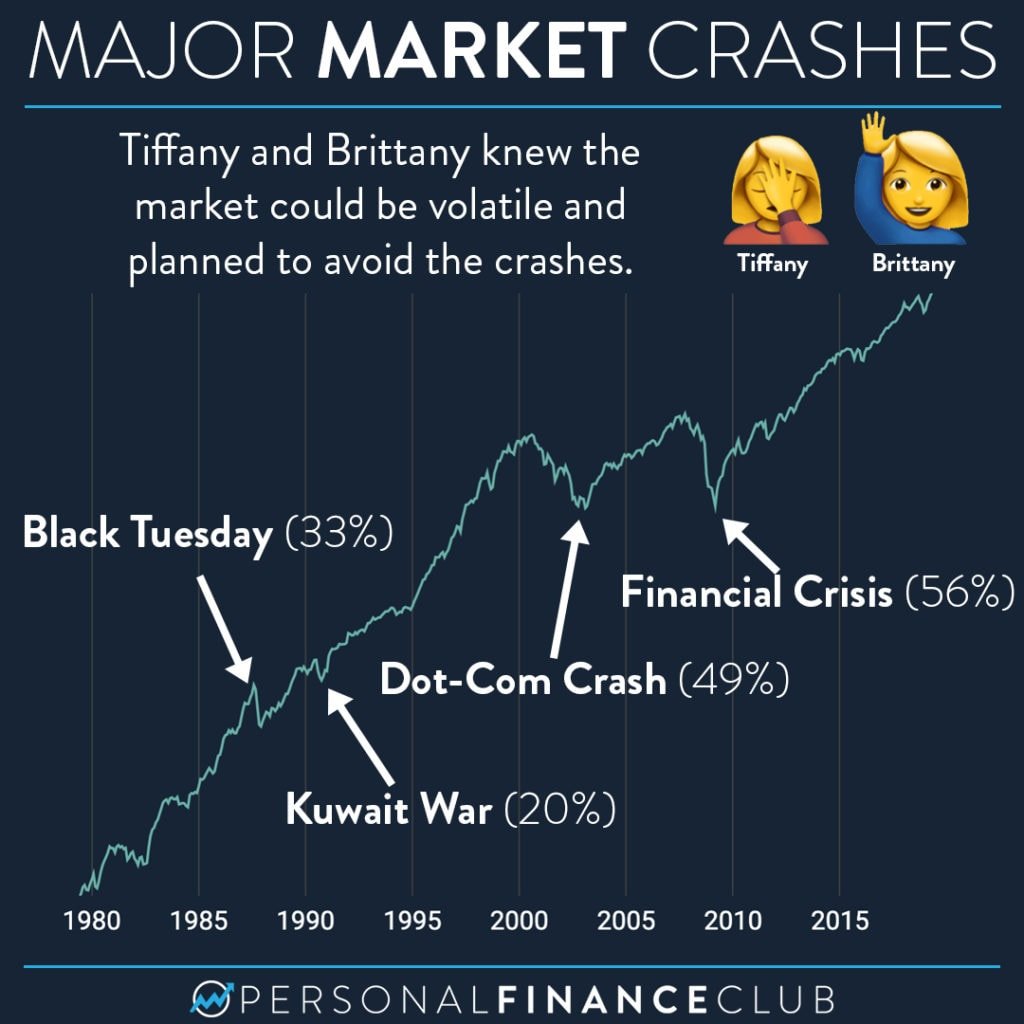

Tiffany and Brittany: Market Timers

Tiffany and Brittany knew the stock market could be volatile, so they tried to time the market and avoid the crashes. Rather than invest every month, they saved their $200 monthly investment in a 3% savings account until they thought the time was right.

Sarah had more important things to do than watch the stock market daily. Plus, she knew that the smartest people in the world are trading every day, trying to eke out the smallest margin possible with the world's fastest computers. How can she compete against that? It's like jumping into a shark tank as a minnow. Not worth competing!

Sarah decided to just invest her $200 per month into the S&P 500 index fund every month.

Some people call this dollar cost averaging, but it's really lump sum investment because she is investing everything she has as soon as she can. Lump sum investment wins out over DCA over 66% of the time.

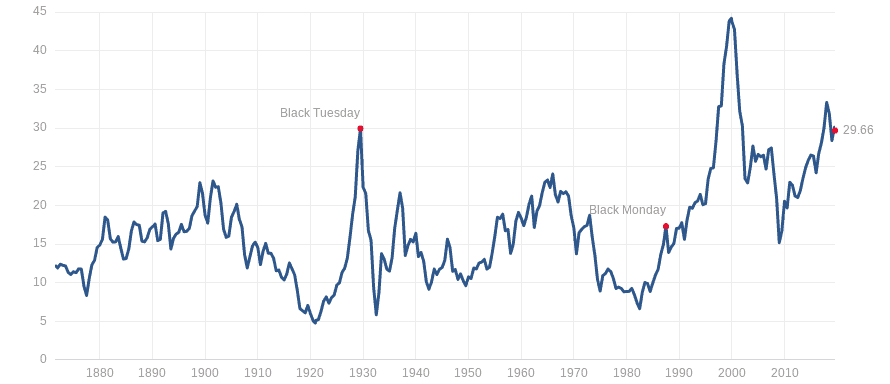

The four major crashes used in this real world example are Black Monday (incorrectly labeled “Black Tuesday” in the picture) on Oct 19, 1987, The First Gulf War July – October 1990, the Dot-com bubble that collapsed around March 2000, and the Global Financial Crisis of 2008.

