19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The Thrift Savings Plan (TSP) offers a unique, low cost, tax advantaged, diversified, and automatic investment opportunity to US government employees and military personnel. Since I’m active duty Air Force, I’ll focus on the military side of the TSP.

TSP is similar to a civilian 401k. The IRS considers the TSP an “employee sponsored retirement plan.” If you are part of the Blended Retirement System (BRS), there is up to a 5% employer matching on the military side of the TSP.

Investing and harnessing the power of compounding interest is the surest and quickest way to achieve financial independence. By investing your military paycheck into the TSP, you put your dollars to work for you in the most efficient way possible.

The TSP allows servicemembers to invest in special US Treasury bonds (G Fund), the US bond market (F Fund), international stock markets (I Fund), and the US stock market (C and S Funds).

With these 5 simple funds, you gain access to a whole world of investing and potentially huge gains.

I covered the TSP in my Military Money Manual podcast, available on Spotify, Apple Podcast, and many other locations.

In this post:

How Much to Contribute to Your TSP

The most important step to investing in the TSP is determining how much of your income you should set aside to invest. If you want to achieve financial independence in the next 20 years, you’ll need a savings rate of 45-50% or more.

A great place to start is maxing out your Roth TSP. You can contribute $19,500 in 2021 ($57,000 if you're in a combat zone), which works out to $1625 per month. This article will show you how much you need to max out your TSP.

If that’s completely out of your league, start by contributing 25% of your after tax pay, or even just $100 per month. If you make investing an automatic priority using your myPay deductions, you won’t even miss the money.

