19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The Marriott Bonvoy Brilliant® American Express® Card and Hilton Honors American Express Aspire Card card both offer amazing benefits to military servicemembers.

Both of these cards offer an annual credit for purchases. Hilton has a $250 resort credit for charges at Hilton Resorts. Marriott has a $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide.

Both cards have an annual fee that is reduced to $0 for US military troops under Amex's SCRA policy.

How long do you have to wait to get these statement credits posted to your account?

In this post:

How Long Does the Amex Hilton Aspire Resort Credit Take to Post?

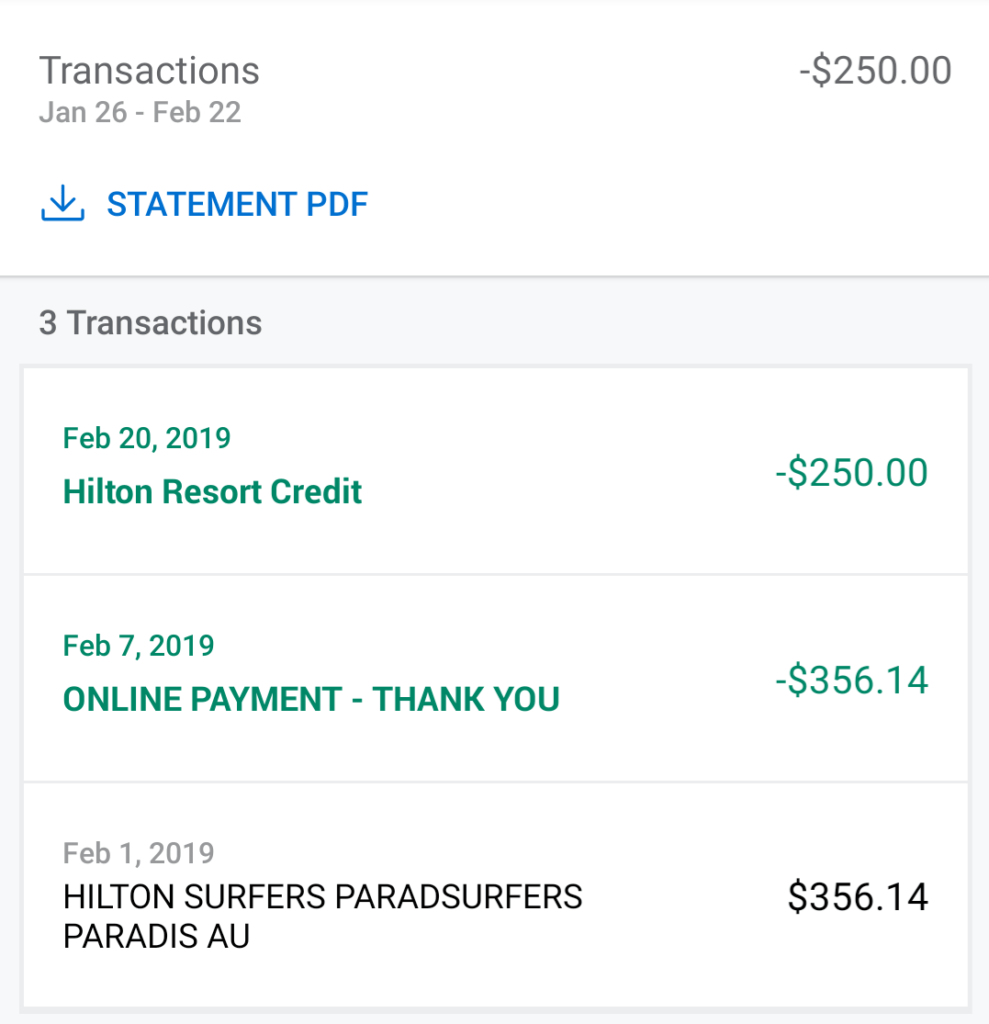

About 3-4 weeks, based on the data point below. I paid $356.14 for dinner at a restaurant in a Hilton resort in Australia on Feb 1. On Feb 20, the Hilton Resort Credit of $250 posted to my account.

