19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

Title 32 and Title 10 National Guard can receive American Express Military Lending Act and Servicemember Civil Relief Act benefits including annual fee reductions on their credit cards, such as The Platinum Card® from American Express.

The Platinum Card® from American Express

Learn how to apply on our partner's secure site

- $695 annual fee. Reduced to $0 with American Express special military protections

- You may be eligible for as high as 175,000 Membership Rewards® Points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you're approved and find out your exact welcome offer amount – all with no credit score impact. If you're approved and choose to accept the Card, your score may be impacted.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel® up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel®.

- $200 Annual Hotel Credit: Get $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using your Platinum Card®. Note that The Hotel Collection requires a minimum two-night stay

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month when you pay for eligible purchases with the Platinum Card® at your choice of one or more of the following providers: Disney+, a Disney+ Bundle, ESPN+, Hulu, Peacock, The New York Times, and The Wall Street Journal. Enrollment required.

- $200 Uber Cash: Platinum Card® Members can get $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. Enrollment required.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Platinum Card® Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- $199 CLEAR® Plus Credit: CLEAR® Plus helps get you to your gate faster by using unique facial attributes to verify you are you at 50+ airports nationwide. Receive up to $199 in statement credits per calendar year after you pay for your CLEAR Plus Membership (subject to auto-renewal) with the Platinum Card®.

- This is a MAJOR time saver–$120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA PreCheck® official enrollment provider) application fee, when charged to your Platinum Card®! Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Lounge life! Enjoy the benefits of the Global Lounge Collection, with over $500 of annual value if you visit Centurion Lounges and each of our partner lounges including Delta Sky Club® lounges when flying an eligible Delta flight (subject to visit limitations), select Lufthansa lounges when flying Lufthansa, Plaza Premium lounges and Escape Lounges, and enroll in Priority Pass Select. See terms.

- A Walmart+ membership can get you free shipping with no order minimum on eligible items shipped by Walmart. Use your Platinum Card® to pay for a monthly Walmart+ membership (subject to auto-renewal) and receive one statement credit for up to $12.95 (plus applicable taxes. Plus Ups not eligible) each month. Free Shipping excludes most Marketplace items, freight & certain location surcharges. Paramount+ Essential plan only, separate registration required.

- Up to $100 annual Saks Fifth Avenue credit, enrollment required

- Global Dining Access by Resy gets you access premium dining experiences. Receive Priority Notify and unlock insider access to some of the world's most sought-after restaurants with Global Dining Access by Resy. Download the Resy iOS app or log into Resy.com and add your Platinum Card® to your Resy profile to take advantage of your special benefits and discover restaurants near you.

- No foreign transaction fees

- Enrollment is required for select benefits

- The Platinum Card® from American Express – learn how to apply

- Read my full review of the Amex Platinum card for military, terms apply

Here is an email I received March 29, 2020:

Spencer,

Email from UMC3 student

Thanks for putting this web site together, lots of good info. I am a traditional Guardsman at this stage of my career. I have just been activated for 4 months to lead the COVID-19 response in (state redacted). I will be Title 32 AD. If I get one of these cards while on AD for the 4 months, will I be able to renew it on my anniversary or do they check each year to verify status?

First to answer your question, when Title 32 or Title 10 National Guard orders end, I believe that Amex checks your active duty status monthly or quarterly in the MLA database.

Once Amex check the MLA database and see you are no longer active duty, they will warn you before they charge the annual fee. You have 30 days to close the account after the annual fee is charged and still get a full refund of the fee.

After 30 days, the annual fee is pro-rated by month, so if you wait 6 months, Amex will refund half of the annual fee.

In this post:

Amex Platinum National Guard

Amex reduces the annual fees to $0 on all personal cards for active duty US military and military spouses, as it has since at least 2012.

Every Guard/Reservists who has contacted me and applied for SCRA or MLA with Title 10 or Title 32 orders has had the fees reduced to $0 thus far. MLA or SCRA benefits were applied, no problems.

US National Guard and Air Guard servicemembers serving their countries under Title 10 and Title 32 orders greater than 30 days are eligible for American Express SCRA credit card annual fee reductions.