Tiffany's Terrible Timing

Unfortunately, Tiffany always had terrible timing. You might even say she was the world's worst market timer.

Tiffany invested all of her money the day before the 4 major stock market crashes of 1979-2019. But (and this is VERY important to notice), she never sold.

Even with her terrible market timing, Tiffany's $96,000 turned into $663,594.

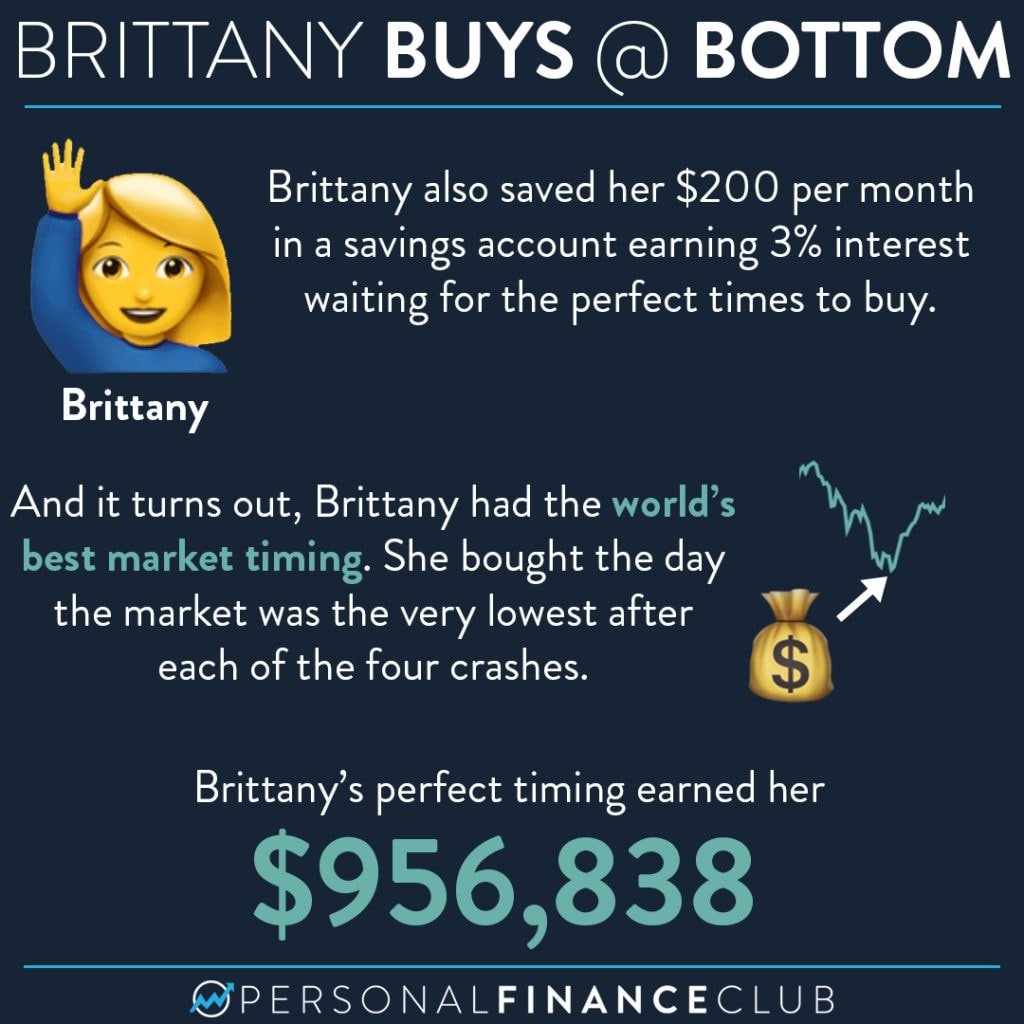

Brittany Buys at Bottom

Brittany also saved her $200 per month in a 3% interest savings account until she thought it was time to buy.

She had much better luck or skill than Tiffany. Brittany always bought the market on the lowest day after each of the four major crashes.

Thanks to her excellent timing, Brittany's $96,000 grew to $956,838.

