20,159 grads of the Ultimate Military Credit Cards Course already know why the

American Express Platinum Card® is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the Ink Business Premier® Credit Card, Ink Business Preferred® Credit Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

American Express generously provides special military protections on their cards for active duty and military spouses. These benefits apply to all Amex personal cards, no matter how many you have.

This includes American Express Platinum Card®.

In general, you can only earn a welcome offer once per card per lifetime, so opening multiple American Express Platinum Cards® won't allow you multiple welcome offers.

Amex may have changed their multiple card rules in 2025, reducing the number of Amex Platinum cards you can have from 10 to 5. FrequentMiler and Doctor of Credit both reported on this change.

Why Have Multiple Amex Platinum Cards®

Usually, if a benefit is per card account, such as the up to $300 per year lululemon credit (enrollment required), the benefit “stack,” so each account you have open adds more annual benefits.

| Number of Cards | x up to $300 lululemon credit | x up to $75 per quarter lululemon credit |

| 1 | $300 | $75 |

| 2 | $600 | $150 |

| 3 | $900 | $225 |

| 4 | $1,200 | $300 |

| 5 | $1,500 | $375 |

| 6 | $1,800 | $450 |

| 7 | $2,100 | $525 |

| 8 | $2,400 | $600 |

| 9 | $2,700 | $675 |

| 10 | $3,000 | $750 |

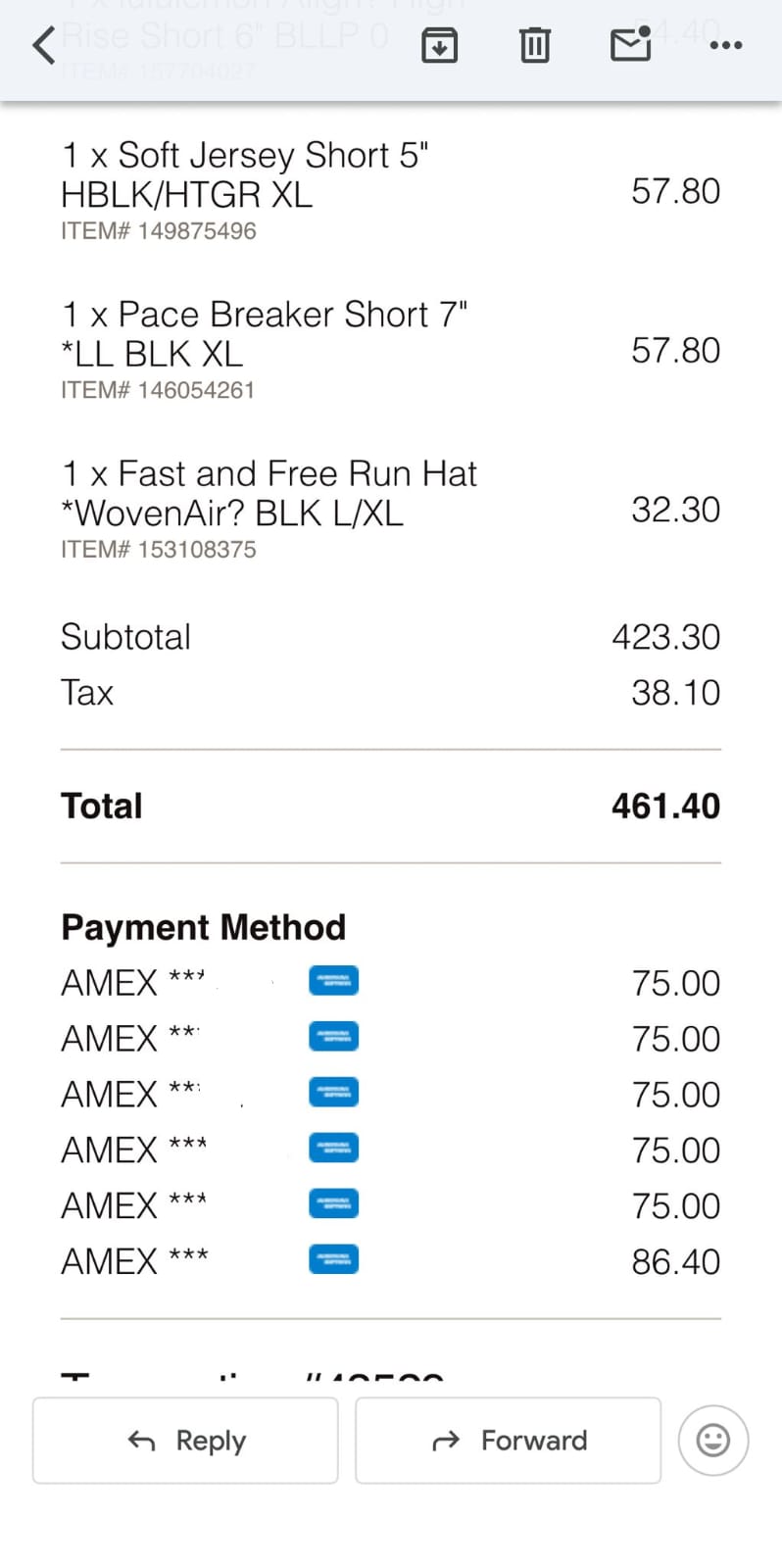

Here is an example of splitting a $461 lululemon purchase across 6 Amex Platinum Cards®. You can split purchases in a lululemon store but not online.

