19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The following is a personal review for Navy Mutual Life Insurance. If you are eligible and get a quote for Navy Mutual Insurance through one of the links below, I can be compensated $10 per referral. You can see my advertising disclosure here. I only recommend products I have used or would recommend to my own family/friends.

Military servicemembers have many great options for life insurance. All servicemembers have access to Servicemembers Group Life Insurance (SGLI). For $28/month you receive $400,000 of life insurance. For $1 more per month you can add SGLI Traumatic Injury Protection Program (TSGLI), which pays up to $100,000 in the event you suffer any of these traumatic injuries.

If $400,000 isn't enough coverage for you or you are in a higher risk career field, you may want to add additional coverage. Servicemembers in high risk occupations include:

- Aviation (pilot, loadmaster, enlisted aircrew, navigator, flight engineer)

- Special forces

- Explosive ordnance disposal (EOD)

- Pararescue

- Infantry

If you are a Navy SEAL, Army Ranger, Air Force Special Tactics, or Marine MARSOC, you should consider the risks associated with your profession.

Supplemental SGLI Insurance

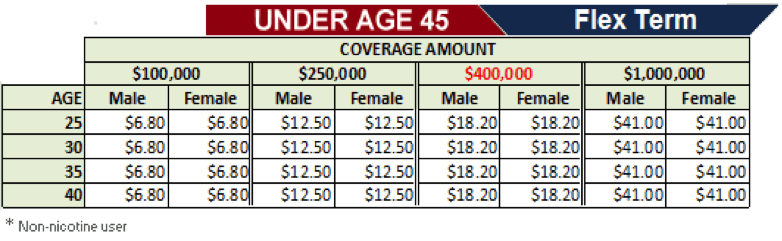

If you want to supplement your SGLI insurance or even save a few bucks a month by not using SGLI, check out Navy Mutual's Flex Term Life Insurance. You can double your SGLI coverage by adding $400,000 of coverage for only $18.20 per month if you're under 45 years old.

Like all life insurance policies for military members, you need to check to make sure there are:

- No War, Aviation, or Terrorism Clauses

- No Military Service Restrictions

- No Sales Fees or Commissions

The Flex Term Life Insurance has none of these restrictions or clauses that would allow the company to deny your claim if your loved ones filed a claim.

Express Term Plus insurance is also available from Navy Mutual. This insurance is offered without a medical exam and becomes active with the first payment you make. That means you can add up to $250,000 of coverage within 24-48 hours. This is perfect if you get tagged with a last minute deployment to Korea or Syria.

Navy Mutual Eligibility

If you are not in the Navy, do not be turned off by the name of the association! Every US military servicemember is eligible for membership. The website states:

To become a Navy Mutual member, you must be on active duty, retired, in the reserves/guard, or separated within 120 days of the United States Military, USPHS, or NOAA.

Some retirees are also eligible depending on what state you live in. Check the website for more details.

Navy Mutual Aid Association Financial Stability

Navy Mutual Aid Assocation (NMAA) has offered life insurance and annuities to sea service officers since 1879. Eligibility expanded over the years to include all seven uniformed services. Today, over there are over 100,000 NMAA members worldwide.

Navy Mutual is committed to good financial stewardship of their members' premium payments. Some of the key facts that demonstrate Navy Mutual's financial strength include:

- 97.8% member retention rate.

- More than $80 million in total direct premiums

- Greater than $26 billion in total insurance in force.

- A net investment yield of 5.90%.

- Over $3 billion in Total Assets.

- An A+ rating from the Fitch Ratings Agency.

If you are looking to supplement your SGLI or looking at insurance options beyond the SGLI, I encourage you to talk to them today. The online form only takes a few minutes to fill out. If you're in the military, sleep more soundly with life insurance from Navy Mutual.

Hey Spencer, long time reader, thanks for all the information you have put out over the years. I currently supplement my maxed out SGLI with a 20 year term for $400k through AAFMAA, it runs about $18/month. I have a second child on the way and the line of business isn’t getting any safer.. is Navy Mutual your only life insurance? I trust you have done your homework and am curious how much total you are carrying and in what variety if you’re willing to share. Cheers, Queen