19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

Below is a guest post from a Naval dental officer. Note that Amex business cards are no longer annual fee waived if opened after January 2020.

In the post below he explains how he obtained 11 Platinum Card® from American Express and how a savvy servicemember could go about obtaining even more. See his strategy below.

I just opened my second Amex Platinum account (Charles Schwab) and will be working on more in the future! Since I am stationed OCONUS I try to send a free dinner to a friend or family member back home once a month. Can't let those credits go to waste!

One of the greatest perks of being active duty is the generous interpretation of the SCRA from the good folks at American Express. They are not obligated to waive the $550 annual fee on their AmEx Personal Platinum charge card, but they have been doing for many years.

I can only assume they do this because they make money on the backend, on retailers that take AmEx. With more card members spread across thew world, this waiver is the cheapest PR they are going to get when every service-members has one of these in their pockets for no annual fee.

I also like to think that the majority of Amex Platinum holders do not take advantage of any of their benefits and pay the $550. Where just the savvy few actually maximize these things on an annual basis.

We are also some of the most financially responsible members of the workforce seeing how we would lose our security clearance if our credit score started to dip. This post is to outline the many approaches to getting multiple Personal Platinum to maximize these benefits.

Each Amex Personal Platinum card pays dividends in the form of these annual benefits:

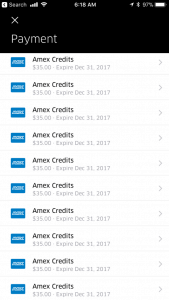

- $200 in Uber Credits (good for rides and uber eats) paid in the form of $15 each month (with a $20 extra bonus in December) into the Uber account the AmEx card is added to. I added all of my 11 personal cards to my wife's Uber account so she sees a credit of $165 on the first of each month ($385 in December). This credit must be used by midnight Hawaii time at the end of the month or will be lost.

- $200 in flight fee reimbursements for an airline of your choosing. This resets every 01 January, which means if you get a new card in November, you can hit the benefit again in January. I use all 11 of mine for $2,200 in AA gift cards, some people use it for Delta or Southwest gift cards. The current airlines and what AmEx pays for are found here: AA Thread, AS Thread, B6 Thread, DL Thread, HA Thread, UA Thread, WN Thread

- $100 at Saks 5th Avenue payable in a $50 credit from January to June and another $50 from July to December. This credit expires at the end of each period and does not require any minimum spend.

- $100 for global entry which presumably should only be used every 5 years for yourself, but some reports of any charge of $100 for any application will be covered without any limitation (try at your own risk). I would just use one $100 credit per card per 5 years.

Each AmEx Business Platinum card has only the $200 in airline fee reimbursements among other things such as the 35% points back which we have discussed on other posts.

Rules of the game:

- AmEx has a lifetime (de facto 7 year rule) limitation on bonuses to be paid for a new product. If you ever got the bonus for getting a card at any time in your life they will NEVER pay that bonus again.

- You can't apply for a product you already have. If you have a Green AmEx, they won't give you another green AmEx or if you have one personal Plat, you can't apply for another.

- You can only product change after one year of having the card to another card you have

- Co-Branded cards are considered separate products. the Morgan Stanley Platinum Card is not the same as the Charles Schwab Platinum Card. You can get the sign up benefit for both.

- Your annual fee will get waived for AD and reservists, but if you are in a state that doesn't have common property rules your non active duty spouse may not get a waiver.

- Some co-branded Platinum Cards require relationships to keep open (Schwab and Morgan Stanley, but not Ameriprise)

- There appears to be no limit to how many CHARGE cards you can have, there is a 5 CREDIT card limit.

- Buying only gift cards and paying with multiple accounts is suspicious for bust out fraud, so don't try it!

Strategy:

- Always get the highest product first, then the lower compatible product to product change in the future.

- DO NOT product change to a product you haven't gotten yet

- Go slow and make sure you hit the minimum spend for the bonuses, it will take many years to get to where I am now

- Have a plan lined up and stick with it!

Best Practices Sequence:

- Amex Platinum

- The Business Platinum Card® from American Express

- Open Schwab account with code ‘refer' for $100 free dollars ($1k min) and then apply for AmEx Charles Schwab Platinum

- Open Morgan Stanley Account ($5K min) then apply for AmEx Morgan Stanley Platinum Card

- Apply for Ameriprise Platinum Card Directly without opening an Ameriprise account (No bonus)

- Apply for American Express® Green Card, then Product Change in one year to AMEX Platinum.

