19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The Hilton Honors American Express Aspire Card military benefit reduces the annual fee to $0 on the card for active duty military and military spouses. This is all thanks to the American Express Military Lending Act policy.

American Express Hilton Honors Aspire Card

Learn how to apply on our partner's secure site

- $550 annual fee *See more details about American Express protections for you and your spouse

- Complimentary Diamond Status at all Hilton brands (suite upgrades, breakfast, check in gifts, etc)

- 175,000 Hilton Honors Bonus Points welcome offer after $6,000 of eligible purchases in the first 6 months offers

- 1 weekend night reward after opening your account and every year on renewal

- $400 Hilton Resort Credit – $200 each semi-annual period

- $200 airline fee credit – Earn up to $50 statement credit each quarter

- $189 Clear Credit

- 14x Hilton Honors Bonus Points at Hilton properties

- No foreign transaction fees

- The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by Military Money Manual and has not been reviewed or provided by the card issuer.

- Full review of Amex Aspire card, terms apply

- All information about American Express Hilton Honors Aspire Card has been collected independently by MilitaryMoneymanual.com

Verify your eligibility for Military Lending Act benefits in the MLA database before you apply. The Amex Hilton Aspire card unlocks free Hilton Diamond status for military servicemembers and military spouses.

American Express currently offers 3 Hilton Honors personal credit cards and 1 business card. Together, you could earn 400,000+ Hilton points if you acquired all 4 cards and met the minimum spend on each. That's more than enough for a 6 night stay at any of the top Hilton properties.

- Hilton Honors American Express Aspire Card

- Hilton Honors American Express Surpass® Card

- Hilton Honors American Express Card

- The Hilton Honors American Express Business Card

Amex reduces the annual fees to $0 on all their personal cards for military servicemembers in accordance with their MLA policy. This includes The Platinum Card® from American Express and the American Express® Gold Card.

In this post:

Upgrade Amex Surpass to Amex Aspire

You can upgrade the lower tier cards (Amex Hilton Surpass and the plain Amex Hilton Honors Card) to the higher tier Amex Hilton Aspire card after 1 year of card membership. The military annual fee reduction is still applied.

This allows you to get up to 3 Amex Aspire cards per person. A married couple could have 6 Aspire cards and earn 6 free nights annually in addition to 6x $250 credits at Hilton properties. That's $1500 per year of credit. And again, you pay no annual fees on any of these cards as a military servicemember or spouse.

If you and your spouse each opened up your own cards, you could earn over 1,000,000 Hilton Honors points in just a few months. Looks like you'll need to take some more leave!

Earning 1 Million Hilton Honors Points

Late in 2020 I earned over 1 million Hilton Honors points thanks to these cards and multiple TDY stays at Hilton properties around the world. Screenshot of me becoming a Hilton Points Millionaire™:

