Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the Ink Business Premier® Credit Card, Ink Business Preferred® Credit Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

Starting a business when you or your loved ones are in the military is no easy feat. Whether you are a military spouse trying to make it work overseas in Japan, Germany, or Italy, or an active duty servicemember who has that entrepreneurial itch, I get it.

As a military entrepreneur myself, I started my online business while I was on active duty in 2012. It started as the site you are reading now. It eventually grew to encompass a course, book, podcast, website, a mentor program, and much more.

I ran my business as a sole proprietor, filing Schedule C income returns with my 1040 personal tax return for 8 years.

Later, I formed a Limited Liability Corporation (LLC), shutdown that LLC when I moved, and formed a new LLC, and eventually I elected the LLC to be taxed as an S Corp to save a bit on taxes.

There were a lot of mistakes along the way and it wasn't very clear what I needed to do at different points on the business journey.

I'm writing this page as lessons learned and an after action report for my fellow military entrepreneurs, whether you are a military spouse, active duty, Guard, Reserve, officer, or enlisted. I don't have all the answers, but I can at least share what worked for me and what hasn't.

If you want to talk to me about your business idea, I'm happy to do business coaching and advise through my Military Money Mentor program here.

How to Start a Business in the Military

The thrill of earning that first $1 from your business is electrifying! I always recommend you start earning money first before you incur lots of expenses setting up your business.

Some of my favorite business books are:

- The Four Hour Workweek by Tim Ferriss

- Anything You Want by Derek Sivers

- How to Get Rich by Felix Dennis

The Military Business Stack

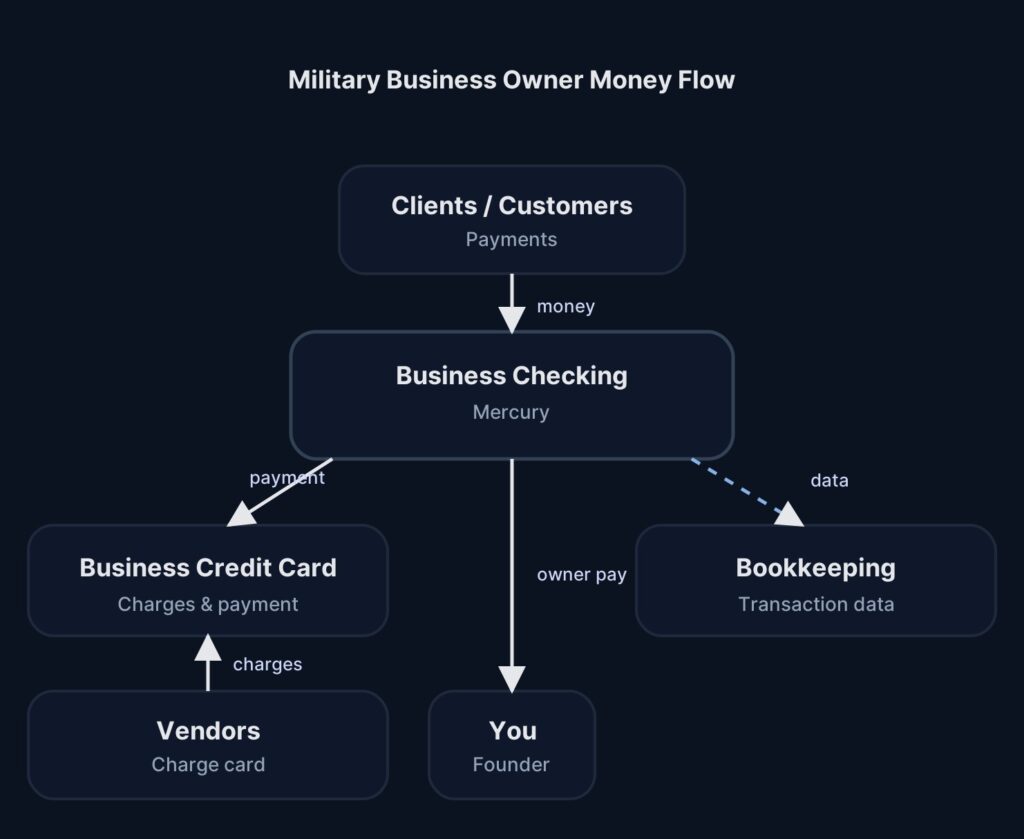

There are a couple tools I recommend to help run your business without a lot of cost or complexity.

Business Banking – I use and recommend Mercury. This is the heart of your business money management. You can have multiple checking and savings account for your business. Mercury is free.