Eligible statuses for the American Express Servicemember Civil Relief Act (SCRA) or Military Lending Act (MLA) benefits are:

- Active duty US military

- Reservists on Title 10 active duty orders

- National Guard on Title 10 mobilization orders

- National Guard on Title 10 CO-ADOS orders

- National Guard on Title 32 orders

My top recommend card for all US military personnel eligible for SCRA protection, including National Guard and Air Guard is the American Express Platinum.

The second most popular card on my site is the Chase Sapphire Reserve® Card. Chase also waives annual fees for Guard and Reserve on 30 day or greater active orders under MLA. Check the MLA database before you apply to confirm that you are correctly showing as eligible for MLA benefits as a “covered borrower.”

Chase Sapphire Reserve® Card

Learn how to apply on our partner's secure site

- $795 annual fee waived to $0 for US military + spouses with Chase MLA policy

- Earn 100,000 bonus points + $500 Chase Travel℠ promo credit after you spend $5,000 on purchases in the first 3 months from account opening.

- Earn 8x points on all purchases through Chase Travel℠ including The Edit℠

- 4x points on flights and hotels booked direct

- 3x points on dining worldwide

- 1x points on all other purchases

- Get a $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Live the lounge life at over 1,300 airport lounges worldwide with a complimentary Priority Pass™ Select membership, plus every Chase Sapphire Lounge® by The Club with two guests.

- Up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years which saves you a ton of time

- Up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables.

- Trip Cancellation/Interruption Insurance, Auto Rental Coverage, Lost Luggage Insurance, no foreign transaction fees, and more.

- Complimentary Apple TV+ and Apple Music. Subscriptions run through 6/22/27 – a value of $250 annually

- Member FDIC

- Learn more in the Chase Sapphire Reserve review

The annual fee of $695 is reduced to $0 for Guard and Reservists on 30 day or greater Title 10/32 Orders.

Please note that I have not yet tried this National Guard SCRA program myself, since I am still active duty. I have several reliable data points from National Guards members, including an Army National Guard Warrant Officer. In his words:

Spencer,

Got a notice back today that Amex has put my account under SCRA protections…Title 32 didn’t seem to be a problem.

I am on a finite set of orders, ending 30 Sep in my case, my notice said I would be protected until the end of my orders. I’ll just have to send in a new set of orders, if I get carried on AD after 30 Sep.

Anyway, there you have it. And thanks to you for all your info! I only wish I had known all this 15 years ago!

You can read about how I originally discovered this benefit while on active duty and got the word out to my email subscribers way back in 2013.

Other Amex cards with SCRA fee reductions for National Guard include:

- American Express® Gold Card

- The Platinum Card® from American Express

- Hilton Honors American Express Aspire Card*

- Marriott Bonvoy Brilliant® American Express® Card

- Delta SkyMiles® Reserve American Express Card

- Chase Sapphire Reserve® Card

- Chase Sapphire Preferred® Card

*All information about American Express Hilton Honors Aspire Card has been collected independently by MilitaryMoneyManual.com

American Express and Chase both reduce the annual fees on all of their personal credit cards.

Amex Platinum Military Reservist

Here's an email I received from 8 June 2019:

Hi Spencer,

I’m a veteran and my spouse is currently on active duty for training orders Title 10 with the USANG.

Wanted to let you know that Amex applied SCRA benefits to our accounts, no questions asked.

*** **** in Denver

This is a very encouraging data point! Please leave a comment or send me an email if you also have an Army/Air National Guard SCRA or MLA Amex data point.

How to Get Amex SCRA Benefits in the National Guard

If you are National Guard on Title 10 orders, you can check your SCRA status at this site and your MLA status at this site.

If you input your social security number, your birthday, last name, and today's date, it will present you with a PDF certificate of your Title 10 status. You want to look for the “Active Duty End Date” and “Status.”

If the end date is in the future and your status is “Yes,” then you are eligible for Title 10 SCRA coverage until your end date.

If the SCRA check comes up with N/A, then you can still apply for SCRA benefits from Amex, you may just need to provide a copy of your Title 32 orders.

Step 1 – Apply for an American Express Platinum card or any of the other excellent American Express cards with no annual fees for military.