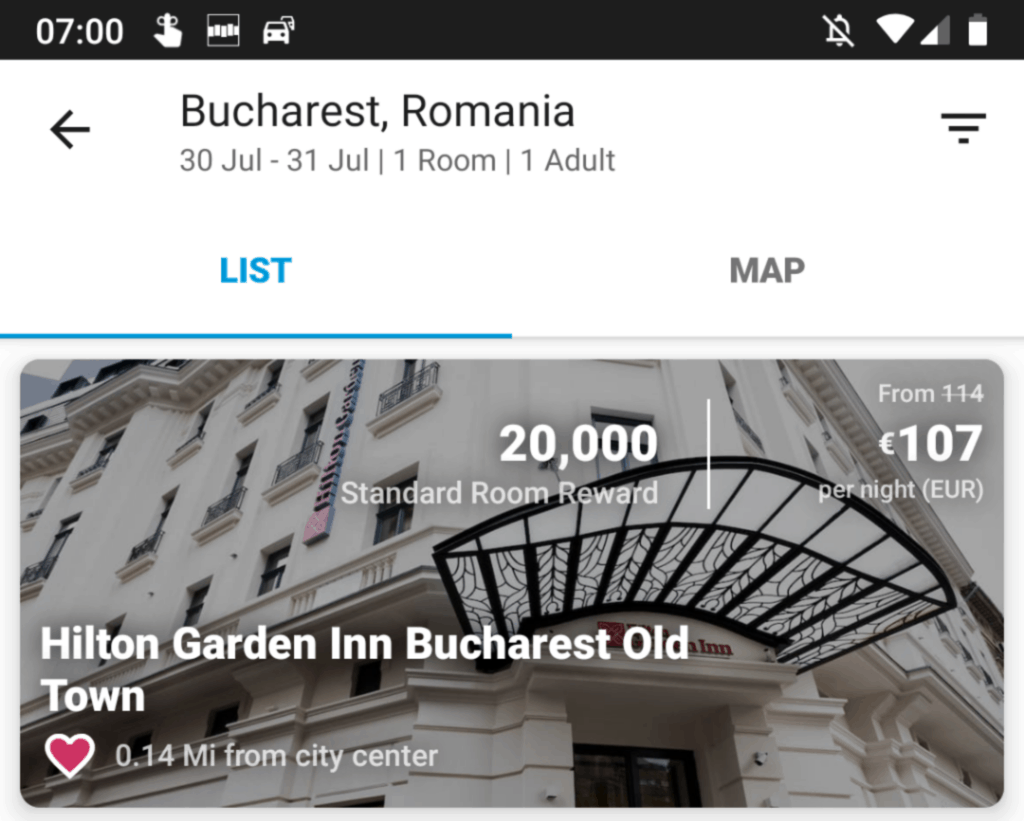

One million Hilton points is enough for 100 nights at some of Hilton's properties, like the Hilton Garden Inn Hanoi or 50 nights at the Hilton Garden Inn Bucharest Old Town in Romania.

Plus, even if you book the cheapest room in the hotel, you will probably get upgraded because of your automatic Diamond status through the Hilton Honors Aspire card.

Some of these welcome bonuses are at all time highs. You should apply for these cards when the bonuses are high because Amex only allows you to get bonuses on their cards once per lifetime.

Amex Hilton Aspire Card for Military

The perks of the Amex Hilton Honors Aspire include:

American Express Hilton Honors Aspire Card

Learn how to apply on our partner's secure site

- $550 annual fee *See more details about American Express protections for you and your spouse

- Complimentary Diamond Status at all Hilton brands (suite upgrades, breakfast, check in gifts, etc)

- 175,000 Hilton Honors Bonus Points welcome offer after $6,000 of eligible purchases in the first 6 months offers

- 1 weekend night reward after opening your account and every year on renewal

- $400 Hilton Resort Credit – $200 each semi-annual period

- $200 airline fee credit – Earn up to $50 statement credit each quarter

- $189 Clear Credit

- 14x Hilton Honors Bonus Points at Hilton properties

- No foreign transaction fees

- The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by Military Money Manual and has not been reviewed or provided by the card issuer.

- Full review of Amex Aspire card, terms apply

- All information about American Express Hilton Honors Aspire Card has been collected independently by MilitaryMoneymanual.com

If you add up the 18 nights stay (worth at least $1500), the 1 weekend reward night ($200), $250 resort credit, and $250 airline fee credit this card can easily give you $2200 of value in the first year PLUS the annual fee of $550 reduced to $0!

The free weekend night award can be cashed in at luxury properties that would normally cost hundreds if not thousands of dollars a night.

That's $2,650 of value from this card alone. Learn how to apply for the Amex Hilton Aspire card here.

Hilton Honors American Express Surpass® Card

The benefits of the Amex Hilton Honors Surpass include an annual fee reduction for active duty military and military spouses.

Hilton Honors American Express Surpass® Card

Learn how to apply on our partner's secure site

- Earn 130,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 8/13/2025.

- Earn a weekend night award when you spend $15,000 on the card in a calendar year

- Earn up to $200 back each year on eligible Hilton purchases when you use your Hilton Honors American Express Surpass® Card.

- 12x Hilton Honors points at Hilton properties

- 6X Points for each dollar of purchases on your Card at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- 4X Points for each dollar on U.S. Online Retail Purchases.

- 3X Points for all other eligible purchases on your Card.

- Complimentary Status: Get Hilton Honors ™ Gold Status with your Hilton Honors American Express Surpass® Card.

- Elevate your status to Hilton Honors™ Diamond Status when you spend $40,000 on eligible purchases on your Card in a calendar year (good through the end of the next calendar year)

- As a Hilton Honors American Express Surpass® Card Member, enroll to receive complimentary National Car Rental® Emerald Club Executive® status through the link on your American Express online account. After you're enrolled, you can reserve a rental car by calling National Car Rental directly, using your travel service, or by booking online or through the National Car Rental mobile app. Terms apply.

- Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- No Foreign Transaction Fees.

