19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The Chase Sapphire Preferred® Card military benefit is an annual fee waiver for active duty, Guard and Reserve on 30 day orders, and military spouses.

The Chase Sapphire Preferred annual fee is lowered to $0 for anyone listed as a covered borrower in the Military Lending Act Database.

Chase Sapphire Preferred® Card

Learn how to apply on our partner's secure site

- Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

- 5x points on travel purchased through Chase Travel℠

- 3x points on dining (includes takeout, delivery, and dine-in), select streaming services and online groceries

- 2x points on all other travel purchases

- 1x points on all other purchases

- Earn up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠

- 10% anniversary points boost – each account anniversary you'll earn bonus points equal to 10% of your total purchases made the previous year

- No foreign transaction fees, great for overseas OCONUS assignments, TDY, and PCS

- Primary rental car insurance coverage & trip cancellation/interruption insurance, and more.

- DashPass is complimentary which unlocks $0 delivery fees & lower service fees for a minimum of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

- Upgrade to a Chase Sapphire Reserve after 1 year (compare Reserve vs Preferred)

- $95 annual fee waived for military and spouses with Chase Military Lending Act

- Member FDIC

The Chase Sapphire Preferred® Card is a great starter card for military servicemembers. If you are building an awesome portfolio of annual fee waived credit cards, the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® Card are important cards to get early on because of Chase's 5/24 rule.

You should compare this card to the Chase Sapphire Reserve in my Chase Sapphire Preferred versus Sapphire Reserve article. Chase waives the annual fee on the CSR and the CSR comes with a $300 annual travel credit.

Military troops and their spouses can both open this travel rewards card, earn the huge welcome bonus, and pay no annual fee. You can then upgrade the Chase Sapphire Preferred® Card to a Chase Sapphire Reserve® Card after one year, giving you a card with even better recurring travel benefits.

Personally I opened the Preferred for the extra Chase Ultimate Rewards points and then upgraded to an annual fee waived Chase Sapphire Reserve after one year.

In this post:

How to Use 60,000 Ultimate Reward Points

Chase's Ultimate Rewards (UR) points are extremely flexible. With 60,000 Chase points, you have the following options to redeem:

- Spend the points at Amazon for $420

- Cash out and received an $600 check

- Apply a $600 statement credit to your credit card bill

- Book a flight through Chase Travel℠ for $750 of airfare

- Transfer the points to a travel partner for potentially $1,200 or more of value (best value!)

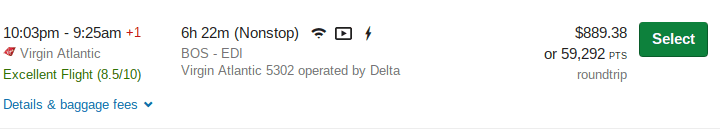

$890 cash or only 59,292 UR points!

In the above example, I searched for a flight from Boston to Edinburgh in August. Normally it would cost $890, but you can cash in your UR points at 1.5 cents per point when you have the CSR. The total roundtrip cost is under 60,000 UR points.

The best value of UR points is when you transfer them to partner airlines. You can get 2 cents or more value per point, making your 80,000 UR points worth $1600 or more of airfare.

Chase Ultimate Reward Transfer Travel Partners

Chase's UR Transfer Airline partners are:

- Aer Lingus AerClub

- British Airways Executive Club

- Flying Blue AIR FRANCE KLM

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

And the Chase hotel transfer partners are:

- IHG Rewards Club

- Marriott Bonvoy

- World of Hyatt

All of these programs transfer at a 1 UR point = 1 airline/hotel point. Sometimes they run promotions where you can get more than one airline/hotel point for a UR point.

Chase MLA Rules

Chase began waiving annual fees for military servicemembers and spouses in September 2017. The easiest way to confirm you are eligible is to check your MLA status in the MLA database.

Any personal (not business) Chase credit card opened after 20 Sep 2017 is eligible for Military Lending Act or MLA protections for active duty servicemembers (Army, Navy, Marines, Air Force, Coast Guard) or guard/reservists on 30+ day active duty orders AND their spouses.