- Apply for Biz Gold and Upgrade to Plat in one year

- Apply for American Express® Gold Card, then Product Change in one year

- Apply for Ameriprise Gold Card Directly then product change in one year

Theoretical Unproven Sequences:

- Apply for Morgan Stanley Credit card and PC to another Plat in one year (Have not tried this yet)

- Apply for Charles Schwab Credit card card and PC to another Plat in one year (Have not tried this yet)

- Apply for another Green and Gold after Upgrading and PC in one year

Unicorn Cards:

- Goldman Sachs AmEx Platinum (Been working on this for years)

- Mercedes-Benz Platinum (Discontinued March 2018)

Predicting how much free money you need

I asked my O-6 select friend what he thought the number of cards you need are and he said “infinite”. However I am framing this in the terms of maintenance, as each card requires time investment to maximize the benefit. Otherwise the effort will be for a benefit you have no time to use. Using the below chart you can see how many cards you will need to fit your lifestyle:

| # of Plats | $ Uber/ Mo | $ Uber Dec | Airline | Saks 6 mo | Total Yr |

| 1 | $15 | $35 | $200 | $50 | $500 |

| 2 | $30 | $70 | $400 | $100 | $1,000 |

| 3 | $45 | $105 | $600 | $150 | $1,500 |

| 4 | $60 | $140 | $800 | $200 | $2,000 |

| 5 | $75 | $175 | $1,000 | $250 | $2,500 |

| 6 | $90 | $210 | $1,200 | $300 | $3,000 |

| 7 | $105 | $245 | $1,400 | $350 | $3,500 |

| 8 | $120 | $280 | $1,600 | $400 | $4,000 |

| 9 | $135 | $315 | $1,800 | $450 | $4,500 |

| 10 | $150 | $350 | $2,000 | $500 | $5,000 |

| 20 | $300 | $700 | $4,000 | $1,000 | $10,000 |

Take your time, it took me 5 years to have 11 Personal and 3 Business between my wife and myself.

How many Platinum cards do you have? Click here to read about all the free benefits you can get with an Amex Platinum card if you're in the military. It would sure be nice to have $150+ of free Uber rides every month!

Can confirm, you can have multiples of AMEX cards without having to upgrade.

Correct. I currently have 3 platinums. The first one I did a standard application and was approved. The second one was a gold thati had for over a year and upgraded to a platinum. The third one I had open my browser in incognito mode and apply that way. I got the pop-up saying I wasn’t eligible for the sign up bonus but proceeded with the application and was approved.

Adam, did you get the SUB though?

This is old but still gold. I’m up to 9 Platinums and 3 Aspires while P2 has 9 Platinums and 2 Aspires. The aspires are just as valuable if not more valuable for military to stack. The free stays at Waldorf Astorias can’t be beat. 10 free nights a year if you’re married! For any card(s) in the family of points you’re working with (Membership Rewards, Hilton, Sky Miles, etc.) get all the cards in the family for their welcome bonuses and upgrade as appropriate. To then get more cards simply outright apply every 90 days and you should be approved. Between P2 and I we’ve gotten approved for Platinums outright 6 times times and for Aspires once. No need to get a lower card and wait a year to upgrade. Oh and stack up your United Travel Bank every year with Platinum and Aspire Airline Credits!!!!

I’m currently at 4 Platinums and 2 Aspires while P2 has 2 Platinums and 1 Aspire. Can you please explain how you are able to get 9 Platinums? Are you saying that you just apply for another Amex Plat without any product change and Amex is okay with that?

Yes.

I can’t see a way to apply for another Platinum card while logged into my account. Do you apply for an additional plat card via incognito or do you create a different Amex Userid/account to apply for another plat?

The easiest way to get additional Platinum cards is to upgrade Amex Gold and Amex Green cards to additional Amex Platinum cards. Direct application of a card that you already have it probably going to be denied based on Social Security Number (SSN) and creating different user ID accounts won’t help.

As I said above it does not get denied. You can do it every 3 months, applying outright. THAT is the best way and fastest way to get multiple platinum. P2 and I have 19 Platinums, 1 Gold (Keeping), and 7 Aspires now.

