Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the Ink Business Premier® Credit Card, Ink Business Preferred® Credit Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

You can upgrade Chase cards to multiple Chase Sapphire Reserve® Cards. If you are eligible for Chase Military Lending Act benefits as an active duty servicemember or a spouse, your annual fees will be waived on all personal Chase card accounts.

The primary benefit of multiple CSR cards is the $300 annual travel credit. You can also get Global Entry credit on each account. There are other annual benefits as well, check out the full Chase Sapphire Reserve® Card article for more details.

Cards that can be upgraded to Chase Sapphire Reserve include:

- Chase Freedom Unlimited® Credit Card

- Chase Freedom Flex® Credit Card

- Chase Sapphire Preferred® Credit Card

In order to upgrade, the card must have at least a $10,000 line of credit to be eligible for Visa Infinite privileges and the account must be at least 1 year old.

To upgrade, call the number on the back of your Chase card, or call 1-800-524-3880 or internationally call +1-302-594-8200. Ask to speak to a representative about “product changing” your current Chase card to a Chase Sapphire Reserve. If the customer service representative says it's not allowed because you already have a Chase Sapphire Reserve, hang up and call again.

Ultimate Rewards points will be moved to the upgraded account, so there's no risk there.

You don't need to create a separate login, which is necessary when upgrading Amex cards.

There are usually no upgrade bonus offers and you will not receive a welcome bonus offer for upgrading a lower-tier card to the Chase Sapphire Reserve® Card.

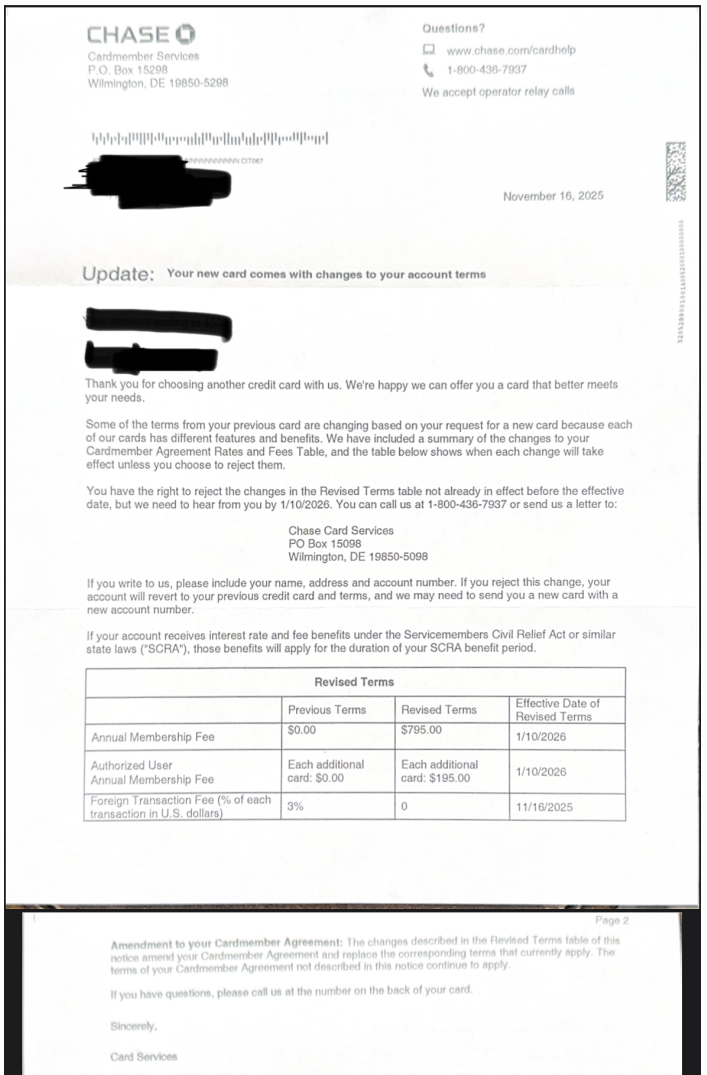

Letter from Chase After Upgrading to Chase Sapphire Reserve

When you upgrade a lower annual fee card to a Chase Sapphire Reserve, you might get a letter from Chase explaining your new card terms. The letter reads:

Update: Your new card comes with changes to your account terms

Thank you for choosing another credit card with us. We're happy we can offer you a card that better meets your needs.

Some of the terms from your previous card are changing based on your request for a new card because each of our cards has different features and benefits. We have included a summary of the changes to your Cardmember Agreement Rates and Fees Table, and the table below shows when each change will take effect unless you choose to reject them.