- $0 introductory annual fee for the first year, then $150. Terms and Conditions apply

- Upgrade this card to another fee reduced Aspire card and get all the benefits of the Aspire card x2

- Learn how to upgrade to Amex Aspire cards

One tip I have is you can upgrade this card to an Aspire card. You can reap double the benefits, such as resort credit, airline fees, reimbursed, AND get an additional weekend night free annually. You will still pay no annual fees if you are an active duty US servicemember.

Learn how to apply for this card here. (Note this card used to be called the Hilton Honors Ascend card, but Amex changed the name to Hilton Honors Surpass card in July 2019.)

Hilton Honors American Express Card – No Annual Fee

Hilton Honors American Express Card

Learn how to apply on our partner's secure site

- Earn 100,000 Hilton Honors Bonus Points and a $100 Statement Credit after you spend $2,000 on eligible purchases on the Hilton Honors American Express® Card within your first 6 months of Card Membership. Offer Ends 8/13/2025.

- Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio.

- Earn 5X Hilton Honors Bonus Points for each dollar of eligible purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- Earn 3X Hilton Honors Bonus Points for all other eligible purchases on your Card.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- Enjoy complimentary Hilton Honors Silver status with your Card. Elevate your status to Hilton Honors Gold Status through the end of the next calendar year when you spend $20,000 on eligible purchases on your Card in a calendar year.

- Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- No Annual Fee.

- Terms Apply.

This is an EASY way to add to your Hilton Honors points stash.

- You can upgrade the Hilton Honors American Express Card to an Amex Hilton Aspire card. That can get you 3x Aspire benefits per spouse!

- 3 Aspire cards would be $750 in annual Hilton resort credit + 3 free weekend nights annually.

- That's a free weekend away every year, just for holding on to these cards!

- And you will pay no annual fees if you are active duty US military!

The Hilton Honors American Express Business Card

This card's best benefit is a welcome bonus offer you can earn after meeting the minimum spending.

Amex stopped waiving business card annual fees for military servicemembers in January 2020, but this card only has a $95 annual fee.

The annual fee is low enough that it might be worth paying for a year or two just to get the welcome bonus.

Learn how to apply for the The Hilton Honors American Express Business Card

- Limited Time Offer: Earn 150,000 Hilton Honors Bonus Points after you spend $8,000 in purchases on the Hilton Honors American Express Business Card in your first 6 months of Card Membership. Plus earn an additional 25,000 Hilton Honors Bonus points after you spend an additional $2,000 in purchases on your Card within your first 6 months of Card Membership. Offer Ends 8/13/2025.

- Earn 12X Hilton Honors Bonus Points on eligible purchases made directly with hotels and resorts within the Hilton portfolio.

- Earn 5X Hilton Honors Bonus Points on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3X points thereafter.

- Get up to $60 in statement credits each quarter for purchases made directly with a property in the Hilton portfolio on your Hilton Honors American Express Business Card.

- Enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card.

- If the total eligible purchases on your Card Account during a calendar year reach $40,000 or more, you may receive an UPGRADE to Hilton Honors Diamond status through the end of the next calendar year.

- Enroll to receive complimentary National Car Rental® Emerald Club Executive® status through the link on your American Express online account. After you're enrolled, you can reserve a rental car by calling National Car Rental directly, using your travel service, or by booking online or through the National Car Rental mobile app. Terms apply.

- Terms apply.

One tip is that you can apply for this card even if your business doesn't make much money. Even if you only sell a few items on eBay or Craigslist, you should qualify for a business credit card. Driving for Uber or any of the other “gig” economy jobs qualify as businesses as well.

Use your Social Security number instead of a employer tax identification number and select “sole proprietor” from the list of corporation types.

Hilton Honors Diamond Status Perks

The tangible perks of Hilton Honors Diamond Status include:

- Executive lounge access (free food and drink)

- Late check-out

- Room upgrades up to 1-bedroom suite

- Complimentary breakfast at ALL Hilton Hotels

When I check in at any Hilton around the world, I have always been upgraded as a Diamond member. When we stayed at the Hilton Edinburgh Carlton, we were upgraded to a deluxe king room but more importantly we had access to the executive lounge.

Free happy hour, free espresso machine, free breakfast, and a nice place to relax and get some work done while on the road. Make sure you leave a nice tip for the wait staff, since you're eating and drinking for free!

Another excellent perk of Hilton Diamond status is the free breakfast. One of the best hotel breakfasts I ever had was at the Hilton Garden Inn Bucharest Old Town. My god it was good!