Accounting and Bookkeeping – I use and recommend Wave Apps. QuickBooks Online (QBO), FreshBooks, and Xero are all fine as well, I just didn't like their interface as much as Wave Apps. Wave Apps has a free version but I recommend the paid version at about $200 per year.

Payroll Software– I use and recommend Gusto. Payroll software isn't necessary until you are paying yourself or employees in your business. This didn't happen for me for 8 years after I started my business, so if you're just getting started, you won't have to worry about this. Cost depends a lot on features and number of employees, but was usually about $50 per month for me with a single employee and some contractors.

Solo 401k Provider: I used Schwab for a while and they are fine, but now I recommend Gusto 401k

My Advice for Military Entrepenuers

- Start as a sole proprietor. This is the simplest business structure. You don't need to do anything to be a sole proprietor. You just need to conduct business activities and not register any other kind of business.

- Grab all the social media handles you can and the .com domain. I recommend

- Setup a separate business checking account. This is an account just for your business. Keep your personal and business expenses separate. It's okay if there is a accidental personal transaction in your business or if you accidently use a personal card for a business expense. That's what accounting and bookkeeping is for. I recommend if you are a sole proprietor you just use a personal checking account at USAA or Navy Federal.

- Get a business credit card. I recommend any of the Chase Ink cards.

- Once you make your first $100, form an LLC with Northwest Registered Agent

There are many types of business structures, but the simplest one is just a sole proprietorship. You just use your own Social Security number for reporting the income from your business.

I recommend you form an LLC

| Business structure | Ownership | Liability | Taxes |

|---|---|---|---|

| Sole proprietorship | One person | Unlimited personal liability | Self-employment tax Personal tax |

| Partnerships | Two or more people | Unlimited personal liability unless structured as a limited partnership | Self-employment tax (except for limited partners) Personal tax |

| Limited liability company (LLC) | One or more people | Owners are not personally liable | Self-employment tax Personal tax or corporate tax |

| Corporation – C corp | One or more people | Owners are not personally liable | Corporate tax |

| Corporation – S corp | 100 people or fewercertain trusts and estatesno partnerships, corporations, or non-resident aliens | Owners are not personally liable | Personal tax |

| Corporation – benefit corporation | One or more people | Owners are not personally liable | Corporate tax |

| Corporation – Nonprofit | One or more people | Owners are not personally liable | Tax-exempt, but corporate profits can't be distributed |

When you make $10,000 per year

Okay it's time to get serious about your business. I recommend at the $10,000 per year level to form an LLC. This sounds intimidating, but thankfully there are companies out there that can do it easily for you.

I use and recommend Northwest Registered Agent. They can form an LLC for you in whatever state makes the most sense. If you are a military spouse, you have special rights under the SCRA and Military Spouse Residency Relief Act. It might make sense for you to form the LLC in the state

When you start making $100,000 per year in revenue

Now it's time to add a bit of complexity to your business to save on taxes.

When you start making about $100,000 per year in profit, there are big tax savings opportunities available to you. You could setup an LLC, taxed as an S Corp, and not pay Medicare and Social Security taxes on some of your business income.

There are also Sec 199, also known as Qualified Business Income (QBI) deductions available. These can substantially reduce your taxes.

You can also pay yourself a reasonable salary as an employee and contribute to a Solo 401k either as a employee or employer. This opens up $72,000 of tax advantaged retirement savings opportunities as a small business owner.

- Talk to a Certified Public Account (CPA) who specializes in business accounting. It might be worthwhile to elect for your LLC to be taxed as an “S Corp.”

- If you do setup your LLC with S Corp election, use a Payroll software like Gusto to pay yourself a reasonable salary. Your company can contribute up to 25% of your W-2 salary to your Solo 401k. You can make employee contributions as well, up to $24,500 in 2026. This can substantially reduce your taxes.

- You'll probably need to make estimated payments on your income. It's important to have a good CPA at this income level to help you estimate your payments so you don't have any fines or interest charged by the IRS.

The Military Small Business Stack

Vetted recommendations for veteran-owned and spouse-led businesses.

🏦 Business Banking: Mercury

Mercury is built specifically for startups and small businesses. It offers intuitive dashboards, no monthly fees, and seamless integrations.

Get Started with Mercury →💳 Business Credit: Chase

Chase Ink Business cards are essential for separating personal and business expenses while earning high-value travel rewards.

*Note: Standard business card fees apply.

Explore Chase Business Cards →📊 Accounting: WaveApps

Wave is the perfect solution for service-based businesses. It handles invoicing, expense tracking, and scanning receipts for free.

Simplify Your Books →When you start making $250,000+ per year in revenue

Let's talk. I offer bespoke consultations for military business owners making over $250,000 in revenue. I'd love to help you reach the next level of your business.