How to Start a TSP Account

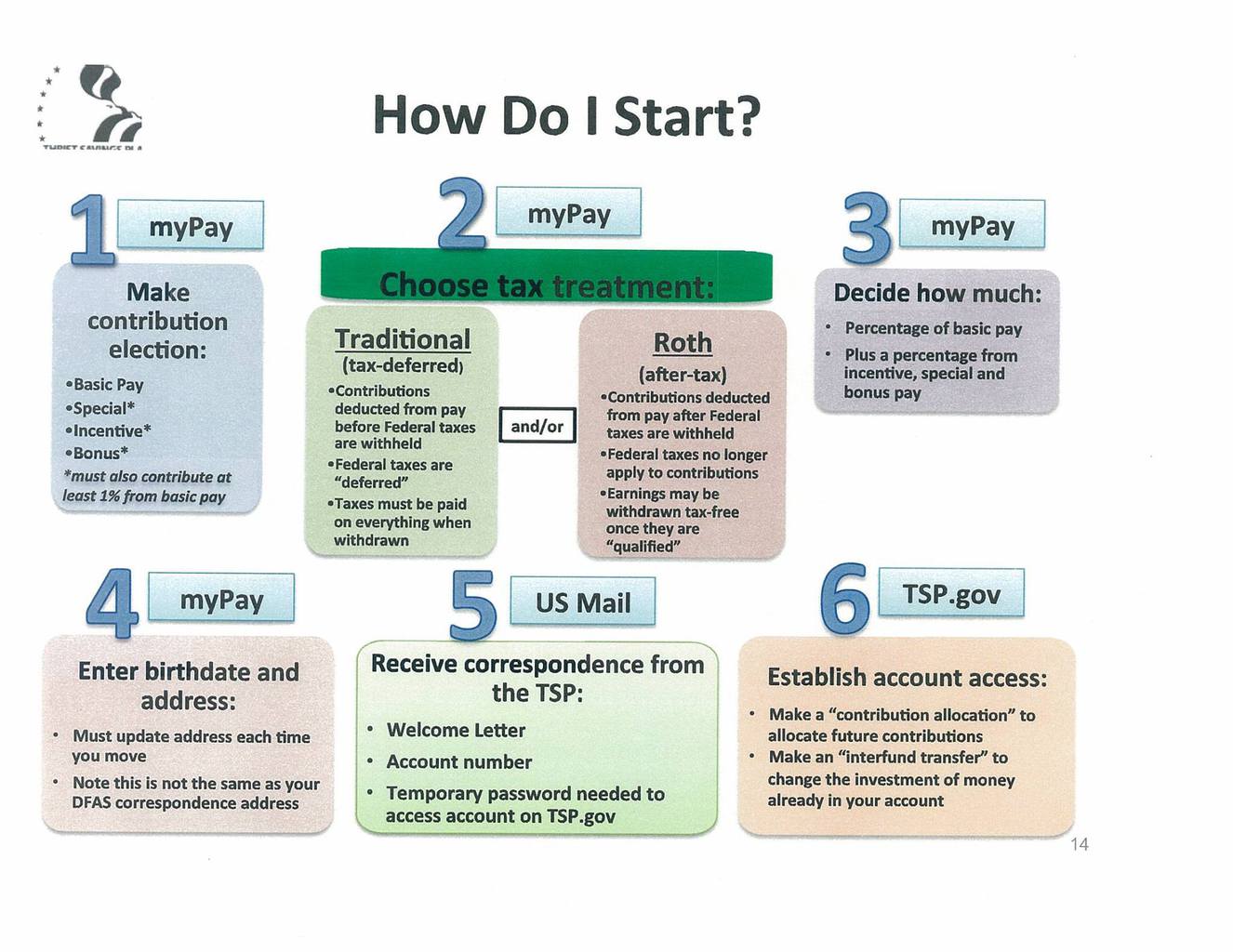

Here's an infographic on how to start your TSP account:

Low Cost Investing for the Military

By leveraging it’s massive purchasing power ($358 billion in assets under management) and it’s simple index fund tracking, TSP keeps it’s expense ratios low.

How low? Try under 0.05%. For every $10,000 you have invested in the TSP, you will only pay $5 a year in management fees. The mutual fund industry average is around 1%, or $100 per $10,000 invested. Even Vanguard and Schwab ETFs, which offer the lowest cost funds publicly available, are about the same as the TSP cost.

The cost difference between paying 0.05% and 1% becomes extreme given a long enough time. Over 25 years, if your investment returns 8% per year, but your expense ratio was 1% a year, you’ll lose 24% of the gains. Alternatively, if you are invested in a low cost fund like those offered by the TSP, you’ll keep 99.1% of your returns. That’s a massive difference.

Investment returns may be hard to achieve, but when you keep costs low, you’ll be sure that the returns you get stay with you and don’t go to your account manager. Control what you can (costs) and don’t worry about things you can’t (return).

Automatic Diversification

One of the first lessons most people learn when their investing is “diversify, diversify, diversify!” If you have all of your money in a single asset (like Bitcoin, gold, or Enron stock), you’re asking to lose a lot or lose it all.

When you spread your money between many assets, like 500 of the largest US companies (S&P 500), you capture all of the losses and gains of all of these companies. In the last 130 years, there have been a lot more gains than losses.

The TSP gives you built in diversification. For instance the C Fund is comprised of all of the S&P 500 companies. When you invest in the C Fund, you buy a small piece of each of the 500 largest companies in America. A little bit of their profits will be fed back to you in the form of dividends and if their share prices go up, your assets will appreciate.

If you were to buy a single share of each S&P 500 company, it would cost you $33,500 ($67 average share price * 500). Instead, you can invest as little as $10 into the C and S fund and gain exposure to every publicly traded company in the US. That’s awesome diversification at an extremely low cost!

Two Tax Flavors of TSP: Traditional and Roth

Military servicemembers can contribute to two different TSP accounts: Traditional or Roth. Any contribution to the TSP has tax advantages. The difference is when you are rewarded with those tax advantages.

For Traditional contributions, the contribution is not taxed when you deposit, but when you withdraw from the account in retirement, your withdrawals are taxed.

Even if you contribute tax free income (such as from the Combat Zone Tax Exclusion), your contributions won’t be taxed but your earnings will be. Invested for 30-40 years, this could be a tremendous portion of your portfolio and cut into your retirement income. I do not recommend the Traditional TSP for most personnel.

For Roth TSP contributions, you pay taxes on your income now, but when you withdraw from the account in retirement, all distributions are tax free. Your earnings and contributions can all be withdrawn without paying a dime to Uncle Sam.

