19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

If you want to upgrade American Express cards to higher tier cards online, you can create separate AmericanExpress.com logins to make it easier and faster.

Creating additional Amex logins allows you to easily upgrade lower tier cards to higher tier cards. For instance you can upgrade the American Express® Gold Card to The Platinum Card® from American Express. Or compare the Amex Gold vs the Amex Platinum.

American Express® Gold Card

Learn how to apply on our partner's secure site

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount – all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year- includes OCONUS Commissaries

- 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- No foreign transaction fees – great for the 4x on restaurants when traveling for fun, OCONUS TDY, or PCS!

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That's up to $120 Uber Cash annually! Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: You can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment required.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. Enrollment required.

- Go explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- Read my full review of the Amex Gold card for military, terms apply

- Enrollment is required for select benefits

- $325 Annual Fee* See more details about American Express protections for you and your spouse

If you are in the military or married to a military servicemember, you get special military protections on all personal, not business, Amex cards.

This allows you to accumulate multiple cards that have recurring annual benefits, like free hotel nights or restaurant credits, without paying annual fees on any of the cards.

Amex Cards You Can Upgrade

You can usually upgrade any lower tier card in the same “family” to a higher tier card. Sometimes there is a welcome bonus offer for the upgrade. If you already have the higher tier card, you may not be eligible for this offer. Check the offer for “lifetime language.”

I recommend you always open the highest tier card first to earn the welcome bonus, then open the lower tier cards and earn the welcome bonuses on them. After 1 year, you can upgrade the lower tier cards to the higher tier card.

| Upgradeable Amex Cards | Low Tier –> | Middle Tier –> | Higher Tier |

| Amex Hilton Honors | Hilton Honors American Express Card | Hilton Honors American Express Surpass® Card | Hilton Honors American Express Aspire Card |

| Amex Metal Cards | American Express® Green Card | American Express® Gold Card | The Platinum Card® from American Express |

| Delta | Delta SkyMiles® Gold American Express Card | Delta SkyMiles® Platinum American Express Card | Delta SkyMiles® Reserve American Express Card |

How to Easily Upgrade Amex Cards

To easily upgrade Amex cards, you just need a separate Amex login username, for instance if “john1” is your primary, make a new account with the username “john2.” You can use the same email and password for both accounts, Amex does not care.

- Go to your john1 account, find the card you want to remove (AMEX Hilton Surpass)

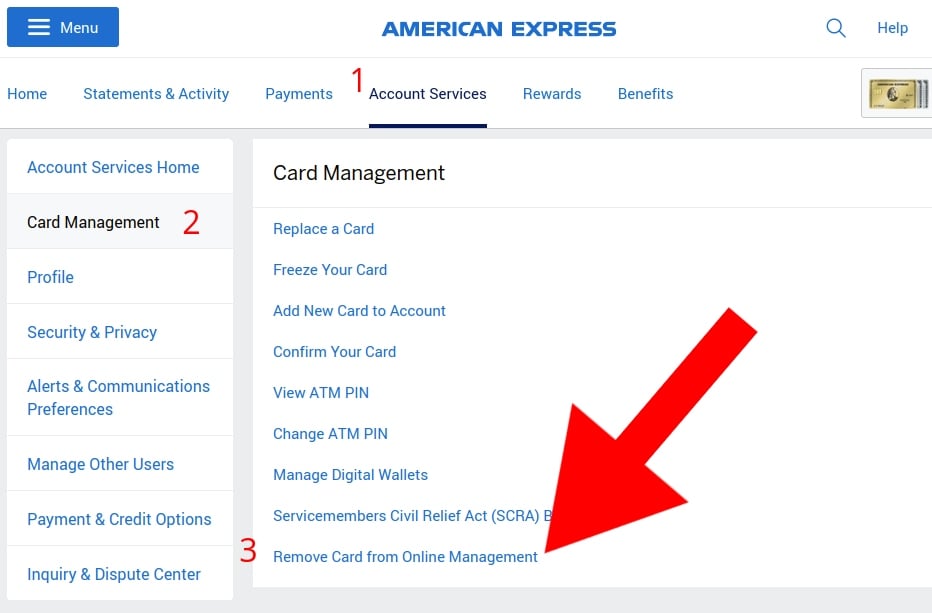

- Go to Account Services, then Card Management

- Remove Card from online management. Select the card you wish to remove.