You have the right to reject the changes in the Revised Terms table not already in effect before the effective date, but we need to hear from you by 1/10/2026. You can call us at 1-800-436-7837 or send us a letter to:

Chase Card Services PO Box 15008 Wilmington, DE 19850-5098

If you write to us, please include your name, address and account number. If you reject this change, your account will revert to your previous credit card and terms, and we may need to send you a new card with a new account number

If your account receives interest rate and fee benefits under the Servicemembers Civil Relief Act or similar state laws (SCRA"), those benefits will apply for the duration of your SCRA benefit period.While there is a table that says your annual membership fee is increasing to the Chase Sapphire Reserve annual fee, in practical purposes MLA or SCRA will still apply to your account. Chase should still waive your annual fee, even if you have multiple Chase cards.

Podcast episode on upgrading Chase and American Express cards:

Podcast episode on the Chase Sapphire Reserve:

Chase Sapphire Reserve® Card

Learn how to apply on our partner's secure site

- $795 annual fee waived to $0 for US military + spouses with Chase MLA policy

- bonus_miles_full

- Earn 8x points on all purchases through Chase Travel℠ including The Edit℠

- 4x points on flights and hotels booked direct

- 3x points on dining worldwide

- 1x points on all other purchases

- Get a $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Live the lounge life at over 1,300 airport lounges worldwide with a complimentary Priority Pass™ Select membership, plus every Chase Sapphire Lounge® by The Club with two guests.

- Up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years which saves you a ton of time

- Up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables.

- Trip Cancellation/Interruption Insurance, Auto Rental Coverage, Lost Luggage Insurance, no foreign transaction fees, and more.

- Complimentary Apple TV+ and Apple Music. Subscriptions run through 6/22/27 – a value of $250 annually

- Member FDIC

- Learn more in the Chase Sapphire Reserve review

It's unknown how many Chase Sapphire Reserve cards you could have at any one time. The most I have heard of is 5 CSRs at once by one cardholder.

Yes, you can upgrade lower-tier cards, such as Chase Freedom cards or Chase Sapphire Preferred, to have more than one Chase Sapphire Reserve per person.

I’ve tried calling in multiple times about PCing and they always say they don’t see the option for me to change from Freedom Flex to a second Reserve. I’ve had the Flew for 4 years w/ $12k limit.

Can you product change to Freedom Unlimited or Chase Sapphire Preferred? I wonder why the product change is locked for you.

According to multple reps/calls, I am only able to PC my Flex to a regular Sapphire card (not preferred/Reserve).The last time I called, the rep acknowledged I already have a Reserve and said she will try anyway but then said there’s no option for it. I’m going to have wife try to PC her Flex to a second Reserve. I wonder what the issue is…

Having this same issue right now. I was able to PC my freedom unlimited to a CSR but whenever I try with my 11k limit 2 year old freedom flex I am told I can only changed to a sapphire. Looking for any updates

I’ve seen other data points on this but don’t have personal experience with the Freedom Flex. Reportedly there are issues with to changing from Mastercard (Freedom Flex) to Visa (CSR). Freedom Unlimited is a Visa and I’ve been able to upgrade to a CSR twice now

I had a freedom unlimited and a flex. No problem was able to PC my freedom unlimited. However, in order to change the flex, you’ll need to first change it to a freedom unlimited to convert it from a Mastercard to a visa. For some reason, Chase doesn’t really allow changes to the sapphire cards from anything but Visa. When I did it I had no problems and before my PC’d Unlimited (flex to unlimited) even arrived I was able to call can convert it to a 3rd CSR

Worked for me- upgraded my old chase freedom to sapphire reserve and already have a sapphire reserve card.

Any news if you were charged the annual fee for the second Reserve? Thanks!

Interested to find this out as well. I have had the CSR for 6 years now and just successfully applied for a CSP with the intent of upgrading it to a CSR after 12 months, ultimately having 2 Reserves with both fees waived.

Base on a recent data point I received, I believe Chase should still be waiving annual fees on multiple CSR cards. See the letter example I added to the post. Let me know if any fees get charged.

Me and my spouse have two CSRs each. No fees charged on any.

I just upgraded a Chase freedom card to be my second Chase Sapphire Reserve approximately end of October 2025. Unfortunately I just got two letters in the mail. The first says my original CSR Is confirmed at $0 annual fee. The second letter says my 2nd CSR will be charged an annual fee of $795 starting 26 Dec 2025. At least they gave me a warning, but doesn’t look like multiple (at least new) CSRs are a thing anymore.

Interesting. You are in the MLA database? It will be interesting to see if the fee is actually charged.

What does the letter actually say? Can you please email a redacted copy to mmm@militarymoneymanual.com

Was it because you originally opened the freedom card before you were eligible for MLA benefits?