This is an awesome option for most servicemembers. Much of your compensation package is tax free (BAH, BAS) and regular pay is often not subject to federal income tax through the Combat Zone Tax Exclusion (CZTE).

Military personnel tax rates are often incredibly low even without CZTE and frequently not above the 10% or 15% bracket. If that’s true for you, I highly recommend exploring the Roth TSP option.

Personally I use the Roth TSP option and love it. My tax rate this year will probably be under 1% and all of the money we’ve managed to contribute to the Roth TSP will grow and eventually be withdrawn tax free forever. Now that’s a tax-advantaged investment!

Many servicemembers are still unclear if you can you contribute the max to your Roth TSP and your Roth IRA. The answer is…

Yes!

The two investment accounts are treated completely separately by the IRS. You are cleared hot to invest $17,500 in the Roth TSP and $5500 in your Roth IRA in 2014. If you’re married, you can put $5500 into his/her account too! That’s $28,500 of tax free forever retirement investments.

Lifecycle Funds: Diversified Investing for the Lazy or Fearful (and that’s okay!)

The Lifecycle Funds are a great product if you don’t have the time, energy, desire, or knowledge to care about your investments. Lifecycle funds are a one size fits all solution and should only be used if you don’t want to take the time to choose your own asset allocation.

When you are decades from retirement, the Lifecycle fund start by investing more in riskier investments (C Fund, S Fund, I Fund) to achieve a higher return.

As you move closer to retirement, more of your assets are moved into low risk and zero risk funds (F and G Fund), to preserve your capital and limit the risk of loss.

Once you reach retirement, your assets are all rolled into the “L Income” fund, which is 74% invested in the G Fund, and 26% invested in the more risky funds. This nearly guarantees that you won’t see a more than 25% drop in the value of your retirement savings.

Personally I don’t use the Lifecycle Funds because I prefer to choose my own asset allocation and manage my risk/reward myself. Pick whatever you are most comfortable with, after doing the proper research.

How I’m Autopilot Investing in the TSP

The best way to grow your investments is by contributing every month. I have heard the arguments for and against dollar cost averaging and I’m convinced that investing as much as possible early as possible is the most optimal solution, but not the most realistic. Most people do not have $17,500 sitting around on January 1st of the year.

What they do have is a bi-monthly paycheck, every 1st and 15th. By setting up a Roth TSP contribution on myPay, you ensure that your money gets invested before it even hits your bank account. This is the best way to save and invest: take yourself out of the equation and make it easier to save the money than spend it.

When part of your paycheck is locked away in the TSP, growing and paying dividends, you are creating the conditions for your own financial independence.

This is how I invest in the TSP. Simply take what you can afford to invest (your goal should be the $17,500 max), divide by 12 months, and contribute that amount every month. If you want to max, it works out to $1458 per month, or $729 per paycheck.

You’ll be amazed at how quickly you can adjust to a smaller budget. If you can’t max your contributions now, increase your contributions every time you receive a time in service pay raise or a promotion. Maybe take only 20% of the pay raise for yourself and contribute the remaining 80% to your TSP. Your contributions will grow quickly towards the max.

Occasionally, you may check your account balances on Personal Capital and you’ll be amazed at how quickly automated monthly deposits add up. If you can max your TSP for 10 years, you’ll save $175,000 (assuming the contribution limit doesn’t go up). But if the market returns it’s long term average of around 8%, you’ll see your money grow to $275,000! That’s a free $100,000 in just 10 years. That’s the power of compounding interest.

My TSP Asset Allocation

My TSP asset allocation is based on the efficient frontier, a concept in modern portfolio theory. As a rule of thumb, I use 120-age to put into stocks and the remainder of the portfolio to put into bonds.

This rule of thumb keeps me risky young (100% stocks at age 20) and then slowly decreases my risk (but also reward) as I approach financial independence.

There are other rules of thumb, like your age in bonds, the rest in stocks, but I find that to be too risk adverse. By age 45 we’ll hit 75% stocks, 25% bonds, which I’ll plan on keeping as my permanent portfolio.