- Log out of john1

- Login or create a new account, for instance “john2” on AmericanExpress.com,

- Then just add the card you just removed to john2. You should be able to upgrade within a few hours or instantly.

Look for the upgrade option under the “card” link at the top of AmericanExpress.com. The Amex “Request an Upgrade” button should look like this:

You can then add the new upgraded Amex card back to your main john1 account. Remove it from john2 just like you did for john1.

You need to hold Amex cards for about 1 year before they are eligible for upgrade. This is due to the CARD ACT, a law that does not allow banks to charge you a higher annual fee than what you signed up for in the first year of card membership.

Sometimes Amex offers upgrade offers like “upgrade your Surpass to Aspire and spend $5000 to earn 150k points.” You should be eligible for this upgrade offer even if you already got a welcome bonus on the Aspire.

I use the same email for all accounts with no issues.

The Platinum Card® from American Express

Learn how to apply on our partner's secure site

- $695 annual fee. Reduced to $0 with American Express special military protections

- You may be eligible for as high as 175,000 Membership Rewards® Points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount – all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel® up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel®.

- $200 Annual Hotel Credit: Get $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using your Platinum Card®. Note that The Hotel Collection requires a minimum two-night stay

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month when you pay for eligible purchases with the Platinum Card® at your choice of one or more of the following providers: Disney+, a Disney+ Bundle, ESPN+, Hulu, Peacock, The New York Times, and The Wall Street Journal. Enrollment required.

- $200 Uber Cash: Platinum Card® Members can get $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. Enrollment required.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Platinum Card® Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- $199 CLEAR® Plus Credit: CLEAR® Plus helps get you to your gate faster by using unique facial attributes to verify you are you at 50+ airports nationwide. Receive up to $199 in statement credits per calendar year after you pay for your CLEAR Plus Membership (subject to auto-renewal) with the Platinum Card®.

- This is a MAJOR time saver–$120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA PreCheck® official enrollment provider) application fee, when charged to your Platinum Card®! Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Lounge life! Enjoy the benefits of the Global Lounge Collection, with over $500 of annual value if you visit Centurion Lounges and each of our partner lounges including Delta Sky Club® lounges when flying an eligible Delta flight (subject to visit limitations), select Lufthansa lounges when flying Lufthansa, Plaza Premium lounges and Escape Lounges, and enroll in Priority Pass Select. See terms.

- A Walmart+ membership can get you free shipping with no order minimum on eligible items shipped by Walmart. Use your Platinum Card® to pay for a monthly Walmart+ membership (subject to auto-renewal) and receive one statement credit for up to $12.95 (plus applicable taxes. Plus Ups not eligible) each month. Free Shipping excludes most Marketplace items, freight & certain location surcharges. Paramount+ Essential plan only, separate registration required.

- Up to $100 annual Saks Fifth Avenue credit, enrollment required

- Global Dining Access by Resy gets you access premium dining experiences. Receive Priority Notify and unlock insider access to some of the world's most sought-after restaurants with Global Dining Access by Resy. Download the Resy iOS app or log into Resy.com and add your Platinum Card® to your Resy profile to take advantage of your special benefits and discover restaurants near you.

- No foreign transaction fees

- Enrollment is required for select benefits

- The Platinum Card® from American Express – learn how to apply

- Read my full review of the Amex Platinum card for military, terms apply

Amex Card Upgrades FAQ

Yes, you can upgrade from one Amex card to another. However, it has to be in the same “family” of cards. A Hilton Surpass can upgrade to a Hilton Aspire, a Delta Platinum to a Delta Reserve, and an Amex Gold to an Amex Platinum.

