19,103 grads of the Ultimate Military Credit Cards Course already know why

The Platinum Card® from American Express is my #1 recommended card

Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. All information about the American Express Hilton Honors Aspire Card, American Express Hilton Honors Card, American Express Green Card, World of Hyatt Credit Card, Marriott Bonvoy Bold Credit Card, Marriott Bonvoy Boundless Credit Card, and the Chase Freedom Flex has been collected independently by Military Money Manual. These cards are no longer available through CardRatings.com. Thank you for supporting my independent, veteran owned site.

If you find this information valuable or you want to learn more, you can sign up for my 100% free, 5 day course on maximizing your Military Lending Act (MLA) and Servicemembers Civil Relief Act (SCRA) benefits.

The MLA and SCRA unlock the best parts of the travel reward credit cards that you see all over the web, but with the additional benefit of no annual fees.

Questions I answer in this post:

- What effect does opening this many cards have on your credit score?

- Do travel miles and credit card points have an expiration?

- Are Credit Card Welcome Bonuses One Time Only?

- How Often Do AMEX and Chase Check Active Duty Military Status?

- How to Get Military Spouse Fees Waived on American Express and Chase Credit Cards?

- Do I need to tell AMEX when I leave active duty?

- What to do with my MLA and SCRA military credit cards when I retire?

- When Does Chase and AMEX Check Your Active Military Status After Leaving the Military?

American Express, Chase, and other companies are all waiving annual fees for active duty US military servicemembers to comply with the MLA and SCRA laws.

It almost sounds too good to be true, but it is true. I get over $5000 in annual fees waived annually and $2000+ in annual recurring benefits like free shopping, free hotel stays and dining at Marriott and Hilton, and automatic Hilton Diamond status.

Here are some of the questions I have received from the 400+ graduates of my Ultimate Military Credit Cards Course.

Sign up now. All you need is an email address. I'll never send you spam and you can instantly unsubscribe at any time.

In this post:

What effect does this have on your credit score?

Love the site. I'm currently deployed and have saved $22k in cash which I will use upon redeployment for a hefty down payment on a car and to pay for a post deployment vacation.

After looking through the site, I have identified 8 rewards cards and their introductory rewards that would benefit my lifestyle (7x AMEX and 1x Chase Sapphire).

I have excellent credit (817), however I don't own any of these 8 cards yet. How would applying for these 8 cards in a short amount of time (approximately 2 months) effect my credit score? That's the only thing holding me back from starting this! Thanks for any advice you can offer.

Almost no effect at all. My credit score when I started opening credit cards 4 years ago was 800+. Today, after opening 30+ credit cards, my credit score is still 790+, depending on which score you check.

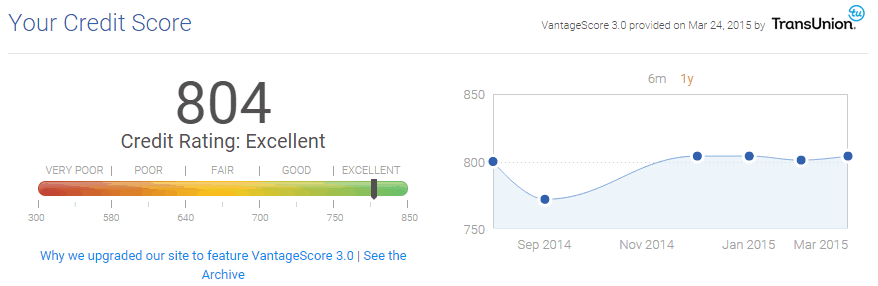

Here's my credit score as a screenshot from CreditSesame in March 2015:

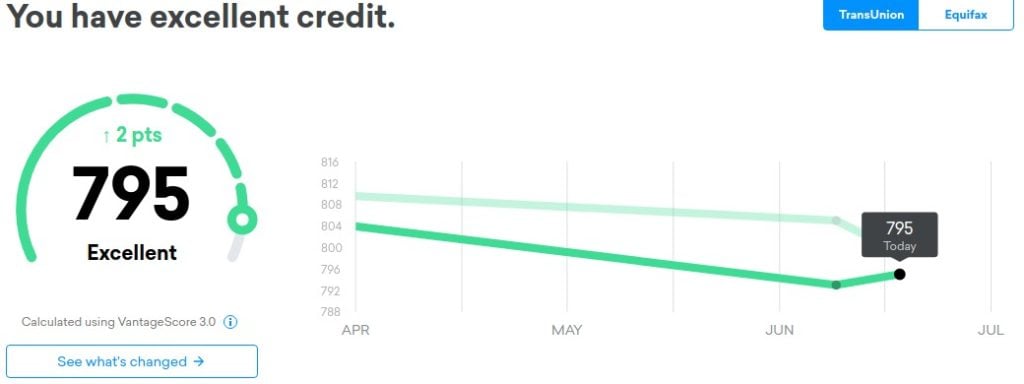

And here's another screenshot from June 2019, also from CreditSesame:

Do travel miles and credit card points have an expiration?

Thank you for all the great content. I am a graduating med student about to start my active duty career with the Navy.

I will be in residency for the next 3 years or longer if I have to do a flight surgeon tour, just wondering if all the bonus miles have an expiration.

My wife and I love traveling, but know we will be restricted with my schedule during medical residency. I would love to get started with all your great tips, but wondering if will be worth or not depending on how these miles work.

Most credit card points DO NOT have an expiration, especially the most flexible and valuable points like AMEX Membership Rewards and Chase Ultimate Rewards.

The most valuable cards to add to your portfolio are AMEX Platinum and Chase Sapphire Reserve.

Thanks to the AMEX SCRA and Chase MLA military fee waivers, you can start building your portfolio of cards and points for the next 3+ years AND pay no annual fees on these cards. It's a win-win situation!

Some airline points expire after 12-36 months of no activity. Delta Skymiles never expire, but they are not as valuable as other miles programs. Marriott Bonvoy points expire after 24 months of no activity and Hilton points expire after 12 months.

However, you can easily earn points, buy points, transfer points, and redeem points to keep your point balances active. You can put a transaction or two through your airline or hotel co-branded credit card and earn points to keep the accounts active every few months easily.

The AMEX Marriott Bonvoy Brilliant and AMEX Hilton Honors Aspire card both offer annual free night stays and no annual fees for military. I'm sure you can get away for at least one night a year while in residence.

Also the AMEX Delta Reserve and Delta Platinum offer annual companion passes after you have had the card for 1 year. I would definitely pick up both of these cards when you are approaching 12-18 months out from ending your residency.

Think of a great travel goal to work towards over the next 3+ years and I'm sure you will be amazed at how many points you can accumulate between you and your wife.

Wait for the best bonuses on each credit card, hit your minimum spends, and never carry a balance, and you can profit immensely. Let me know how it goes.

Are Credit Card Welcome Bonuses One Time Only?

I've been digging through and reading tons of awesome information from your site – thank you so much! But the question is, how are you able to redeem so much via points when most cards give only a one-time signup fee?

There are so many cards out there offering welcome points and new cards are released every year. So even though you can only get the sign up bonus once on the AMEX Platinum card, there are at least 4 versions of the AMEX Platinum card, all eligible for their own sign up bonuses.

Also, you can refer friends and families to cards and earn points that way. And then of course your everyday spending can earn you points as well.

I've opened over 30 cards in the last 3 years between my wife and me. We still have so many cards to go and since new cards are getting released every year, we'll probably never run out of cards.

Also, companies merge and change. So you could have opened Marriott and SPG cards years ago, and now open the new Bonvoy cards and be eligible for the sign up bonuses.

How Often Do AMEX and Chase Check Active Duty Military Status?

What a great resource you have here; thanks for your insight over the past couple years. I have a question for you.

I am also an Air Force officer (reservist) that was activated on orders from December 2016-August 2018. I started getting into credit cards a little before that so once I found out about the incredible benefit on waived Amex fees, my wife and I got a regular and MB Platinum and we both got the Hilton Aspire cards.

Since I have gotten off orders I cancelled the MB Platinum before it was converted since my wife has never had the regular one and I wanted her to be able to get that sign up bonus.

Also, one of our Aspire cards annual fee should have come due but it was

still waived.

Do you know how long they will keep waiving annual fees? I want to get a Gold card or another one with an annual fee but also don’t want to change my file if this will keep on. Have you see this before?

Many data points suggest that AMEX doesn't really check your active duty status frequently. Some veterans have reported 5+ years of fees continuing to be waived after they leave active duty.

I would just press to test and continue getting cards until AMEX catches on. Worst case scenario you are on the hook for a few annual fees, but you can close the other cards before the fees hit.