A covered borrower is a consumer who, at the time the consumer becomes obligated on a consumer credit transaction or establishes an account for consumer credit, is a covered member of the armed forces or a dependent of a covered member (as defined in 32 CFR 232.3(g)(2) and

https://www.fdic.gov/regulations/compliance/manual/5/v-13.1.pdf

(g)(3)).

Covered members of the armed forces include members of

the Army, Navy, Marine Corps, Air Force, or Coast Guard currently serving on active duty pursuant to title 10, title 14, or title 32 of the U.S. Code under a call or order that does not specify a period of 30 days or fewer, or such a member serving on Active Guard and Reserve duty as that term is defined in 10 U.S.C. 101(d)(6).

Both my wife and I have opened several Chase credit cards since the new Chase MLA rules went into effect. Both of us received letters stating our annual fees would be waived in accordance with Chase's MLA policy.

Chase Sapphire Preferred Benefits

The CSP offers many recurring benefits and perks that allow you to rack up points and savings.

$50 Annual Chase Travel Hotel Credit

The first $50 you spend on hotels through Chase Travel℠ is reimbursed. This is a great way to save on hotel stays.

The annual period is defined as the month you open the card account and the following 12 months. It resets on the date of your card approval.

No Foreign Transaction Fees

Military service frequently brings servicemembers and their families on international travel. When you leave the United States, you need a credit card that gives you no foreign transaction fees.

Personally, I estimate I saved over $2000 in foreign transaction fees over the last 7 years of military service. With over 400 days on overseas TDYs, deployments, and 2 years spent stationed in the Middle East, I spent a lot of money overseas on dining, travel, groceries, gas, and many other items.

5x Points on Chase Travel℠

You can earn 5x points on all travel including hotels, rental cars, and flights booked through Chase Travel℠ .

The 5x points on hotel purchases excludes hotel purchases that qualify for the $50 Anniversary Hotel Credit. In other words, you start earning the 5x points on hotel purchases after you've received the $50 hotel credit.

2x Points On Travel

Travel includes any of the following:

- Airlines

- Hotels, motels, timeshares,

- Car rental agencies

- Cruise lines

- Travel agencies, discount travel sites

- Campgrounds

- Ground transportation such as: Trains, buses, taxis, limousines, ferries

- Toll bridges and highways

- Parking lots and garages

Any purchases at these types of places will give you 2 Ultimate Rewards points per dollar spent.

3x Points on Dining at Restaurants

Restaurants include any establishment classified as a sit-down or eat-in dining, including fast food restaurants and fine dining establishments. Anything from a McDonald's in Paris to the French Laundry in NYC counts.

If you go TDY often, you know how hard it is to keep costs down on the road. If your going out to eat, might as well get some points for it. 2 UR points per dollar spent on dining adds up fast!

Upgrade Chase Sapphire Preferred to Sapphire Reserve After 1 year

Chase Sapphire Reserve® Card

Learn how to apply on our partner's secure site

- $795 annual fee waived to $0 for US military + spouses with Chase MLA policy

- Earn 100,000 bonus points + $500 Chase Travel℠ promo credit after you spend $5,000 on purchases in the first 3 months from account opening.

- Earn 8x points on all purchases through Chase Travel℠ including The Edit℠

- 4x points on flights and hotels booked direct

- 3x points on dining worldwide

- 1x points on all other purchases

- Get a $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Live the lounge life at over 1,300 airport lounges worldwide with a complimentary Priority Pass™ Select membership, plus every Chase Sapphire Lounge® by The Club with two guests.

- Up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years which saves you a ton of time

- Up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables.

- Trip Cancellation/Interruption Insurance, Auto Rental Coverage, Lost Luggage Insurance, no foreign transaction fees, and more.

- Complimentary Apple TV+ and Apple Music. Subscriptions run through 6/22/27 – a value of $250 annually

- Member FDIC

- Learn more in the Chase Sapphire Reserve review

Due to the CARD ACT, a federal law passed in 2009, credit card companies are not allowed to charge you an increased annual fee for a period of one year. Because of this, you are restricted from upgrading your CSP to a CSR for 1 year.