In the lululemon credit example, instead of receiving $75 per quarter in credit, you could receive up to $750 per quarter or up to $3,000 per year, if you had 10 Amex Platinum Cards® open.

Amex has rules about how many cards you can have per person.

In general, you can have 5 cards without a preset spending limit (such as the American Express Platinum Card®, the American Express® Gold Card or the American Express Green Card) and 5 credit cards (such as the Hilton Honors American Express Aspire Card).

So a military family might have:

- 10 American Express Platinum Card® (5 for each person in the marriage)

- 10 Hilton Honors American Express Aspire Card (5 for each person in the marriage)

The Amex special military protections apply to all personal card accounts. We did a podcast episode explaining the state of military credit cards:

How to Open Multiple Amex Platinum Cards®

There are 2 easy ways to open multiple accounts of American Express Platinum Cards®:

- Directly apply – You can directly apply for another Amex Platinum Card® every 91 days.

- Upgrade lower tier cards – You can upgrade your American Express® Gold Card or the American Express Green Card

When directly applying, simply go through my link American Express Platinum Card® (thanks!) or use a friend's referral link. You probably won't be eligible for another welcome bonus offer, but you can open up another account.

If you're having trouble applying for another Amex Platinum card, try an incognito browser. You'll be able to add the card to your American Express login at americanexpress.com after you are approved for the new card account.

You can upgrade your lower tier American Express cards, the American Express® Gold Card or the American Express Green Card, to additional Amex Platinum Cards®. You can do this either while you're logged into your primary Amex account or sometimes you'll need to separate the cards into a secondary Amex login account. See details of that process in these links:

Spencer,

In the lululemon screenshot, you have multiple CC payment methods for what appears to be a single order. How did you split payment?

If we can split payment method, this opens up their whole product line as many of their items are over $75.

Thanks!

You can split payment in US lululemon stores across multiple cards.

New limit for charge cards is 5 according to Amex customer service. Applied for 6th and was denied – called the number in the denial letter and the customer service rep confirmed the new limit. The limit only applies to new accounts – they won’t make you close charge card accounts if you already had more than 5. Schwab/Morgan Stanley platinums still count toward the limit.

They also mentioned that the limit is not advertised because it changes from time to time. Credit card limit is still 5.

Great data point, thanks. 5 charge cards, 5 credit cards going forward.

Thanks Ben, this is really helpful! By far the smartest way to collect a DP on it. I was too scared to poke the bear and get my accounts closed if I called lol

I’m wondering if AMEX changed the max amount of charge cards someone can have. I applied for my 6th and was denied due to having to may of the number/type of cards already opened.

Hey Spencer,

Not sure if you or anyone else has any datapoints on this, but I tried applying for my 7th Amex Platinum today and was automatically denied. In the denial letter, it stated, “According to our records, you currently have the maximum number and type of American Express accounts that we allow.”

I have 6 platinums, 1 BCP, and 1 aspire. I was under the impression I could have 3 more credit cards and 4 more charge cards before I hit their maximum (10 charge cards; 5 credit card limit). Am I misunderstanding something here? My immediate thought is that they possibly updated their terms to limit the amount of platinums and/or other charge cards that someone can have due to the increased value in the Sep 2025 update.

That’s very interesting and might indicate that the limit is 6 charge cards now. I will wait to collect some more data points, thank you for you contribution.

I appreciate the response! One thing I forgot to mention is that of my six platinums, one is a Charles Schwab Platinum. This may add more clarity in case other experiences five as the new limit for regular platinums. I plan on applying for the Morgan Stanley version after a few months of observing other data points, and seeing if this is an effective workaround.

The American Express Platinum Card for Schwab is considered a vanilla Platinum now, i.e. if you’ve earned the welcome bonus on an Amex Platinum Card you’re probably not eligible for the Amex Platinum Schwab welcome offer.

Did you get the non-eligible for the welcome bonus popup or any other alert before the app was processsed? Are you in pop-up jail?

Hey Spencer,

I did receive the not eligible for welcome bonus message when applying last week, but I’ve always received this message when applying for my additional platinums. Never had any issues previously when I continued after that message. I was completely caught off guard when I was denied as it’s my first time getting denied by Amex.

