19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The Platinum Card® from American Express offers cardmembers a great benefit of a $100 annual credit at Saks Fifth Avenue Stores. Enrollment is required for this benefit. The credit is split so you can get $50 reimbursed in January – June of the year and $50 in July – December.

My wife loves it when I give her $400 in Saks gift cards to spend every 6 months. Between the two of us we have 8 Platinum cards, so this is a benefit we really take advantage of!

The credit takes about 2-5 days after completing your purchase at a Saks Fifth Avenue store or their website. Make sure you enroll on the Amex Benefits page before you go shopping.

Military servicemembers can get an Amex Platinum card with NO annual fees thanks to AMEX's generous interpretation of the SCRA law.

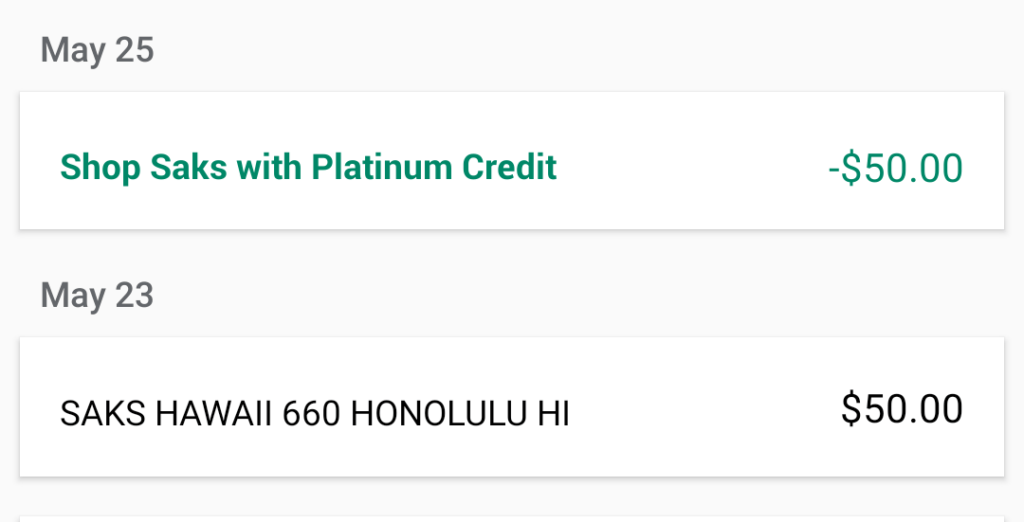

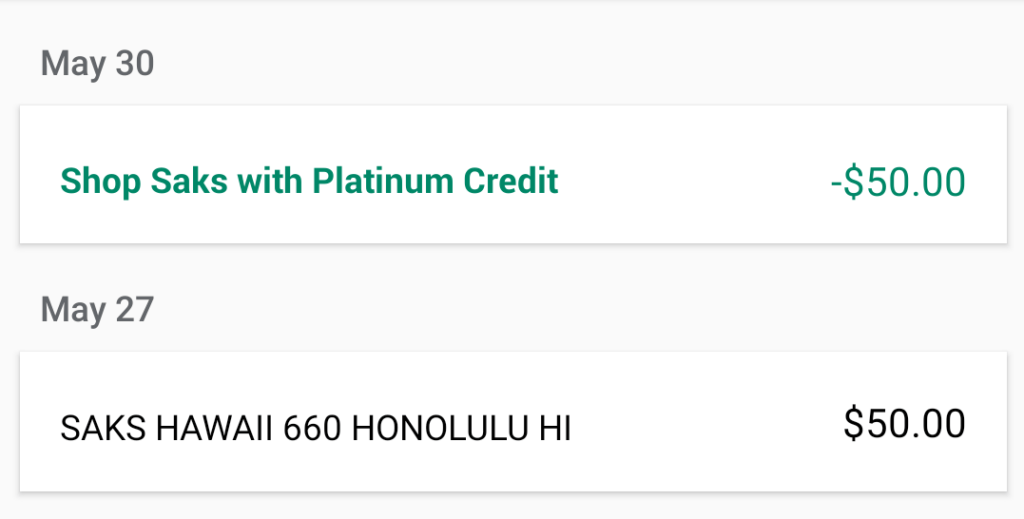

Here are two screenshots from two of the purchases I made at the Saks Fifth Avenue Waikiki, Honolulu, Hawaii in May 2019:

As you can see the credit only took 2-3 days to post to my accounts. I have seen reports online of up to 5 days, but it should definitely be faster than the 6-8 weeks advertised by Amex.

In this post:

What I Bought with My Amex Platinum Saks Fifth Avenue Credit

I'll be honest: I have never shopped at a Saks Fifth Avenue before American Express started this credit. So if their goal was to get new customers into a Saks Fifth Avenue, it worked.