I’m a firm believer in simpler is better when it comes to investing. I use Personal Capital to keep track of my Roth IRA, my wife’s Roth IRA, and my Roth TSP to ensure that my asset allocation is where I want it across my entire portfolio.

Here’s my 2013 TSP allocation and contribution plan. Notice that as funds grow, they'll need to be reallocated at some point. I prefer to reallocate once per year or if the funds get more than 5% out of balance.

In terms of market capitalization the C fund is roughly 4 times larger than the S fund, so if you’re trying to accurately capture the entire US stock market (like Vanguard’s Total US Stock Market Fund VTI), make your C fund allocation 4x your S fund.

The Best 401k in the United States

The Thrift Savings Plan offers tremendous value and opportunity to every US servicemember. The TSP offers:

- The lowest management fees available anywhere

- Automatic diversification with low account minimums

- Easy asset allocation to match any bond/stock ratio you want

- Tax advantages and tax free investing for life in the Roth TSP

All of these factors make the TSP the best plan for achieving financial independence. With the Roth TSP option, servicemembers can realize tax free income for life, an incredibly powerful tool not available to anyone else in the world.

If you’re not investing in the TSP, you need to start today. If you already are investing, you need to work towards maxing your contribution. If you’re maxing, congratulations, have a beer on me! Let me know in the comments at what years of service and rank you started maxing out your TSP.

Why is contributing more money to the traditional TSP on a deployment not that good of a deal? The topic was brought up in the podcast, but not discussed again as to the why. Looking for more information on pros and cons regarding the TSP limit increasing on deployment and whether or not contributing more money to the traditional TSP is a good idea

Oops — got overly aggressive with funding retirement accounts in 2022, between TSP and Vanguard maybe? Concerned I may have overshot the mark and need some advice. Don’t want to pay the IRS an excise tax on overfunded accounts.

Married, active duty O5, 1x income because she’s going back to school when I deploy in a few months.

*Will be deployed to CZTE (KWT) NOV22-JUL23, our married filing jointly taxable income for 2023 will only be $51,921!

Year-to-Date Contributions (as of Jul 19, 2022):

1. my TSP Roth TSP (L2045): $6,022.60

2. my Traditional TSP (L2045): $6,022.60

3. my Vanguard Roth IRA (VTIVX): $3,000

4. my Vanguard Traditional IRA (VTIVX): $3,000 <- funded this one today so I have a Traditional IRA to rollover to Roth IRA in deployment year…

3. her Vanguard Roth IRA (VTIVX): $3,000

4. her Vanguard Traditional IRA (VTIVX): $3,000 <- see #4; funded this one today so we have her Traditional IRA to rollover to Roth IRA in deployment year…

***How much more (if any) can I contribute to ea. account in 2022, or am I over in some places?

Plan on contributing $23,129 more to her/my Vanguard Traditional IRAs between JAN23-JUL23, for a total of $29,129 in our Vanguard Traditional IRA accounts that can then be rolled over to Vanguard Roth IRA at the 12% taxable rate in 2023. Our marginal rate is usually 22%.

Great post Spencer! I work in San Francisco and I am a high income earner ($200k/year). I am in the Air Force Reserves, and I am trying to figure out which accounts to contribute to for next year.

What I have been doing:

Maxing the 457 through work.

Maxing the TSP through the Air Force Reserves.

My work offers a Defined Contribution Plan ($56k after tax), and any growth in the account can be contributed to a ROTH account set up through Fidelity (I’m not sure if this is the same as a back door ROTH).

My plans for 2020:

Max out 457 through work

Max out DCP through work

Open ROTH IRA for the DCP returns, so I won’t be taxed

Max out TSP through Air Force Reserves.

Should I contribute to the ROTH TSP?

What are your thoughts?

At your income level, you might not be eligible for a Roth IRA, unless you’re doing it the backdoor way through a Traditional IRA and then convert to a Roth IRA. More on that here. You probably should be contributing to a Traditional TSP through the Air Force Reserves, since your income is so high. Save on taxes now, invest the tax savings, and you’ll have years for the tax savings to compound before you have to pay taxes on withdrawing the Traditional funds in retirement.