However, once that 1 year has passed you can upgrade to the CSR and start using the $300 annual travel credit immediately. You can also get the 3x points on dining and restaurants, which adds up fast versus the 2x points of the CSP.

I recommend you compare the Chase Sapphire Reserve to the Preferred and decide if you want the $300 annual travel credit or the extra welcome bonus points. Personally I would take the extra welcome bonus points and upgrade to the CSR after 1 year.

Long term, the Chase Sapphire Reserve is definitely the superior card for military servicemembers, thanks to it's 3x points and $300 annual travel credit.

Since active duty military get the annual fee waived on both cards, you don't need to worry about the increased annual fee!

Learn how to apply for the

Chase Sapphire Preferred® Card

I have already retired from the military (retired in 2021) and was wondering if I could still qualify for the Sapphire preferred or reserve with no annual fee?

SCRA only covers active duty servicemembers and Military Lending Act (MLA) only covers active duty servicemembers, guard and reserve on 30+ day active orders, and their dependents.

Unfortunately the benefits are not extended to retirees or veterans, except if you open the cards while on active duty, the benefits may continue for several years after you leave active service.

Thank you so much for all of your information. I have a question: I recently became active duty with the USPHS 9 months ago. I’ve been told that I was supposed to already have a Chase card prior to becoming active duty by other commissioned officers and I’ve called Chase’s military line and they seemed confused if they will waive my annual fee. Just wanted to know if I apply today do you believe they will waive my annual fee or will I have to do something to get the fee waived. Thank you for your help, time and all of your information.

Sir, thank you for all the valuable info on the site, great learning about all the stuff mil members can take advantage of. One question though as I’m looking to start the credit card journey, what’s a good rule of thumb for time between applying for credit cards if I want to accumulate at a fast pace? I have a decent credit score of 760 right now too if that matters in the decision for how quickly you would want to apply for cards.

Happy to be of service! At my fastest pace, I applied for 1 card per month for 12-16 months. Credit score never moved by more than 10-20 points and never below 760. Initially I would just pace yourself to meet the welcome bonuses, so every 3-6 months. If you can meet the welcome bonuses faster, than 4-8 weeks pace per card is probably reasonable. You might run into the Amex pop up jail or Chase 5/24 rule first and they will slow you down naturally. Have fun and don’t stress!

If I upgrade the chase preferred to reserve card after 1 year and I already have a reserve card can I have 2 reserve cards?

Chase won’t approve you for a Chase Sapphire Preferred if you already have a Chase Sapphire Reserve. It’s called the “one Sapphire rule.”

However, you could apply for a Chase Freedom Flex or Chase Freedom Unlimited and upgrade them to another Chase Sapphire Reserve.

This is allowed and does not violate the one Sapphire rule. I have multiple data points of servicemembers and military spouses with 2 or 3 Chase Sapphire Reserves and no annual fees.

Hi Spencer, I am newly active duty, currently I have a chase unlimited freedom. The CSP is offering a SUB of 100k in branch, so I am planning on getting that. However, I really want the reserve. What should I do with my unlimited freedom? Can I upgrade that to a reserve since I am going to apply for the preferred? What’s the best course of action? Thank you always for this awesome and informative website!

Yes, that’s a good plan, but make sure you’ve got the CSP before doing the CSR upgrade on the CFU.

I would recommend apply for CSP in branch for 100k offer, once that bonus is earned product change the Chase Freedom Unlimited to a CSR.

After a year of having the CSP, you can product change CSP to an additional CSR.

Thank you for all this savings intel! I am a new user and loving everything thus far.

I have the CSR, AMEX platinum, and recently approved for AMEX gold. Am I able to apply for another Chase credit card to then upgrade to the CSR after a year? If so, what card would you suggest?

Yes, my friend’s wife just upgraded her Chase Freedom Flex to another Chase Sapphire Reserve. I would open a Chase Freedom Flex or Chase Freedom Unlimited. Compare both Chase Freedom cards here.

Thanks for all this information! Currently looking into getting our first travel card- with the high welcome offer Chase Sapphire Preferred is offering right now, would you suggest getting that one first? Or the Amex Platinum?

Whenever there is a limited time offer best to strike. I’d go with the CSP and then the Amex Platinum.