As far as pop-up jail goes, I was in it for a while until this August. That’s why I finally got the aspire and haven’t opened a new card since.

Just thought I’d update you. Made a post to collect some DPs from military members. From what I was DM’d, it seems like the maximum is three now, but I’m not 100% sure.

Are you saying you can have a regular vanilla Plat card and apply for another 91 days after? Tried that today through incognito and received a message that they need more information. Is that a common process when trying to grab a second platinum?

Yes. I’m not sure, what information did they ask for?

Spencer, first of all, thank you so much for making this website – it is so informative and helpful!!!! I currently have the AMEX Platinum, Chase Sapphire Reserve, and just signed up for the AMEX Gold (I was eligible for a 60,000 point sign on bonus).

1) Is it useful to sign up for the AMEX Green, and then upgrade to Platinum if we can receive a sign on bonus with the Green, similar to how I did with the Gold?

2) My credit score right now is in the 820s; I had some unexpected expenses and had to slowly pay down my cards over about a year, so demonstrated that I could carry debt and pay it off over time if needed, which boosted my score). Have you found that opening multiple credit accounts has impacted your credit score, even if you aren’t using them / paying them off every month?

3) The fact that we can have multiple AMEX Platinum cards and stack these rewards (lululemon, resy, saks fifth avenue, united travel bank, uber, digital entertainment credit.. and oura ring since if you had more than one platinum and stacked them, you could afford one…) seems like a fluke / something they aren’t quite realizing… Aka, it seems too good to be true. How is this true? Sorry, I am truly flabbergasted that this is “allowed” (I’m not complaining… I just don’t believe it).

Hey Ken, first off well done on the cards so far!

1. Yes, that is useful. It was lucky you were eligible for the Amex Gold welcome offer after already having an Amex Platinum. Check the Amex family language rules.

2. I have 30+ credit cards and an 800+ credit score. I use maybe 3-10 of them in any given month. Having multiple cards actually helps your score. Not using them has no impact. I never carry a balance. I never recommend you carry a balance.

3. I don’t know. It’s been allowed for over 10 years now. Perhaps they will close the loophole one day. I still have 6 Amex Platinums with fees waived 3 years after I separated from the military. I know one guy who has 26 Amex Platinums between him and his wife. As long as you play by the rules of the game, it seems to be allowed for now.

Hey, Spencer, thank you for the response!

I have just signed up for my second AMEX Platinum thank to the amazing information you provided! I’m also going to sign up for

How did you get the fees waived after separating? Did they offer it, or did you have to ask? Are these all yours, or split up between you and your wife (Aka, I’m curious whether the waived fees apply to former spouses, or only former ADSM)

Spencer, is my thought process below correct in your experience when it comes to stacking more than one AMEX Platinum card on the same account? Or do any of these credits NOT stack when having (as an example) 2 or more x AMEX Platinums on the same account?

Set up $25 Digital Entertainment credit / month, and add to Uber wallet for additional $15 Uber credit / month.

Receive an additional $300 Semi-Annual Hotel credit on THC / FHR, $100 per Quarter Resy credit, $75 per Quarter Lululemon credit, $50 Semi-Annual Saks Fifth Avenue credit, and $200 Annual Incidental Airline Fees (United Travel Bank). Thus, 300 + 185 + 600 + 400 + 150 + 100 + 200 = $1935 value

(I didn’t include Oura ring because I don’t think it’s a useful credit, TSA/Global entry, Equinox/soul cycle unless you live near an Equinox gym and can use for a massage, etc…)

Yup, all those benefits stack as you described. You can combine the Resy benefit by buying gifts cards. TSA/Global Entry you can buy for family/friends. Equinox I don’t see much value in. Uber One I guess you could buy for a friend. Same with Clear.

Thank you so much! I got the equinox app for exactly $300 for at-home workouts (some states have taxes for online purchases, but mine does not), so the credit covered it completely. Is it worth it if I had to pay for it? Definitely not, but it’s free, and it’s better than youtube. I would never pay for it outside of this.

How did you get the cc fees waived after separating? Did they offer it, or did you have to ask? Are these all yours, or split up between you and your wife (Aka, I’m curious whether the waived fees apply to former spouses, or only former ADSM)

Based on data points, I think for accounts opened before 2020 Amex is not very good about checking active duty military status. I still have 6 Amex Platinum Cards without annual fees. My wife’s Amex Platinum was opened after 2020 and her annual fees are not waived. We chose to keep the card open, because we can easily get our money’s worth from the credits, even with the annual fee.

Spenser,

When you say “stack” do you mean that you would have to split the purchases across 10 different cards or could you use one card with 10 open and get a $750 credit for just one card?

Currently only have 1 platinum and weighing the mental cost of trying to balance that if it is the former.

Thanks – Ty

Split the purchase across 10 different cards. Mental cost is pretty minimal when annual fees are reduced to $0.