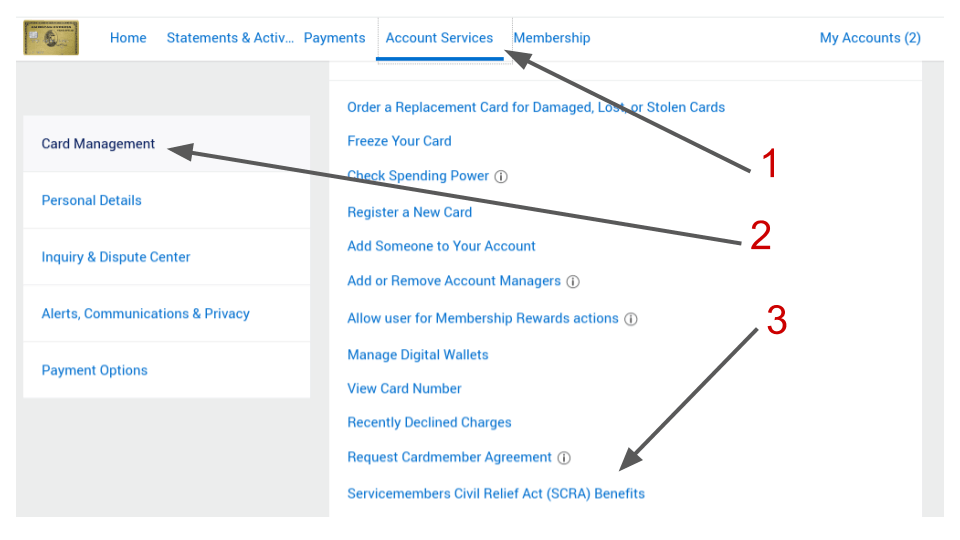

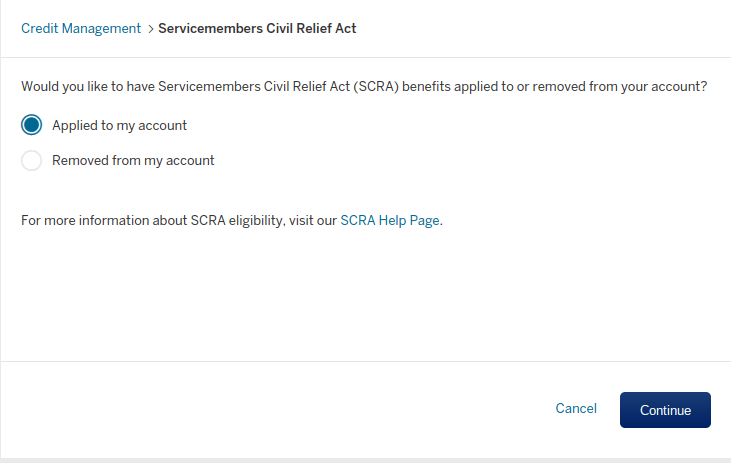

Step 2 – As you are spending to meet the minimum spending for the huge welcome bonus (learn more about maximizing your military credit card benefits in my course, apply for SCRA benefits through this link or on your Amex account services page.

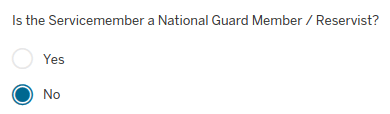

Step 3 – Answer the questions as they are asked. I answered “no” because I am not a National Guard Member, but you might be:

Step 4 – At the end of the SCRA questionnaire you will receive a notification that looks similar to this:

The text reads:

Military Orders Request

Dear _____,

Thank you for your recent request for benefits under the Servicemembers Civil Relief Act.

We will make every effort to complete the review within 60 days of receipt of your request. You will be notified in writing of the actions we have taken.

You may check the status of your request at any time by visiting americanexpress.com/inquirycenter. We are grateful for the service and devotion you have shown to our country.

You may be asked to provide a copy of your orders. If you are asked, just upload the orders to the secure Amex site as requested.

Redact any information you don't feel comfortable sharing with them, but remember they already have your Social Security number!

The Amex SCRA review process usually takes 2-3 weeks to complete. If you are charged an annual fee in that time, AMEX will refund it.

Recently my wife applied for the SCRA benefits as a military spouse. She applied on Feb 27 and the case was closed 4 March, so only 5 days with a weekend in the middle.

