19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

The IHG One Rewards Premier Credit Card is the best credit card for earning free night stays at all IHG hotels and resorts. Military servicemembers and their spouses can get the Chase IHG Premier Card with no annual fee.

You can earn a large welcome bonus points after meeting the minimum spend requirements. The annual fee is waived for US military servicemembers on active duty orders according to Chase's MLA policy.

IHG One Rewards Premier Credit Card

Learn how to apply on our partner's secure site

- $99 annual fee waived for US military according to Chase MLA policy

- Our Best Offer of 2025! Earn 5 Free Nights after spending $5,000 on purchases in the first 3 months from account opening.

- Enjoy a Reward Night after each account anniversary year at eligible IHG hotels worldwide. Plus, enjoy a fourth reward night free when you redeem points for a consecutive four-night IHG® hotel stay.

- Earn up to 26 total points per $1 spent when you stay at an IHG hotel

- Earn 5 points per $1 spent on purchases on travel, gas stations, and restaurants. Earn 3 points per $1 spent on all other purchases

- Automatic Platinum Elite status as long as you remain a Premier cardmember

- Global Entry, TSA PreCheck® or NEXUS Statement Credit of up to $120 every 4 years as reimbursement for the application fee charged to your card

- IHG Rewards bonus points are redeemable at hotels such as InterContinental®, Crowne Plaza®, Kimpton®, EVEN® Hotels, Indigo® Hotels & Holiday Inn®

- No foreign transaction fees – essential for international travel

With the offer of thousands of IHG points, you can easily get over $1000 of value from this card in the first year. I'm adding it to my Best Credit Card Bonuses for Military Servicemembers page.

In this post:

How to Use IHG Points for Maximum Value

IHG, or Intercontinental Hotel Group, has over 5,000 properties in their inventory including many of the hotels on Army posts. This allows you to earn valuable IHG points, even when you stay on base. IHG brands include:

- Kimpton

- Intercontinental

- Regent

- Voco

- Hotel Indigo

- Crowne Plaza

- Candlewood Suites

- Holiday Inn and Holiday Inn Express

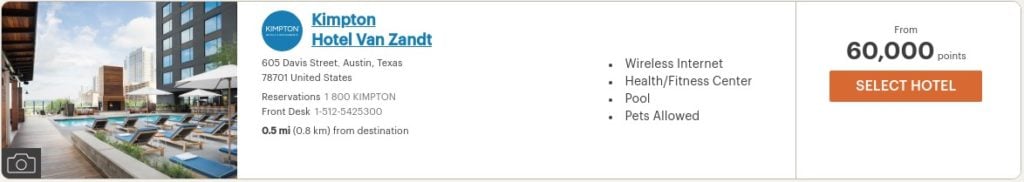

One of my all time favorite hotels is the Kimpton Hotel Van Zandt in Austin, Texas. We used to go here on weekends while we were stationed in Texas. They have a free happy hour, are dog friendly, and just steps away from the famous Rainey Street nightlife.

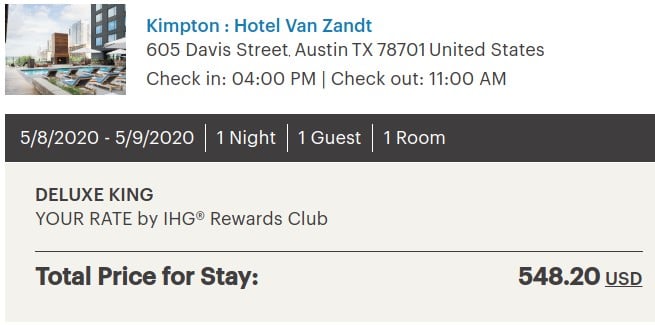

A Friday night stay in May 2020 at the Hotel Van Zandt would run you over $500:

Or you can book it for just 60,000 points!

That's nearly 1 penny per point, which is a pretty good redemption for hotel points. $548 / 60,000 points = .91 cents per point. That means a hypothetical 100,000 points could be worth over $1,000!

Automatic IHG Platinum Elite for Military

If you are a Chase IHG card holder, you automatically earn IHG Platinum Elite status while the account is open. This is IHG's second highest membership level.

Since military servicemembers pay no annual fees on this card, you can get automatic Platinum Elite status as long as you are on active duty orders.

IHG Platinum Elites earn 60% bonus points when paying for stays, complimentary room upgrades when available, and get guaranteed room availability. Check out more of the benefits from the IHG Rewards Club membership chart below:

This is similar to getting automatic Marriot Bonvoy Gold Status with the Amex Bonvoy Brilliant or automatic Hilton Honors Diamond status with the Amex Hilton Honors Aspire Card.

Using IHG Points for Airport Stays

I'm not sure why, but in my travels I notice IHGs are often the closest hotel to airports. When you have a large stash of IHG points (like the tens of thousands you can earn with the Chase IHG card), you can book free reward nights at these hotels.

This makes travelling much more enjoyable when you can spend a night at the hotel before you depart or after you land, if you land very late.

For instance, my wife and I stayed 2 nights at the Holiday Inn Auckland Airport after coming in on a late night flight and again before leaving on an early morning flight to Melbourne, Australia. The accommodations were perfect for recovering from jet lag and having an easy place to Uber to the airport early in the morning.

Clean, quiet rooms and a nice bar/restaurant on the property meant a relaxing stay coming into and departing New Zealand.

Best Hotel Credit Cards for Military Servicemembers

If you travel a lot for the military, other work, or pleasure, I recommend you add the Chase IHG Rewards Club Premier credit card to your roster of cards.

The Chase IHG card is a great compliment to the Amex Marriott Bonvoy Brilliant and the Amex Hilton Honors Aspire card, both of which have an annual fee reduction under Amex's military policy.

You can check out my list of the best hotel credit cards for military servicemembers, especially those that go TDY, deploy, or PCS a lot.