If you are in the military, you should definitely upgrade an Amex Gold to another Amex Platinum. Then just apply for another Amex Gold card. You will not be eligible for the welcome bonus

Yup! You can upgrade from the Amex Green card to the Amex Gold card. However I recommend upgrading from the Amex Green to the Amex Platinum. If you are in the military, you can then open another Amex Green so you still have all the benefits of Amex Green card membership.

Yes, you can upgrade from the Amex Gold to the Amex Platinum. The Amex Gold is a great card though, so make sure you open another one if you upgrade to another Amex Platinum card.

Yes, American Express cards can be upgraded to the higher tier version. So for instance an Amex Green card be upgraded to The Platinum Card from American Express.

Hi Spencer,

Would you be able to combine all the Amex points from that different logins? Thank you.

Yes they automatically combine across logins. I think it’s based on your Social Security Number and your Membership Rewards account number, which is the same across all your Amex cards, regardless of login details.

Hi Spencer – absolutely love the website!

1. I might have missed it, but what’s the actual point of creating 2 accounts? Is it to get the upgrade link online? Be eligible for an upgrade bonus? Or some other reason? The reason I ask is because I was able to upgrade my gold to my 2nd platinum by just calling and that seemed to work fine.

2. How many times are you eligible to upgrade the gold card to a platinum?

Thanks!

1. Yes, to get an upgrade link online and be eligible for an upgrade bonus. Calling is fine but some people don’t want to call or bring human attention to their accounts.

2. You can open up multiple Amex Gold cards and get an upgrade offer on each card to upgrade to an Amex Platinum. However, the upgrade offers are targeted per person so you might need to wait to be targeted for a few months in between upgrade offers.

I am interested in pursuing the multiple AmEx plat option.

1. I currently have a AmEx gold. To clarify, I would apply for the platinum vanilla, and eventually the green (get the bonus for both of these). Then all 3 cards would be a part of my (original AmEx account). After it has been 1 year since my gold…I would then proceed to do the account swap with gold to see if the the upgrade option is available, upgrade the card, remove (new platinum) from the second account and add it back to the original account that has the vanilla platinum?

2. Repeat this same process with (Green+ Delta + Hilton+ Marriott tier cards) when it has been a year since opening?

3. Would you do this same process of swapping accounts with the Charles Schwab or Morgan Stanley platinum? I’m assuming not because they are not lower tier upgradeable cards…so they could be just applied for and added to the original account as well as allow you to get the bonus?

Thank you for all the insight.

1. Yes, that’s the correct strategy.

2. Yes.

3. No, there’s no point in creating multiple accounts for the Schwab Amex Platinum or Morgan Stanley for the reasons you stated.

I am retired military, five years, active 20+ years reserves. Does a retired officer have the same benefits for all of these accounts if not, do you have suggestions for a retired military?

No, sorry, the way the SCRA and MLA laws are written only active duty, Guard and Reserve on 30 day active duty orders, and military dependents (spouses) are eligible as covered borrowers.

Do you have separate hilton honors membership for each aspire cards?

No, that’s not allowed. Have one Hilton account to consolidate all your status, points and free night certificates.

Hello Spencer,

After removing my surpass from account 1 and add to account 2 for upgrade to Aspire, can I move the newly upgraded Aspire to account 1? Will there be any issues if I do that on my main account 1 with 2 Aspire cards?

Thanks!

Yes, you can move the newly upgraded Aspire back to account 1 with no issues. My main Amex account has 2 Aspires, 2 Marriott Bonvoy Brilliants, and 7 Platinum cards. No issues.

Thank you Spencer. Awesome work that you doing for all of us service members. Btw, do you have any tips or tricks to have AmEx target you for an upgrade bonus? I want to upgrade to Aspire but hoping to get an upgrade bonus.

