19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

You will need a Certificate of Eligibility to establish if you are eligible to apply for a VA loan. You may be eligible for a VA Home Loan if you are a Veteran or Active Duty member of the US Military.

In this article, you will learn what a VA Loan Certificate of Eligibility (COE) is, how to get one, and what you'll need to complete the VA loan application process successfully.

This special loan is only available to military personnel, veterans, and some military spouses. The VA loan allows you to buy a home with little or no money down.

Getting the COE is easy, but you will need to show that you meet the criteria by providing the right paperwork. Here's what you need to know about getting your certificate of eligibility and applying for a VA home loan.

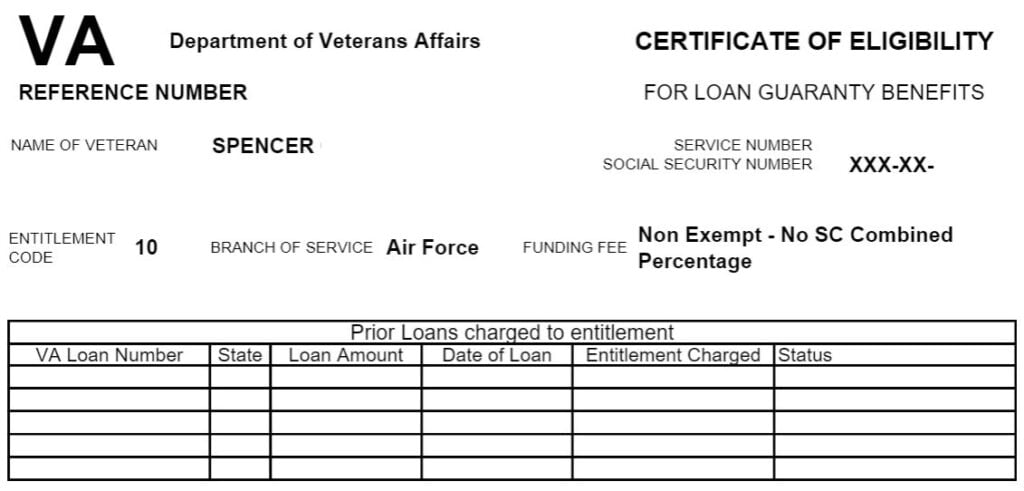

I just pulled my own COE from VA.gov on the eBenefits site. Here's what it looks like:

The VA Certificate is a simple PDF that lists your name, last 4 of your Social Security Number, your branch of service, entitlement code, and whether you are exempt from the VA funding fee.

In this post:

VA Loan Ultimate Guide

I built the VA Loan Ultimate Guide to explain the confusing VA loan process.

- What is a VA loan?

- How to determine if you are eligible for a VA loan?

- How to get a VA loan Certificate of Eligibility?

- What credit score do you need for a VA loan?

- What is the VA loan process, from start to finish?

- Who are the best VA loan lenders?

- What is a VA cash-out refinance loan?

Here's a podcast episode from my Military Money Manual Podcast all about using the VA loan:

What is a VA home loan?

Veterans who want to buy a home can get a guarantee from the Department of Veterans Affairs. These loans are known as “Veterans Affairs” loans, or simply “VA” loans. Compared to typical mortgages, these loans provide the following advantages:

- There is no requirement for a down payment (unless required by law)

- On this loan, there are no monthly mortgage insurance premiums (PMI)

- For 30 years, the interest rate will be fixed (except in rare cases where an adjustable rate might be preferable)

Both the property and the borrower must meet specific criteria to qualify for a VA home loan. The property must have the following characteristics:

- Currently being utilized as your primary residence (not used as investment or rental property)

- A condominium that has been approved by HUD or is listed in the VA's approved directory.

Mortgage firms require you to obtain a Certificate of Eligibility to secure a VA home loan. The COE acts as proof of service and grants you eligibility for VA loan benefits.

What is a VA Home Loan Certificate of Eligibility?

When you're ready to apply for a VA Home Loan, you'll need proof of military service from your mortgage provider to qualify. The Department of Veterans Affairs (VA) will issue you a Certificate of Eligibility (COE) that authorizes you to use your VA Loan and specifies the amount of funding you are eligible for

You won't be able to use your VA loan if you don't have your COE since your lender won't be able to verify proof of service without it.