Sorry for the gratuitous photos of a hotel buffet breakfast, but just look at that bacon!

Hilton Honors Military Program

While we're discussing Hilton military benefits, I recommend checking out the Hilton Honors Military Program.

This program offers 100,000 Hilton Honors points to separating or retiring military servicemembers. The points are intended to be used for job search, relocation, or setting up your post-military life. Check out the email below one of my reader's received when they applied for the program.

You can learn more about the free 100,000 Hilton points for separating military.

Hilton Aspire Card FAQ

Yes, the Amex Hilton Honors Aspire Card is 100% worth it. Especially if you are in the military, you can get the annual fee reduced on this card with Amex's Military Lending Act policy. The card comes with complimentary Diamond Status, Hilton's highest tier of status.

No, the Amex Aspire card does not have foreign transaction fees. This makes it a great card for overseas military, whether TDY/TAD or PCS.

Yes, you can upgrade the lower tier Amex cards like Hilton Honors card and Hilton Honors Surpass card to additional Amex Hilton Honors Aspire cards.

You must stay at a Hilton Resort property listed on hilton.com/resorts. Even if the property has resort in the name, it may not be an official Hilton Resort and eligible for the $250 credit from the Hilton Aspire card.

Yes, I have 3 Amex Hilton Honors Aspire cards and my wife has 2 Aspire cards. You can upgrade the lower tier Amex Hilton cards to the American Express Hilton Honors Aspire card and receive multiple free nights per year.

What are your favorite perks of the Hilton Honors Aspire card? What was the best upgrade you received as a Hilton Diamond member?

Good afternoon!

Huge fan of the show and content. I am currently a LTJG who is on his 13th Credit card.

I am currently in the middle of a PCS and trying to get another credit card. Aiming to get the Amex Hilton Aspire but I have a tiny problem. It seems that I am in Pop Up Jail and won’t get the spending bonus from the card.

So my question is should I wait and hope I get free from Pop up jail or would it be worth it to get the card without the Spending Bonus purely for the perks.

Thank you!

PS – You guys should look into the BILT card and give your thoughts on it. It’s not a military exclusive card or anything but it’s perk is that you can earn points by paying for Rent and I know you guys are a proponent of Renting vs buying while on active Duty.

I upgraded my Hilton NO fee card to Aspire Oct 2024, will I get the Annual Free Night Certificate 8-14 weeks after that or will I get it after the card renewal next year? Agent says I will not get it this year and have to wait for card renewal but a lot of folks in forums said they received their FNC after upgrading. I’m so confused, thinking I should just get another Aspire.

i was thinking to try and get them in pairs at the same time each year, so eventually we would have 6 annual nights show up available for basically the same time frame each year, but that will take quite awhile. if you have them all staggered, have you had an issue with that? i guess there would likely be a small window when they all might overlap, or do you just plan to use them here and there for smaller stays? thanks!

Sure, you could try to do that. But it seems like a lot of work. I get them staggered throughout the year and it’s fine. We usually combine the free night certificates with points or we book multiple rooms and shorter stays to travel with family or friends.

I am a little late to the multiple Aspire game. I’m thinking about applying for the Surpass and upgrading in a year, but I will be leaving Active duty in June (before the 1 year mark for upgrading to Aspire). Is there any data point that reflects retaining the annual fee waiver if I upgrade after leaving the military? Or is there any risk to upgrading early?

Since it’s an upgraded account, it will be under MLA even when you upgrade. But, Amex will probably start charging you annual fees within a year or 2 of separating. Here’s my advice for credit cards when you leave active duty. You probably won’t be able to upgrade earlier than a year. That’s usually the length of time to go from a lower annual fee card to a higher annual fee card, thanks to the 2008 CARD ACT.

Does anyone have any tips on the best way to utilize the new semi annual $200 dollar Hilton resort credit. I use to just charge $250 to my room during my free night stay to maximize the benefit. However, now that the structure has changed I’m curious if buying Hilton gift cards online or in person has worked for anyone to trigger the credit?

Is it possible to get 5 Aspire cards / have you heard of anyone getting 5? I already had the Aspire, Surpass, Honors and the business card then i figured why not try and just apply for another Aspire and I was approved. I plan on upgrading the Surpass & Honors after hitting 1 year and dropping the business Hilton after 1 year to see if it’s possible to get 5 Aspire’s for myself and my spouse. I was also approved for a second Vanilla platinum by applying directly for it.