The Hilton Aspire card has a $250 “Hilton Resort Credit” for any charges at the Hilton properties listed here: http://www.hilton.com/resorts. Essentially anything you can charge to your room, i.e. room service, valet, laundry, room rate charges, spa services, restaurants, drinks, etc are reimbursable by the credit.

The credit kicks in as soon as you open a Amex Aspire card and renews every card anniversary.

Amex says it can take 8-12 weeks for the statement credit to post, but in this example it only took 19 days or just under 3 weeks.

Eligible Hilton Resort purchases must be made directly with the participating Hilton Resort and charged to your Hilton Honors American Express Aspire Card account for the benefit to apply. Incidental charges (including charges made at restaurants, spas, and other establishments within the hotel property) must be charged to your room and paid for with your Hilton Honors American Express Aspire Card at checkout in order for them to be recognized as Hilton Resort purchases.

Amex Aspire Benefit Terms

Using the Amex Hilton Aspire $250 Resort Credit Example

We celebrated my father-in-law's 60th birthday this year with a week on the Gold Coast of Australia. Located about an hour south of Brisbane, our week in Surfer's Paradise was full of koalas, kangaroos, swimming, and early morning walks on the beach to get delicious coffee and pastries.

We didn't stay at the Hilton Surfers Paradise hotel, but I noticed that it was listed on Hilton's Resort page. That means it is eligible for the $250 resort credit, even though it doesn't have resort in the name. I always check that page before trying to use my $250 Aspire credit.

Since I had just opened my Hilton Honors American Express Aspire Card and it was the new year, my wife and I decided to take the family out to dinner at the well reviewed restaurant at the Hilton, “Catch.”

Normally I don't like eating at hotel restaurants if I have a choice, but if I was getting a $250 credit and it had good reviews, why not?

The seafood was great and the wine was tasty. The bill was not outrageous for 6 people, but getting $250 taken off the top made it much easier to manage!

American Express Hilton Honors Aspire Card

Learn how to apply on our partner's secure site

- $550 annual fee *See more details about American Express protections for you and your spouse

- Complimentary Diamond Status at all Hilton brands (suite upgrades, breakfast, check in gifts, etc)

- 175,000 Hilton Honors Bonus Points welcome offer after $6,000 of eligible purchases in the first 6 months offers

- 1 weekend night reward after opening your account and every year on renewal

- $400 Hilton Resort Credit – $200 each semi-annual period

- $200 airline fee credit – Earn up to $50 statement credit each quarter

- $189 Clear Credit

- 14x Hilton Honors Bonus Points at Hilton properties

- No foreign transaction fees

- The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by Military Money Manual and has not been reviewed or provided by the card issuer.

- Full review of Amex Aspire card, terms apply

- All information about American Express Hilton Honors Aspire Card has been collected independently by MilitaryMoneymanual.com

How Long Does the Amex Marriott Bonvoy Brilliant Restaurant Credit Take to Post?

About 2-3 business days, based on the data point below.

Marriott Bonvoy Brilliant® American Express® Card

Learn how to apply on our partner's secure site

- $650 Annual Fee* See details about American Express protections for you and your spouse

- Earn up to 150,000 Marriott Bonvoy® bonus points. Earn 100,000 points after you spend $6,000 and an extra 50,000 points after you spend an additional $2,000 in purchases on the Card within your first 6 months of Card Membership.

- Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card at restaurants worldwide.

- With Marriott Bonvoy® Platinum Elite Status, you can receive room upgrades, including enhanced views or suites, when the stay is booked with a Qualifying Rate at hotels that participate in Marriott Bonvoy (subject to availability upon check-in).

- Earn 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy® program.

- 3X Marriott Bonvoy® points at restaurants worldwide and on flights booked directly with airlines.

- 2X Marriott Bonvoy® points on all other eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card.

- Enjoy a night away when you receive 1 Free Night Award every year after your Card renewal month. Free night can be used for one night (redemption level at or under 85,000 Marriott Bonvoy® points) at hotels participating in Marriott Bonvoy®. (Certain hotels have resort fees)

- Get rewarded each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant® American Express® Card. Select one Brilliant Earned Choice Award benefit per calendar year. See here for Award options.

- Elevate your stay with $100 Marriott Bonvoy® Property Credit: Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card.