Remember that just because you have your COE doesn't mean you'll be approved for a loan. Other minimum requirements that you must achieve to use your benefit will be specified by your mortgage provider.

How to apply for a VA certificate of eligibility (COE)?

There are a few ways to acquire the Certificate of Eligibility for your VA Home Loan:

- Apply Online: Visit the VA eBenefits website and follow the directions to register.

- Ask your lender: All VA-approved lenders can pull your COE in minutes. Most Efficient

- Mail-In: Form 26-1880 can be filled out and mailed back in, but this method can be time-consuming and may cause your loan to be delayed, slowing down your application process.

While all of these options are viable, it is recommended that you request your COE through your VA-approved lender to avoid any unnecessary wait times. All lenders are not able to request your COE, they must follow VA guidelines.

What do you need to get a VA COE?

If you are a member of the Active Duty, Reserve, or National Guard, you will need to provide additional documentation, such as a Notice of Basic Eligibility (NOBE) and/or a Statement of Service (SOS).

If you are a veteran applying for a VA Home Loan, you will also need your DD Form 214 (discharge or separation papers).

Service Members

To prove that you are eligible for the VA home loan program and receive your COE you have to show that:

- You served on active duty for at least 90 days during the conflict (or 181 continuous days during peacetime)

- You served in the Reserves or National Guard for six years.

- Due to a service-related disability or medical condition, you were dismissed from Active Duty, Reserves, or National Guard.

- You are the surviving spouse of a service member who was killed in the line of duty or suffered injuries as a result of military service.

As an active duty service member, you will need to obtain a Statement of Service that includes:

- Your Full Legal Name

- SSN (Social Security Number)

- Birthday

- Duty Commencement

- Any time lost while serving

- Discharge (Type)

Your commander, adjutant, or personnel officer should sign the Statement of Service, which should be written on military letterhead.

National Guard or Reserve

If you are a current or former activated National Guard or Reserve member, you will need to provide your DD214, which shows your activation date, or any discharge documents that you were given at the end of service.

Current members of the Reserve or National Guard that have never been activated will need to obtain a Statement of Service signed by your commander adjutant or personnel officer providing the same information as an Active Duty service member.

If you are a former National Guard member that has never been activated, you will need NGB form 22, NGB form 23, and proof of honorable service.

If you are a discharged Reserve member that was never activated, you will need to provide your latest annual retirement points statement and proof of honorable service.

Veterans

As a veteran, you will only need to provide your DD214 (discharge or separation papers). You will qualify if you received any discharge aside from dishonorable, other than honorable, or bad conduct.

For those with a negative discharge status, there are a couple of options available. You can attempt to have the discharge upgraded or you can go through the VA Character Discharge review program.

Military Spouse

A surviving spouse applying for the VA loan program has to prove at least one of the following:

- The veteran was reported missing in action.

- The veteran was imprisoned during the war.

- The veteran died while serving or as a result of a service-related injury, and you never remarried.

- The veteran died in service or as a result of a service-related injury, and you did not remarry before reaching the age of 57, or before December 16th, 2003.

- The veteran died after becoming completely disabled, but the disability was not the cause of death.

As a surviving spouse who is eligible for a VA loan,you will need to provide the veteran's DD214 (discharge or separation papers) along with VA form 26-1817 if you're receiving Dependency & Indemnity Compensation (DIC).

If you are not receiving DIC you will need to provide the VA with the application for benefits form 21P-534EZ, a copy of your marriage license, as well as the Veteran's death certificate.

Visit the VA's website to view the full list of eligibility requirements

What is full entitlement on a VA COE?

You have “full entitlement” on your VA loan COE if your basic entitlement listed as $36,000.