Yes it’s possible. A lot of people add some diversity to their portfolio by adding an Amex Marriott Bonvoy Brilliant, but 5 Aspires can be nice. Enjoy your five free annual nights :)

Anyone recently apply and get the new welcome offer? I’ve been in pop-up jail for more than a few months, and I was wondering with the new welcome offer restrictions if they’re just not offering it to military folks anymore.

Do you think they will ever include reservists for this discount?

Amex does include reservists as they are required to under Military Lending Act and SCRA, but you need to be on 30 day or longer active orders.

I am a reservist and have 2 annual fee cards from AMEX I add a new one each time I go on active duty orders. So deployments, ADOS tours, and classes that are over 30 day orders. My oldest card is 4 years old and I was not on active duty pretty much since I got it. I have never been charged an annual fee by AMEX. I’m not sure how they would handle SCRA benefits to waive the fee if you open a card while not on active duty. They might turn the fee on sooner in that case. Since I open my cards while on active duty the fees are waived under MLA and so far my experience is that they take their time turning the fee back on.

I want both cards at the same time. Will I receive both welcome offers if I apply for both cards simultaneously? Will AMEX allow me to apply for both cards at the same time?

Most of our expenses are paid using our credit cards. The Surpass card has the best opportunity to receive several free night rewards in a calendar year compared to the Aspire card if we spend at least $15K/yr – which we do.

Lastly, will AMEX recognize if my spouse applies for the Surpass card and I apply for Aspire at the same time? For some context, my spouse is not a service member. I think having the $95 annual fee for the Surpass card under my spouse’s name is considerably manageable compared to the steep Aspire yearly fee. I don’t want my spouse to apply for a Surpass card if we do not qualify for the current welcome letter. I guess it doesn’t hurt to try. However, would you know of a better way to get both welcome offers? I am open to any potential available options. Thank you!

Yes, you can receive the welcome bonus for all 3 Amex Hilton Honors cards if you are approved.

Usually Amex application rules are limited to 1 credit card every 5 days and 2 cards every 90 days. You’ll need to play by those rules to open all 3 Amex Hilton cards.

Military spouses are eligible for annual fee waived cards if they are listed in the MLA database. Check the database before applying to confirm that they will get their fees waived.

A good strategy would be check the MLA database for your spouse, then the servicemember (you) applies for the Amex Aspire. Earn the welcome bonus. Then refer your spouse for an Amex Aspire. Then your spouse can send you a referral link from their Amex Aspire card to apply for an Amex Surpass card. Then you can send them a link from your Aspire or Surpass card and they can apply for an Amex Surpass card.

So now you’ve earned 3 referral bonuses and 4 welcome bonuses. After one year, upgrade the Surpass card to an Aspire card and you’ll get free night certificates without any spending. Add the Amex Hilton cards and upgrade them to Aspire cards to earn more Hilton welcome bonuses and add another Free Night Certificate to your lineup.

How do these cards work do you have to apply for the lowest tier card and work up to get all the rewards of each card or can you apply for the highest and get everything in that one

I recommend starting with the highest tier card and working down. That way you’ll get the top tier benefits, the welcome bonuses, and after a year with the lower tier cards you can upgrade to the highest tier card.

Hi Spencer, love the website.

I think I heard you mention on a podcast that you get the benefits of the Hilton Aspire when staying at a Hilton when TDY. How do you do this if you book your room with the GTC? I’m AD Air Force with an upcoming TDY to San Diego, so looking at how to maximize the benefit. Thanks.

Add your Hilton Honors number to your booking either over the phone or when you check in. If you have an Aspire card you’ll be Diamond Status and will get the benefits that might include executive lounge access, free breakfast, free drinks, etc. If it’s a Hilton resort you can split the bill when you check out and put your room on one bill for the GTC and your restaurant charges on another bill to pay with your Aspire card.

Is it possible to get a second Hilton Aspire without upgrading? Just apply for if it is through a separate online account. (I’m not able to get the Sign up Bonus on the Surpass/Hilton Honors anyway)

Yes it should be possible. Why are you not eligible for the welcome bonus on the Surpass or Honors card? If you are getting the dreaded “Amex pop-up” that say’s you are not eligible, so people are reporting that they are still earning the bonuses after applying and getting the pop-up.

Yes, it is the pop-up. Maybe I will try that. But if I can get the Aspire without the upgrade one year’s benefits (weekend night+$250 flight credit +$250 resort credit) may be a wash in terms of the value of the points vs. value of one year’s benefits.