- Save time traveling with either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant® American Express® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Receive 25 Elite Night Credits toward the next level of Marriott Bonvoy® Elite status each calendar year with your Marriott Bonvoy Brilliant® American Express® Card. (Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express.)

- Lounge Access! Enroll in Priority Pass Select, which offers unlimited airport lounge visits to over 1,200 lounges in over 130 countries, regardless of which carrier or class you are flying. Escape the busy airport and enjoy snacks, drinks, and internet access in a quiet, comfortable location.

- Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- No Foreign Transaction Fees on international purchases.

- Terms Apply, Enrollment is required for select benefits

The $25 per month worldwide restaurant statement credit starts as soon as you open a Marriott Bonvoy Brilliant® American Express® Card and renews on the 1st of every month.

Amex says it can take 8-12 weeks for the statement credit to post, but in this example it only took 2 days.

Staying at the Ritz Carlton Geneva

My wife and I recently stayed at the wonderful Ritz Carlton Geneva, Hotel de la Paix Geneve. The most basic, classic room cost 60,000 Marriott Bonvoy points. The cash value of the room at booking was 700 Swiss Francs, or about $700 USD.

Thanks to Platinum Elite status, we were upgraded to a room overlooking Lake Geneve. This room would have added another $100-150 to our rate, so our 60,000 points were even more valuable.

We were able to get 1.4 cents per Bonvoy point with this booking. See how to earn tons of points and redeem them at excellent rates in my 100% free, 5 day Ultimate Military Credit Cards Course.

We had dinner at the excellent Living Room Bar & Kitchen, just off the Lobby of the Hotel de la Paix. We charged our drinks and the awesome lamb risotto for 2 (cooked in a cheese bowl) to the room and paid at check out with my Marriott Bonvoy Brilliant® American Express® Card.

We also charged the valet parking charge to our room as well. The total bill was $134.50.

From the chocolates offered at check in, to the free Swiss chocolate and Swiss wine tasting in the lobby, to the excellent and friendly staff, we had a perfect time at the Geneva Ritz Carlton.

Using Bonvoy points for the room and the $25 Bonvoy Brilliant credit to offset the cost of dinner was just the icing on an already delicious cake.

Summary

The $25 Marriott Bonvoy Restaurant Credit sometimes posts within 2-3 days. The Hilton Aspire credit may take a bit longer and posts within 3-4 weeks. Remember to pay your credit card bills on time, set up autopay, and never carry debt on your credit cards.

If you end up with a credit on your account, you can spend it, move it to another card, or request a refund check.

The Amex Hilton Aspire and Amex Marriott Bonvoy Brilliant are the best hotel credit cards and are a must have in any military troop's wallet.

Whether you go TDY for work often, travel for pleasure, or don't even travel that much, these cards are still necessary in your card portfolio. The recurring annual benefits, the huge welcome bonuses, and the reduced annual fees for military and spouses make these cards extremely valuable.

Find out more about the Marriott Bonvoy credit cards and Hilton Honors credit cards, all with annual fees reduced to $0 for military.

Can I use the $300 credit resort for hotel stays?

On Marriott Bonvoy Brilliant yes, room charges (cost of the room) counts towards the $300. For instance if you stayed one night at a JW Marriott at $400 per night, the $300 credit would kick in if you haven’t used the credit yet that year and you paid for the room on your AMEX Bonvoy Brilliant card. $400-$300 = $100 you would still be responsible for $100 of the room cost.

For the Marriott $300 credit, are there specific hotels that trigger the credit or do all hotels in the Marriott portfolio trigger the credit (as long as you charge expenses to the room)?

All hotels, resorts, and properties in Marriott portfolio trigger the credit. This is different than the Hilton credit, where you need to be at a “Hilton resort.”

To clarify, you do or don’t have to stay there? You said you weren’t staying at Surfer’s Paradise, but you ate at their restaurant, and got the credit? But the rules say it must be charged to your room?

If that’s not the case, does this mean you can essentially dine at a hotel or resort (or just one, but not the other) for free, even if you’re not staying there?

Thanks for the clarification.

I still got the credit. The restaurant was a part of the hotel, so it coded as a Hilton resort charge.