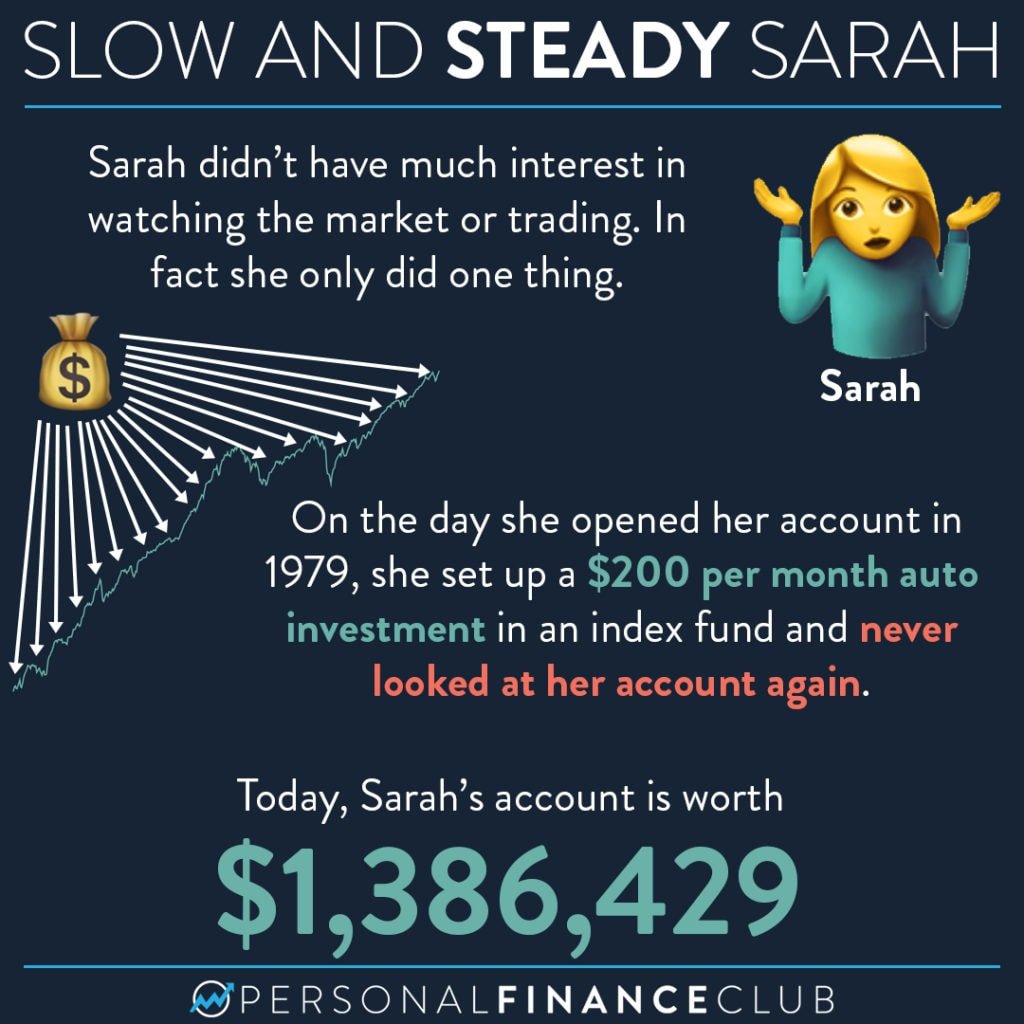

Slow and Steady Sarah

Sarah invests like I do. Automatic, diversified, low cost, and simple. Rather than save her money and try to time the market, Sarah just threw her $200 per month into a low cost S&P 500 index fund for 40 years.

Sometimes the market was overpriced when she bought, sometimes it was under priced, but she continued to receive dividends through the highs and lows.

Thanks to her diligent and consistent investment and ignoring the instinct to time the market, Sarah ended up turning her $96,000 of investment into $1,386,429!

That's the power of continuous investment, ignoring the noise, staying the course, and allowing compounding interest to go to work.

Conclusion and Thanks to Personal Finance Club

The images above come from Personal Finance Club's great guide on “How to Time the Market.” Thank you PFC!

I republish these images here because it's such a great example of how even perfect market timing doesn't even make the average market return you would get from just showing in the cash every month.

Also, as the worst market timer shows us, you are better off investing in the stock market today rather than leaving the money parked in a bank account.

Even if the market is at it's peak, you must get your money to work in the stock market. If it crashes the next day, DO NOT SELL! Let it ride. You still own a little piece of the largest publicly traded companies in America or the world when you buy Vanguard Total Stock Market Index Fund (VTI) or Vanguard Total International Stock Market Index Fund (VXUS).

Remember that if you invested $200 per month into a 2% interest bank account over 40 years, from 1979-2019, you would only have $186,000. Even Tiffany, the world's worst market timer, ended up with 350% more than the “safe” strategy.

This example also demonstrates how if you buy and hold you will end up winning in the long run. It shows how you should never sell during a market crash or panic. History shows us markets do return to their previous levels once the dust settles, it just might take a few years.