What’s the benefit of having 2x Aspires cards. I assume the benefits don’t double (you aren’t getting 500 in airline credit)

The benefits double. So with two Aspire cards: 2x free annual nights, 2x $250 resort credit, 2x $250 airline credit, etc.

With two Amex Platinum cards you’ll get 2x hotel credits, 2x airline few credits, etc.

Do you get 50 Elite night credits having 2 Bonvoy Brilliants?

No unfortunately that benefit does not stack over cards of the same type. Elite night credits do stack if you get a business and a personal Marriott credit card.

Hi Spencer, years ago we upgraded our amex card to PLAT and never got he welcome bonus as it was an upgrade. Since the recent amex offer is so high. Is it possible to move the PLAT card to account 2, and then in account 1 completely reapply new for the AMex plat to get the welcome bonus? will that work or is this workaround only available for upgrades?

Only works for upgrades. You can usually only get an Amex card bonus once per lifetime. Technically it’s once every 7 years but that’s 7 years since closing the last card.

Hi Spencer-great site, great course!

My wife and I both have the Platinum card and I’m about to open the Gold for myself. I understand it’s necessary to create a new user name in order to upgrade to Platinum after one year.

In regards to the signup bonus and accumulation of all other MR points, can I pool them from all of my cards onto one of my user names (most likely my original Platinum)? Maybe you’ve written about this already.

Also-unlike Chase, Amex does not allow you to combine MR points with anyone else like a spouse, correct?

Thanks!

Points automatically pool across accounts, even on different logins. Amex must match them by the account owner’s Social Security Number (SSN).

So for instance, if you have an account with username Kevin1 with an Amex Platinum and an account Kevin2 with an Amex Gold, the points combine across both accounts. Your Amex MR points will add up across both accounts.

Thank you so much for the reply. I was thinking about the upgrade offers from low tier to higher tier Hilton cards. I understood that you recommended to make multiple Login accounts to get the upgrade offers. Realistically, I am not sure if Amex would offer any upgrade bonus to the MLA beneficiaries. I wonder if you have received any upgrade offers.

Yes, I received an upgrade offer once on a lower tier Hilton card to upgrade to an Aspire card for 150,000 points when you spend $4000 in 3 months. This was a few years ago and was just a lucky break I think. I would rather have the $250 resort credit + annual free night rather than wait around for the chance to maybe, possibly, get a 150k point upgrade offer.

Spencer, I have a couple of questions. I have Marriott Bonvoy Brilliant, Hilton Honors Aspire, and Hilton Honors (no AF).

1. Would you recommend another Marriott Brilliant or Hilton Surpass? If I get a Surpass, I will plan to upgrade to another Hilton Aspire on year 2. I think Hilton Aspire is probably a better card than Marriott Brilliant but I am already in a diamond status with the existing Aspire card. I don’t know how much benefit I am getting more by having additional Aspire vs Marriott Brilliant. I feel Brilliant is little bit easier to use the $300 credit and annual free night stay. Of course, I won’t get another sign up bonus with 2nd Brilliant.

2. Would you upgrade the Hilton Honors card to Aspire on year 2 or upgrade to Surpass on year 2 and then to Aspire on year 3. Obviosuly, I will end up with more bonus points by upgrading twice. However, I will start using the Aspire benefits 1 year early by upgrading Hilton Honors to Hilton Aspire card on year 2.

Thanks in advance

1. I would get the Surpass for the welcome bonus and then close it after a year to open another Bonvoy Brilliant. Then you’d have 2 Hilton Aspires, 2 Marriott Brilliants, and 1 other Amex credit card to complete your 5.

2. You are usually not eligible for the welcome offer when you upgrade. So no reason to upgrade to Surpass and then Aspire. Just go straight to Aspire. And again, no welcome bonus is usually offered, unless you see one on AmericanExpress.com