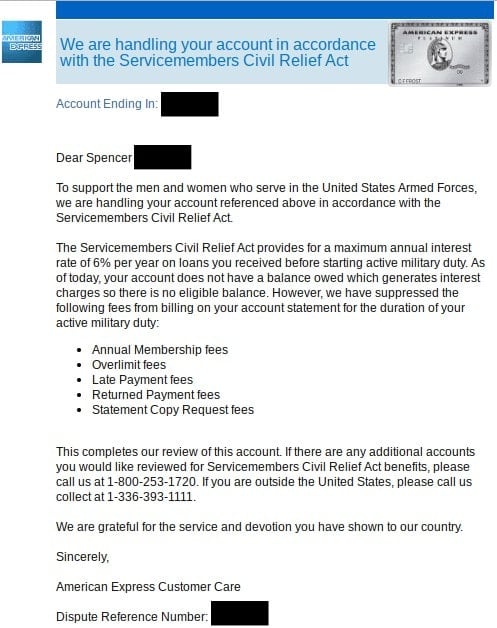

Here is the response you want to see from Amex:

Dear Spencer,

To support the men and women who serve in the United States Armed Forces, we are handling your account referenced above in accordance with the Servicemembers Civil Relief Act.

The Servicemembers Civil Relief Act provides for a maximum annual interest rate of 6% per year on loans you received before starting active military duty. As of today, your account does not have a balance owed which generates interest charges so there is no eligible balance. However, we have suppressed the following fees from billing on your account statement for the duration of your active military duty:*Annual Membership fees

*Overlimit fees

*Late Payment fees

*Returned Payment fees

*Statement Copy Request fees

This completes our review of this account. If there are any additional accounts you would like reviewed for Servicemembers Civil Relief Act benefits, please call us at 1-800-253-1720. If you are outside the United States, please call us collect at 1-336-393-1111.

We are grateful for the service and devotion you have shown to our country.

Sincerely,

American Express Customer Care

What are the Amex SCRA Benefits for Title 32 National Guard?

Title 32 National Guard get the same Amex SCRA benefits as active duty servicemembers. These include:

- Annual Membership fees

- Overlimit fees

- Late Payment fees

- Returned Payment fees

- Statement Copy Request fees

This is NOT due to the SCRA law. The way the SCRA law is written, only Title 10 National Guard members are eligible for SCRA benefits.

However, American Express goes above and beyond what is required by the law to support the men and women of the National Guard.

Why do they do this? I don't think it's out of the goodness of their heart. I think it's due to Amex's lawyer's interpretation of the SCRA and Military Lending Act (MLA) laws. AMEX proceeds with an abundance of caution with how they treat military servicemembers, no matter what their activation status.

American Express has probably calculated that rather than risk lawsuits, federal legal action, and bad press from negative treatment of servicemembers, they would rather just not charge fees to US military and be done with it.

What Happens When My Title 10/32 Orders End?

Ok now this is a tricky one. I will be honest, I'm not sure. If anyone does know, please sound off in the comments.

My best guess is Amex will get in touch with you to confirm your status and ask you to provide documentation you have been extended beyond your original orders end date.

If you cannot produce new orders, I suspect they will remove you from SCRA protection and you will be eligible for annual fees at that point. I suspect they will not charge the annual fee until your card anniversary, or the day you opened the account.

Please note that Amex will refund the annual fee completely if you cancel the card within 30 days after the statement in which the annual fee hits.

So if the annual fee is charged April 2, the statement closes April 30, you have until May 30 to close the account and get a full refund.

If you product change the card, so for instance downgrade your Amex Platinum to a no annual fee Amex Everyday card, you can keep your Membership Reward points and the annual fee will be prorated.

For example, if you wait 6 months after the annual fee is charged on the AMEX Platinum, you will receive $225 back after the product change.

Why Should I Get the Amex Platinum?

Do you ever travel? Hate airports? Let me tell you about airport lounges: free food, free drinks (usually beer, wine, and mixed), quiet, and separated from the loud and obnoxious crowds. It will change the way you travel and make travelling so much less of a painful experience.

You can access over 1200 Priority Pass Lounges and the famous Amex Centurion Lounges for free with the Amex Platinum. You can even get a guest in free.

I used the 60,000 point welcome bonus I earned with minimum spending to upgrade my wife and me to business class. A 14 hour flight is much more manageable when you spend half the time sleeping. I can show you how to do this in my 5 day, free, military credit cards course.

How Many Amex SCRA Cards Can You Get With No Annual Fee?