How to Get Military Spouse Fees Waived on American Express and Chase Credit Cards?

I am active duty and have the AMEX platinum card already. What is process for my spouse to get it with fee waived as well?

It's a very simple process to get your military spouse annual fees waived. Go to AMEX's SCRA page. Submit the active duty servicemember's orders through that link but specify you want the benefits applied to the spouse's accounts. Include the account numbers to make it easier.

If AMEX does not waive the fees initially, then add the active duty servicemember as an authorized user to the spouse's accounts. Go through the SCRA process again and with the servicemember on the account there should be no issue with the fee waiver.

Do I need to tell AMEX when I leave active duty?

I have had an AMEX Platinum since 2014 (recommended by a buddy, same story as most), however I resigned my commission and left active duty on 31-Aug-2017.

**1) Was I required to inform AMEX of this?

**2) Will they charge me for the last two years' annual fees?

We continued to use the card, paid it off monthly, and have not seen an annual fee to date.

That said, I was laid off back in March and have struggled to find work. I may have to pay the minimum this month and I fear that will open Pandora's Box.

Any advice is appreciated.

- Possibly.

- No.

I doubt you will “open Pandora's box” for just making a minimum payment.

AMEX may check your info against the SCRA database here and ask you to confirm you are no longer active duty.

With no response or if you confirm you left active duty, they will probably start charging you the annual fees going forward, but you will have a grace period to close the card and avoid the annual fee.

I hope you find work again soon.

When Does Chase and AMEX Check Your Active Military Status After Leaving the Military?

I signed my AD wife up for CSR last night, but she’s probably getting out in the next 12-24 months. Will they/when will they charge her?

She will probably get a letter from Chase 6-9 months after getting out of active duty service, asking if she is still active duty.

If she cannot provide evidence that she is still activated, they will probably charge the fee within a few months of you receiving the letter. Should be plenty of time to close the account if you are no longer getting value from it. Check out my longer answer on what to do with credit cards when you separate from the military.

You can check your MLA status here: https://mla.dmdc.osd.mil/mla/#/home

And SCRA here: https://scra-w.dmdc.osd.mil/scra/#/home

What to do with my MLA and SCRA military credit cards when I retire?

Check out my full article on credit cards after you leave the military. I address retirement, separation, and what to do with your waived fee cards when the annual fees start coming.

I just want to say thank you for military money manual and the financial tips you give to service members like me.

I recently commissioned from NROTC and was already planning my credit card strategy for the future. I plan to have around 10 credit cards but this may change in the future.

My question to you is what should I do with all the credit cards once I plan to retire, as I do not want to pay for annual fees when I retire from the military?

Specifically, I am curious of the effects this can have on my credit score and what you would do in this hypothetical situation.

First off, congratulations on graduating NROTC! I am an ROTC grad myself.

You have a long time to come up with a good credit card strategy. Long story short: closing the credit card accounts when you retire will have very little, probably less than 10 points, of effect on your credit score.

Why do you plan on exactly 10 cards? I have 30+ and those are rookie numbers!

Follow my step by step guide here to get started.

After you retire, close the cards that you aren't getting value from. I close multiple cards per year when I am no longer getting value from them. My credit score hardly varies more than 5-10 points.

Just make sure you keep your oldest card open (to age all of your accounts) and don't close all your accounts the same day, maybe stagger them by a few weeks or months. Great question!

Ultimate Military Credit Cards Course

If you want to learn more about how to maximize your military credit card benefits, sign up for my 100% free, 5 day Ultimate Military Credit Cards Course.

Hey Spencer, thanks for all this great information. I am curious how the hard credit pulls when you sign up for new cards effects your credit score. I’ve noticed my score seems to drop a few points when I have more than 5 hard inquiries in a year. Do you experience the same? Is there a way to avoid the dip in credit due to inquiries, but continue to sign up for new cards?

Yes, I experience the same dip. Then a few months later my score goes back up. Credit score really doesn’t matter much. As long as you are above 760 or so, you are still going to get the best mortgage and auto loan rates. My score has always been above that, even when I opened a dozen cards in the same year.

I wouldn’t worry about it much. If you are worried, then just slow down the pace at which you open cards. But I’ve never seen my score dip by more than 20 points after opening a bunch of cards. And then it always recovers soon there after.