I contribute to the Roth TSP (L2050 Fund) and a Roth IRA through USAA at the moment. Based on the TSP low expense ratio and high returns over the past few years, would you recommend that I shift all my contributions to Roth TSP as opposed to USAA Roth IRA?

Contribute to both Roth TSP and Roth IRA. I would recommend leaving USAA and going to a lower cost IRA custodian like Vanguard. Don’t chase the performance of the TSP. Have an investment strategy that understands what’s hot know may not be for the next few years. Performance chasing is a fool’s game. So yes, keep contributing to the TSP, but not because of recent good returns. Look at the 100+ year history of the US and int’l stock market for some perspective.

In a follow-up to Ben’s question, should a Roth IRA through a separate institution be pursued only after maxing out the Roth TSP contributions (currently $19,000/year, I believe)?

It depends on your goals. The advantage to a Roth IRA account is the contributions can be withdrawn at any time, tax and penalty free. So let’s say you contributed $6000 per year for 10 years and the account has grown in value to $80,000. You have $60,000 of contributions in there and $20,000 of growth. You can withdraw the $60,000 of contributions at any time and pay no taxes or fees on it. The $20,000 of growth will remain in the account. You cannot do this easily with a TSP.

I recommend contributing at least 5% to your TSP (especially if you are in BRS), receiving the full match in any spouse 401k or TSP, then maxing out you and your spouses IRA accounts up to the annual limit ($6000 each for 2020 or $12000 total), then maxing out your TSP elective deferral limit ($19,500 for 2020), then maxing out your spouse’s 401k.

If you have enough income, the optimal solution is maxing both IRAs, getting a 5% match every month with BRS, getting full match on spouse’s 401k, and maxing out both spouse’s 401k/TSPs. That would be $51,000 per year in 2020.

I separated in 2009. Any thoughts on whether I should keep about $100K in a Betterment Traditional IRA vs rolling it over into my TSP account? I love the tools that Betterment offers, but obviously money >>>> tools and TSP is cheaper. Thanks!

I would probably take advantage of the TSP’s incredibly low expenses, or split the difference and keep half in Betterment, half in the TSP. Betterment’s tool are nice, but a well allocated TSP account can probably match the performance for less cost. However, you do get the benefit of automatic re-balancing, portfolio selection, and tax loss harvesting. All of these could pay for Betterment’s additional cost vs. a user selected TSP portfolio. Some things to think about.

Great article! I will commission in December 2016 as a Second Lieutenant in the Army. I do not plan to make the military a career, but rather an opportunity to gain new skills and afford post-grad education. I have not started a Roth IRA justifying it instead by saving up money to contribute into the TSP. Is this an effective method or should I open a Roth IRA now? I plan on maxing my TSP payments for 6 years.

I would recommend starting a Roth IRA or Traditional IRA now (at Vanguard). Note that contributions to your TSP must come out of your paycheck and cannot be contributed from saving or checking accounts. It’s better to get your money into the market now so it’s working for you rather than waiting, since you cannot contribute those savings to into your TSP.

Hi I’m new to all this, hired on with the government in August, I turn 50 years old in 2016 ,I rolled over 50k from another 401k from previous employer into tsp. Does max out and catch up of (18k+6k)24k a year into The Roth tsp sound good? Or should I go another route and any other advice would be appreciated… Thank you.

If I want to convert my current Roth IRA into a Roth TSP, is that possible and who do I talk to?

This is currently not possible with the TSP.

From the article I see you believe in contributing as much money as you can as early as you can but have you ever looked at the argument for avoiding bear markets during your investment horizon? If not you should give it a deep look.

Your other suggestions were spot on. I personally try and save approximately 50% of my take home pay but it’s a little difficult with two young kids ;-) Nonetheless sitting down and mapping out your priorities goes a long way. I cannot tell you the amount of individuals who are in their 40s who wish they had started in their 20s.