Currently, I have 14 and my wife has 5 of the following 19 American Express cards, all with the annual fees reduced to $0:

- Amex Platinum x7 ($4,875)

- Amex Gold Card x2 ($500)

- Green Card ($150)

- Charles Schwab Amex Platinum Card ($695)

- Amex Delta Reserve $650

- Amex Marriott Bonvoy Brilliant x3 ($1,350)

- Amex Hilton Honors Aspire x4 $1,800

Total annual fees reduced: $9,920

From these 13 cards we receive annually:

- 3 free nights at Marriott annually and Marriott Gold Elite

- 1 free night at Hilton annually with Diamond Status

- $1150 in airline fee credits reimbursed

- $800 of Uber or Uber Eats credit annually

- $250 Hilton Resort credit

- $600 Marriott expenses credit

- Annual companion pass in Delta first class

And those annual benefits are on top of the 250,000+ Hilton points, 260,000+ AMEX Membership Reward Points, 400,000+ Marriott Bonvoy points, and 75,000 Delta Skymiles I earned by meeting the minimum spend and earning the welcome bonuses on these cards.

As you can see, the Amex MLA & SCRA benefits are extremely lucrative for US military servicemembers. Lounge access, free hotel nights, free credit at the hotels, upgraded status, airline fees reimbursed, and free food make this a very lucrative hobby.

Start travelling easier by taking my 5 day, 100% free, email based Ultimate Military Credit Cards Course.

If you are in the Guard or Reserve and have successfully received SCRA or MLA annual fee reductions from AMEX, please let me know either by email or in the comments below.

Amex National Guard & Reserves FAQ

Yes! If you are a National Guard servicemember on Title 10 or Title 32 active duty orders for 30 days or more, you are eligible for annual fee reductions on your American Express cards.

Yes, the American Express Platinum card annual fee is reduced for National Guard and Reservists if you are on Title 10 or Title 32 active duty orders for 30 days or more. Learn more about the Amex National Guard fee reduction in this article.

Yes, if you are in the Reserves and on 30 day active orders, Amex Platinum fees are reduced for you and your spouse.

Yes, military reservists can get Amex cards with no annual fees, thanks to MLA and SCRA.

Amex Platinum verifies military service in the Military Lending Act database. You can check your status in the MLA database before you apply.

Yes, if you in the Reserves and on active orders for 30 days or greater, you are eligible for MLA fee reduction on cards you open while on active orders, or SCRA benefits if you open the account before active status.

Yes, military reservists can qualify for Amex Platinum with a credit score over 720. They can also qualify for annual fee reduction through MLA and SCRA if on active orders of 30 days or greater.

I am in USAR but currently in TDY order until the End of June 2024. If I apply for an Amex or Chase credit card and am approved, then I will pay that annual fee next year in 2026 if I am not in AD order at that time! Am I correct?

Great info, but there is a major catch 22 that AMEX throws at you. National Guard Military members are eligible for annual refund fees under SCRA and MLA. SCRA ONLY applies if you got the card before active duty orders started and MLA ONLY applies IF a National Guard Military member was or is currently on TITLE 10 ORDERS. I have been back and forth with AMEX for MONTHS over getting my annual fee refunded and in the end I was told “to bad, netter luck next time” I am a National Guard Service Member and I received my card in March of 2021, and I have been on orders since 2008. AMEX “kindly” informed me that I DO NOT qualify for SCRA and because I am Title 32, I don’t qualify for MLA benefits. If you don’t mind paying the annual fee out of pocket, its a good card, HOWEVER if you are getting this in the assumption of receiving annual fees refunded and are currently on any type of T5 or T32 orders and have never been T10, then I would be prepared to pay out of pocket.

Hope this helps others avoid the headache.

Ok, Just to clarify for everyone how this works. I am not sure if I missed it on a previous post. Yes American Express will waive the Annual fee and waive any penalty fee’s etc. under the SCRA. As a Reservist or National Guard Member, you first apply for the card, then as shown above you apply for the SCRA benefits. Then a file is opened up for AMEX to review the validity that you are on Active duty orders through the Defense website that they use which will show who is active who is not and the fees will be waived. A heads up once you come off active duty orders there is a grace period for a few months but you will be eventually be charged the $550.00 annual fee and not be protected under SCRA. I do not agree because I feel that Reserve and Guard get deployed as well and this day and age things rare unpredictable, but that a SNCO opinion.