Spencer,

First off love your stuff and appreciate your dedication to the community. I already have a platinum express card (for about 5 months) and after reading your material realized that the platinum Schwab is better for my situation and that why not have both! I went to open up a platinum Schwab card but was denied because I already have a platinum express card… Do I need to wait until i hit the “year mark before applying for the Schwab express” or would you recommend cancelling the current card, applying for Schwab and then upgrading gold cards as you suggest. Thank you in advance!

Thanks David. Can you elaborate on the denial for the Amex Platinum Schwab card? You should be able to open both as they are separate products. You may need to wait for a few more weeks between applications. What’s your credit score? That will have an impact too on whether you’re approved or not.

Thanks for the quick reply! Credit score is in the 750 range, but it just got hit since we are refinancing our home. I am also still within the 6 month sign up bonus for the first platinum express. I signed up for the Schwab platinum express card online and received the dreaded “your application is pending further review.” I went to the online approval status AMEX provides and it was not listed. I then called AMEX and the rep told me that i already have a platinum express card so am not eligible and would have to cancel my first one and then reapply. I knew it sounded fishy so I came here.

I’m going to do some further research on this David. Amex may have changed their policies. Schwab Platinum used to be a different product than the Amex Platinum but maybe they changed their policies recently.

I will try again in a month or two. Regardless, I will keep you updated to anything I find as well! Thank you

Definitely not right. My wife and I both have 9 Platinum cards, 7 regular, 1 Charles, 1 Morgan Stanley. Can outright apply to new cards (including additional platinums) every 90 days. No need to do the gold / green and upgrade over and over once you get those welcome bonuses. Either way hope you were able to get the Schwab card without cancelling your platinum.

Any chance you can recreate and update this entire blog post?

Just a general housekeeping suggestion- the Flyertalk links you have are all DPs for 2011-2019, and they’ve created new ones for each airline in new running pages for the 2020s.

Is it possible to upgrade from green/gold to plat, get new green/gold, and after another year, upgrade again? In other words, can you upgrade once a year every year? Not asking about bonus points.

Yes, I’ve done this my self. 6 Platinums for me at the moment.

is it possible to upgrade a green or a gold card to a regular amex plat card even if you already have one? If so, should you call in for the upgrade or wait for it to appear in your offers?

Thanks.

Yes you can upgrade an AMEX Green or Gold to another Platinum. You need to move the card to another AmericanExpress.com login to get the offer.

You just need a separate AMEX login username, like if john1 is your primary, make a new account john2. You can use the same email and password.

Go to your john1 account, find the card you want to remove (AMEX Green or Gold) and go to account or card services, card management and remove from online management.

Log out of john1, login or create john2, and add the card you just removed card to john2. You should be able to upgrade to another Platinum within a few hours or instantly. You can then add the newly upgraded card back to your main john1 account.

You need to hold the AMEX Platinum for 1 year before it’s eligible for upgrade.

I use the same email for all accounts.

Once the account is upgraded you can apply for another Green or Gold card, since you no longer have that account type open. However you will not be eligible for the bonus again for 7 years. Or if you find an offer without a lifetime bonus in the terms and conditions, you may be able to get around the 7 year restrictions.

Under the strategy section it advises us to “go slowly.” Why? What is considered slow ( In regard to AMEX cards)? I’d like to build my credit card profile making sure to apply for cards w/in an acceptable time range from the last application. Is there a tried and true rhythm to it?

I am in the National Guard. I went for BOLC and was considered active duty to SCRA for my Amex Platinum, Marriot Bonvoy personal, and business. When I went back to my unit, they still have not charged me any Annual Fees for my cards. I applied for the Amex Gold recently and they charged me the annual fee. Im afraid to call them to have it reviewed because I feel like they are giving me a pass with my other credit cards and I do not want mess with my other cards. I was wondering if you or anyone you know that is in the Guard know the rules for Guard/Reserve soldiers.

Yeah, I would not press this one. If you are receiving the fee waiver on the AMEX Platinum, Bonvoy Brilliant, and Bonvoy Business, I would just close the AMEX Gold card if you are not comfortable paying the annual fee. However, if you are planning on receiving active duty orders soon, keep the card open and they will refund all annual fees paid once you are eligible for SCRA protections. It can be worth paying the annual fees for a few years if you think you will get active duty orders for greater than 30 days in the next few years.

Does AMEX refund all prior annual fees paid (when not under SCRA/MLA) when you are activated for Active Duty?

Not sure, I think they will only refund fees charged while on active duty. Try it and let me know!