Hi Spencer-

Good Article. I love reading about the TSP. I have been working for the government since Jan 2007. I am a civilian working for the NAVY. Since 2007 I have been contributing to the TSP traditional. The Roth option just became available a year or two ago. I have about 50k in the traditional TSP and I also have a Roth IRA through Vanguard. I am only able to contribute about 5% to my traditional TSP and my company matches 5% too. In my Roth IRA through Vanguard I only have about $1800 but only contribute about $520 a year right now. I have too big of a mortgage payment. My question to you is…should I stop my contributions to my Traditional TSP now and begin a Roth TSP? It seems to me like I have a good start on the Traditional TSP now and that compounding is about to start kicking butt, If I stop my contrinutions to begin a Roth TSP then I feel like I will be starting all over…please advise

You have to look at total portfolio size. Even though it seems like you’re “starting all over” you’re not, because compounding doesn’t care if you have 1000 accounts with $1 in them or 1 account with $1000 in it. Sure it might have psychological implications to start building up from zero again, but the math works out. The Roth vs Traditional question is more difficult for civilians, because your income is not as tax advantaged as a military service member. I would recommend running the numbers based on your income, but I would bet that unless you’re making over six figures the Roth option is better. Again, run the numbers or talk to a fee-only financial adviser to run the numbers for you.

I started Investing in the TSP only a few years ago when I was 21. I’m currently an E-4 in the Air Force Reserves finishing up my engineering degree. After which, I plan on becoming an officer in the reserves. As I have it set up right now, I don’t even see any money from my drill weekends because I have all my pay allocated to the Roth TSP making it a bonus retirement account in addition to my civilian 401k. The TSP really is one of the best things going and it’s a shame more people don’t utilize the incredible leveraging power it gives you. Not only that, but you have the option to make a “partial”, penalty free, withdrawal upon separation from from the military. I see that as a nice little cherry on top when it comes to retirement. The only reason I started investing was because an old retired MSgt I was working with kept hounding me to start investing early and when he told me he and his wife had made 10,000 dollars last quarter from their TSP’s he had my absolute attention. I try to spread the word among my peers but it doesn’t seem like they’re all too interested, instead they simply find creative ways to cyclically squander their monthly pay. Anyways, it’s great to know that there are like minded people out there.

Brandon – sounds like you got your ducks in a row. Keep throwing money in that TSP and good luck getting the commission in the Reserves. By starting so young, you can probably achieve FI/ER even before 40!

I’m a 30yo Army E5. I’ve been living longer everyone else, carrying debt and living recklessly. Ironically, a credit card article led me to the boglehead forum and money other like minded sites. So I decided to just pay off all my debt, and open a select few rewards rich credit cards to enjoy some free leisure. I’ve just started putting in the exact amount into my Roth tsp that will take me to 17500 by years end. Thanks for the article, and love the site.

Awesome! Max out that TSP every year!

oops sorry, I assumed a 6% rate of return in the example…

Thanks Eric! I also HATE fees and I’m so happy to have access to the TSP. For my Roth IRAs and taxable investments accounts, it’s Vanguard all the way!

Keep up the good work. For all government employees reading this, take advantage of the ridiculously low expenses associated with the TSP program. I keep looking for ways to get more money into the program to gain the benefit of the low cost.

As an easy example, one year of investing the maximum $17,500 will turn into $100,000 over 30 years at a .027% yearly expense level. At a 1% yearly level, that money is only $75k. TAKE ADVANTAGE! (I hate fees….)

Spencer,

Just came across your site a few days ago while I was doing some financial research and reading. Great stuff man… I’m also a 25 year old officer in the Air Force and just returned from a deployment. I graduated with a BBA from college, so I’ve always thought I was savvy on personal financial management; however, your blogs are definitely helping me out.

I’ve moved this year into maxing out my Roth IRA AND my Roth TSP (which I wasn’t doing previously). Thanks a ton.

Ben

Happy to help! Maxing out that Roth TSP and Roth IRA + a tax free deployment is a powerful tax advantaged investment. Let me know if there’s any topics on the site I need to cover that are relevant to you.

Great advice, Spencer!

The military version of the TSP came only five months before I retired, and I really wish I’d had more years of savings in it. The lower expense ratio (to say nothing of the tax deferral) would have greatly accelerated our financial independence.

Was there a employer sponsored savings plan for military personnel before the TSP? I’ve never even thought about what I’d do if I couldn’t invest in the Roth TSP!