My wife and I currently each have an AMEX Platinum. I also have an Ameriprise AMEX Platinum and the Charles Schwab AMEX Platinum. That's 4 Platinums total so each year I get $400 in AMEX Saks credit or $200 each half.

I recently stayed at the Hotel Le Germain Calgary (get $20 off your stay if you use my referral link!), an awesome choice for business travelers, TDY, official government travel, or just a day in the city which was what brought my wife and me there. We stayed there as part of our epic 13 day circuitous travel PCS.

The toiletries the hotel offered were Molton Brown, a brand I had not heard of before (uncultured rube that I am). After using these fancy soaps for a day, I was impressed. They smelled great, left you feeling super clean, and they looked really nice in the shower too.

I'm no expert of super fancy soaps and body washes, but these Molton Brown luxury bath products stood out to me. I noticed Saks carried them, so of course I spent some of my $200 of AMEX Saks credits on outfitting our new house with fancy bath products.

Here's what I bought with my AMEX Saks credit in May 2019:

- Molton Brown Heavenly Gingerlily Bath & Shower Gel $32

- Molton Brown Thickening Shampoo With Ginger Extract $30

- Molton Brown Delicious Rhubarb and Rose Body Lotion Free Sample

- 2x $50 Saks Fifth Avenue Gift Cards – $100

Total: $162 + tax. Total out of pocket: $0.

Buying Saks Gift Cards With American Express Platinum

First things first, you need an Amex Platinum card:

The Platinum Card® from American Express

Learn how to apply on our partner's secure site

- $695 annual fee. Reduced to $0 with American Express special military protections

- You may be eligible for as high as 175,000 Membership Rewards® Points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount – all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel® up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel®.

- $200 Annual Hotel Credit: Get $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using your Platinum Card®. Note that The Hotel Collection requires a minimum two-night stay

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month when you pay for eligible purchases with the Platinum Card® at your choice of one or more of the following providers: Disney+, a Disney+ Bundle, ESPN+, Hulu, Peacock, The New York Times, and The Wall Street Journal. Enrollment required.

- $200 Uber Cash: Platinum Card® Members can get $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. Enrollment required.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Platinum Card® Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- $199 CLEAR® Plus Credit: CLEAR® Plus helps get you to your gate faster by using unique facial attributes to verify you are you at 50+ airports nationwide. Receive up to $199 in statement credits per calendar year after you pay for your CLEAR Plus Membership (subject to auto-renewal) with the Platinum Card®.

- This is a MAJOR time saver–$120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA PreCheck® official enrollment provider) application fee, when charged to your Platinum Card®! Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Lounge life! Enjoy the benefits of the Global Lounge Collection, with over $500 of annual value if you visit Centurion Lounges and each of our partner lounges including Delta Sky Club® lounges when flying an eligible Delta flight (subject to visit limitations), select Lufthansa lounges when flying Lufthansa, Plaza Premium lounges and Escape Lounges, and enroll in Priority Pass Select. See terms.

- A Walmart+ membership can get you free shipping with no order minimum on eligible items shipped by Walmart. Use your Platinum Card® to pay for a monthly Walmart+ membership (subject to auto-renewal) and receive one statement credit for up to $12.95 (plus applicable taxes. Plus Ups not eligible) each month. Free Shipping excludes most Marketplace items, freight & certain location surcharges. Paramount+ Essential plan only, separate registration required.

- Up to $100 annual Saks Fifth Avenue credit, enrollment required

- Global Dining Access by Resy gets you access premium dining experiences. Receive Priority Notify and unlock insider access to some of the world's most sought-after restaurants with Global Dining Access by Resy. Download the Resy iOS app or log into Resy.com and add your Platinum Card® to your Resy profile to take advantage of your special benefits and discover restaurants near you.

- No foreign transaction fees

- Enrollment is required for select benefits

- The Platinum Card® from American Express – learn how to apply

- Read my full review of the Amex Platinum card for military, terms apply

Besides the fancy bath products I purchased 2 $50 gift cards, 1 with my Ameriprise Amex Platinum and 1 with my wife's AMEX Platinum. Both coded as $50 Saks Fifth Avenue purchases and both credits posted in 2-3 days.

I have also purchased 1x $400 gift card and split the payment across 8 Platinum cards. $50 on each card and all the transactions were reimbursed a few days later.

The fine print states that gift cards are not eligible for the credit, but in my experience if you purchase the gift card in the store it does not code as a gift card and the Amex credit will kick in.

At the Saks Fifth Avenue I went to they were able to split payments across multiple cards. I simply asked the cashier to put $50 on one AMEX Platinum card and the remainder on my Charles Schwab Amex Platinum.

All personal (not business) varieties or flavors of the Amex Platinum card come with the Saks credit benefit. If you rack up multiple Amex Platinum cards, you can rack up multiple $50 semi-annual credits at Saks Fifth Avenue.