So only 5 of the can be credit card right? The rest must be charged cards

Yes, AMEX has a five credit card limit, but unlimited charge cards (like the Platinum card).

Anyone know if AMEX will waive the second user fee ($175) on this SCRA deal?

Yes, it’s waived for military and military spouses.

How do you set up separate log in for multiple platinum cards?

You can keep all your AMEX Platinum cards on one login, you don’t need separate ones. If you are talking about keeping AMEX Gold or AMEX Green on a separate login, just create a different login when you get the card and open an online account. If you have already added the card to your main account, you can drop the card from the account by going to Account Services – Card Management on the left menu – “Remove card from Online Management.” Then you can add the card back to a new AMEX account.

Simple followup. Say you do this, and you successfully get the 15000 points, will they be kept separate from your main pool of points considering it’s under a different login?

If you self refer? All Membership Reward points are aggregated across logins, so it’s all in the same pool of points.

Just to update this post my current progress and the issues that I’ve stumbled across so others don’t have to deal with it.

Current cards without issue:

AmEx Platinum

AmEx Charles Schwab Platinum

AmEx Gold (Might actually keep the card, its got some great perks)

AmEx Biz Platinum

AmEx Gold Biz (Will upgrade)

AmEx Green (Will upgrade)

The cards I ran into issue with:

AmEx Morgan Stanley Platinum Card

-This is less of an issue and more of a warning if you plan on keeping this card and don’t want to keep your CS account. Many individuals would create an account (you have 90 days to fund it) become eligible for the Amex plat and never actually fund their account.

From the many hours of reading it appears that Amex has been aggressive in closing these cobranded cards when you no longer have a qualifying account with that partner. So be weary of this.

Ameriprise Platinum Card

– So there’s been reporting of this and it actually happened to me. If you have the regular Amex plat personal card (vanilla), you are now not eligible for the Ameriprise card. The system would just not let the request go through and would cancel it. I tried to get this overridden by Amex but they had no clue and said I’d likely have to apply through Ameriprise (although I don’t know if that would help).

Just thought I’d share my experience with you!

Awesome info, thanks for sharing!

This was the best guide on the internet. I’m now up to 7 Plats and will be at 11 by the end of the year.

Why apply business platinum before co- brands’? The threshold of spending 10k is much higher than others.

I was thinking the same thing…

I just opened a regular account with Charles Schwab. How soon can I apply for an Amex Platinum?

You should be good to apply after 48 hours. Let us know if it worked.

I heard that MLA/SCRA benefits did not apply to business cards. Are you paying the annual fee?

Chase does NOT waive business card annual fees. They do waive personal card annual fees under MLA.

AMEX DOES waive business card annual fees under SCRA.

Spencer,

Great info as always, thank you! Just a quick update to your comment, Amex no longer waives the business card annual fees under MLA for any new applicants. Folks who don’t pay their annual fee on their business cards will continue to be grandfathered though.

Yes, that’s correct as of January 2020.

So just to confirm all of these accounts are active at the same time correct? your not cancelling each one before applying for the next? Or are you?

All active at the same time.

I’ve turned my attention to the Goldman Sachs one as well. A tough nut to crack!

I confirm that the following also works:

I applied for the AmEx Hilton Aspire and the Ascend cards. I upgraded the Ascend to the Aspire after 9 months.

I just did this exact same thing as well.

Does Schwab waive annual fee for Schwab Amex Platinum for military?

Yes, I can confirm this. The American Express Platinum Card from Charles Schwab waives the annual fee for military. Plus it usually has a welcome bonus of 60000 MR points.

I recently read on Reddit r/MilitaryMS that you do not need to wait 1 year to PC business cards to Platinums. Do you have any other DPs on that strategy?

I have no DPs but it sounds like a thing based on the Reddit threads. Give it a shot!

While not yet mentioned, changes to MLA might affect MSers and Churners. https://www.npr.org/2018/08/13/637992389/white-house-takes-aim-at-financial-protections-for-military?utm_source=facebook.com&utm_medium=social&utm_campaign=politics&utm_term=nprnews&utm_content=20180813

Thanks for the info. More weakening of military consumer protections by the current administration. Thanks to the SCRA though I think military churners will still do alright and we’ll have plenty of warning if things change.

Different people probably have different feelings on this. Some will say the company offers the benefit I’ll accept it. Others will say this clearly isn’t the intent of the benefit and is going way to far.

We’ll see if this gravy train keeps on running costing amex some significant cash.