Note that this doesn't mean the VA will only fund up to $36,000. Read the fine print below:

THIS VETERAN'S BASIC ENTITLEMENT IS $36,000* TOTAL ENTITLEMENT CHARGED TO PREVIOUS VA LOANS IS $0* The Veteran is eligible for the home loan benefits of Chapter 37, Title 38, U.S. Code, subject to any condition(s) cited below. Basic entitlement available to a Veteran is $36,000. Entitlement previously used may be restored when the property is sold, or the loan is paid-in-full. For loans above $144,000, the maximum amount of entitlement available to a Veteran with full entitlement is 25 percent of the loan amount. For Veterans who have previously used entitlement and such entitlement has not been restored, the maximum amount of entitlement available to the Veteran, is 25 percent of the Freddie Mac conforming loan limit (CLL) reduced by the amount of entitlement previously used (not restored) by the Veteran. CLL loan limits are adjusted annually, and the current limits are available at www.homeloans.va.gov.

Full entitlement on a VA COE

If you read closely, it states that for loans above $144,000, the maximum entitlement is 25% of the loan amount. This means that if you can qualify for a $1,000,000 mortgage on a house, then the VA will guarantee up to $250,000.

Entitlement Code 10 on VA COE

Most veterans who served on active duty in the last 20-30 years will receive an entitlement code of 10. This represents an enlisted date during or after the Gulf War, which the VA has defined as enlistment between 8/2/1990 – present. Maybe it's time to update that since we've started and ended several wars since then?

Here is a list of all the VA entitlement codes you can find on the COE.

VA Entitlement Codes

| Entitlement Code | Era |

|---|---|

| 01 | World War II |

| 02 | Korean War |

| 03 | Post-Korean War |

| 04 | Vietnam War |

| 05 | Entitlement Restored |

| 06 | Surviving Spouse |

| 07 | Spouse of POW/MIA |

| 08 | Post-World War II |

| 09 | Post-Vietnam |

| 10 | Persian Gulf War |

| 11 | Selected Reserves |

Learn more about VA home loans in our in depth article.

Do you have more questions about your VA Certificate of Eligibility?

Your VA-approved lender should be able to answer any other questions you have regarding your entitlement, which code identifies you, and the process.

Bottom line, now that you know how to obtain a VA loan Certificate of Eligibility and how to use it, you can move on to the next step in the home-buying process. Locate a VA-approved lender and realtor, begin your home search, and obtain pre-approval.

If you have any other questions, there are additional articles on VA home loans in general and

The method you use to request your Certificate of Eligibility greatly influences the time it takes to receive it. If you ask your lender, you could get an answer in minutes, whereas if you mail your request, it could take up to 6 weeks.

Loans of more than $144,000 are no longer subject to limits for eligible service members with full entitlement. The amount of your loan is determined by your lender after reviewing your credit history, income, and assets. The VA does not consider your credit score when determining eligibility, but most lenders do.

If you currently have an active VA loan, your loan limit will be determined by your county's loan limit. You can get another VA loan with your remaining entitlement alone or with a down payment. If your previous VA loan is paid off, you will regain full entitlement.

No, the COE does not guarantee you a loan. Your home must pass VA appraisals and you must meet your lender's minimum requirements.

This line of your COE verifies to your lender that if you were to default on a loan under $144,000 the VA would guarantee up to $36,000. If your loan is over $144,000 the VA guarantees up to 25% of the loan value.

If the entitlement says $0, it means you've already used it and don't have any remaining benefits. Once you have paid off the old loan, you will be able to reclaim your entitlement.

Your lender will use your COE to verify your eligibility. You can then get pre-approved for the VA loan and start searching for a home.

Your COE will not expire, but if your military service status changes, you will have to get a new one to reflect that change.

You or your lender can reapply for your certificate using one of the methods listed above.

If you used your VA entitlement to purchase a home with your spouse and the spouse keeps the home after the divorce, your entitlement will still be associated with that home. If the home is refinanced, paid off, or sold you will have access to your full benefit again.

Under some circumstances, your lender may not be able to gain access to your COE. Those reasons could include, but are not limited to: you did not receive an honorable discharge, more information is needed because you are a surviving spouse, you have a previous VA loan foreclosure, you are a member of the Reserve or National Guard, or your lender is not VA-approved

If you disagree with your eligibility status or are denied a COE, you can appeal the decision on the VA website by providing more supporting evidence. There are three tiers to submit your appeal to: Supplemental Claim, Higher-Level Review, Board Appeal. Choose the one that best applies to your situation and check the status of their decision online.