One thing to note is the credit DOES NOT work at Saks Off Fifth. However you can buy Saks gift cards at Saks Fifth Avenue and then use them at Saks Off Fifth. This was tested in June 2019 and July 2021 and worked for me.

Amex Platinum Saks Credit Terms and Conditions

Here's the fine print from AMEX's Benefit Terms.

Only the Basic Card Member or Authorized Account Manager(s) on a U.S. Consumer Platinum Card®Account can enroll in the benefit. Eligible purchases must be charged to the enrolled Card Account for the benefit to apply. Purchases by both the enrolled Basic Card Member and Additional Card Members on the eligible Card Account are eligible for statement credits. However, each Card Account is only eligible for up to a $50 statement credit from January through June and up to a $50 statement credit from July through December for a total of $100 per calendar year in statement credits across all Cards on the Account. Valid at Saks Fifth Avenue online or at locations in the US and US Territories. Not valid on Saks Fifth Avenue Gift Cards or purchases at outlet locations (in stores and online). Excludes purchases at restaurants located within the store and Online Bill Pay for Saks Credit. Not valid on online purchases shipped outside of the US. Please allow 2-4 weeks after an eligible purchase is charged to your Card Account for statement credit(s) to be posted to the Account. Please call the number on the back of the Card if statement credits have not posted after 4 weeks from the date of purchase. Note that American Express may not receive information about your eligible purchase from merchant until all items from your eligible purchase have been provided/shipped by merchant. Statement credit may be reversed if the eligible purchase is returned/cancelled. If American Express does not receive information that identifies your transaction as eligible for the benefit, you will not receive the statement credit. For example, your transaction will not be eligible if it is not made directly with the merchant. In addition, in most cases, you may not receive the statement credit if your transaction is made with an electronic wallet or through a third party or if the merchant uses a mobile or wireless card reader to process it. To be eligible for this benefit, Card Account(s) must be not canceled and not past due at the time of statement credits fulfillment. If a charge for an eligible purchase is included in a Pay Over Time feature balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time feature balance. Instead, the statement credit may be applied to your Pay In Full balance. For additional information, call the number on the back of your Card.

$100 Amex Saks Credit: Actually Useful!

Honestly, I was surprised that I ended up using this benefit. When I first saw it announced, I did not think I would get much value out of it, especially since it was only $50 per six months.

By getting multiple AMEX Platinum cards and still paying no annual fees thanks to AMEX SCRA, I am able to stack the benefits and get a few hundred dollars worth of Saks products every six months.

This should keep my shower well stocked with luxury bath products. It's also a great way to get gifts for people, as most people would be really excited to receive a Molton Brown gift pack from Saks.

How about you? What luxury products did you pick up at Saks with your AMEX Platinum $100 annual credit? Let us know in the comments!

Thanks for the great content Spencer! I think another option for this credit worth mentioning is that websites like cardcash.com allow you to trade or sell gift cards. So stacking $50 gift cards to buy luxury bath products might not be everyone’s cup of tea, but you can trade that $50 gift card for $40 cash or for $42ish dollar gift cards to Amazon or Home Depot. That’s actually a legit benefit to me that doesn’t require I blow credits on stuff I wouldn’t otherwise buy. Sure you lose a few bucks on the trade, but for me I would take a $42 Amazon credit every six months over a $50 Saks credit any day.

Might have just been updated but their fine print now states that the credit cannot be used on gift cards. I bought a $50 gift card in October and never saw a credit for it. So they may be enforcing that now.

Thanks for the data point. Did you buy online or in person?

E gift card purchased thru their website.

Website doesn’t work because they go through a third party, must be purchased in person.

You may want to mention that Saks doesn’t bill until the item ships. If you order something in Dec, but it doesn’t ship until Jan, that’d be on the Jan-Jun 2022 credit. With all the supply chain issues, that happened to me last year.

Good point, I will add something about it.

so does the additional card get $50 credit too?

Yes, all personal Platinum cards you hold get the credit. Currently I have 5 so I’m getting $50×5 = $250 per 6 months.

But in the fine print it says “Purchases by both the enrolled Basic Card Member and Additional Card Members on the eligible Card Account are eligible for statement credits. However, each Card Account is only eligible for up to a $50 statement credit from January through June and up to a $50 statement credit from July through December for a total of $100 per calendar year in statement credits across all Cards on the Account.”

a total of $100 statement credit across all cards on the account, I’m confused now…

Ah, I see, I read your initial question wrong. You are correct. If you have one AMEX Platinum account with multiple authorized users, you only get 1 $100 credit per year. BUT, if you have multiple AMEX Platinum accounts, like Schwab, Ameriprise, Regular, etc, (like I do), then it’s $100 statement credit per account.

This is the “oh yeah, I should buy socks and undershirts” credit, but I may have to check out those toiletries.

It’s a little ridiculous, but they are free and look really nice in the guest bathroom. They also smell really nice!